A year after DeepSeek’s launch, China’s artificial intelligence (AI) momentum raises an important question: is this a cyclical surge in enthusiasm or evidence of a deeper structural shift?

Key takeaways:

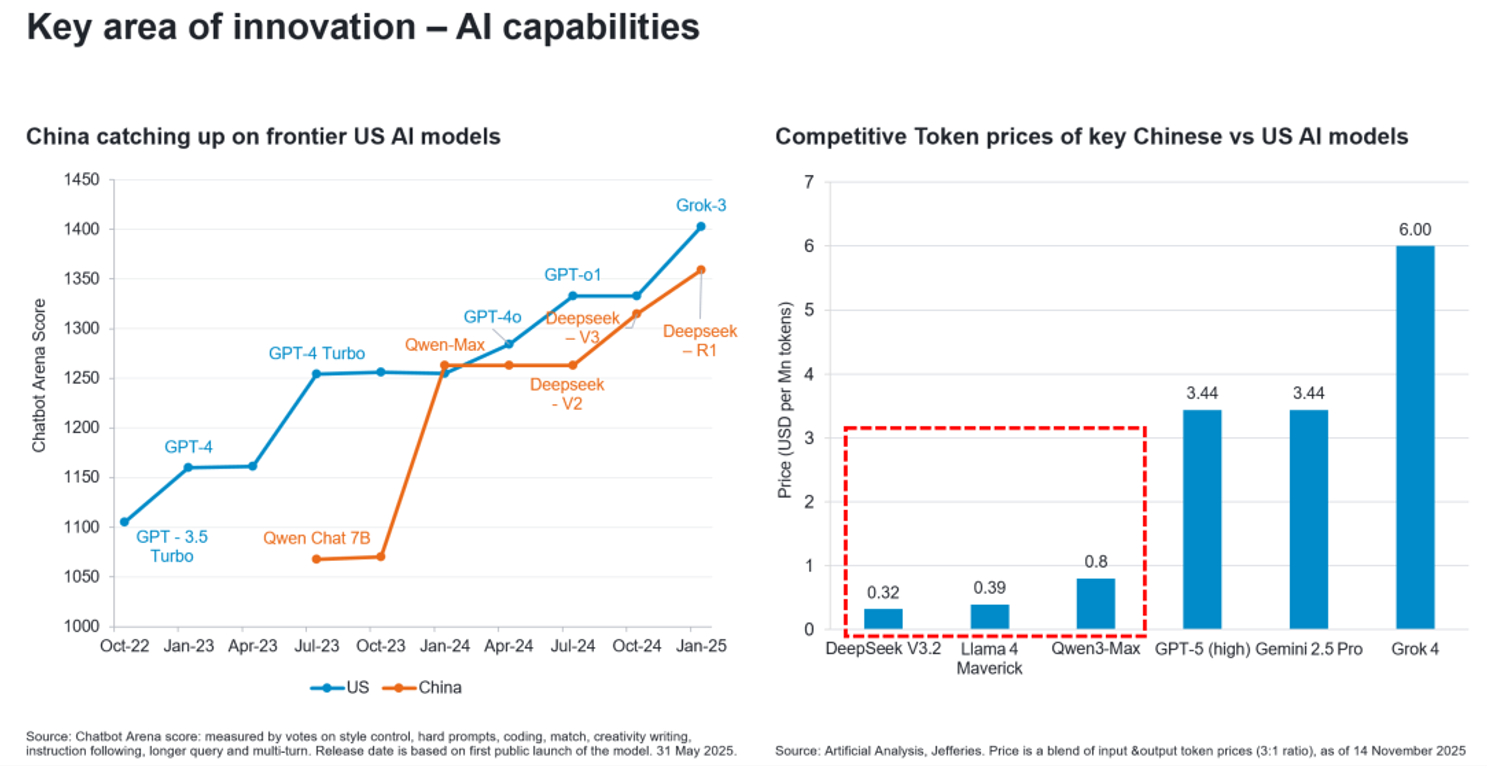

- China’s domestic AI capabilities continue to narrow performance gaps with global peers, with competitive pricing that supports broader use

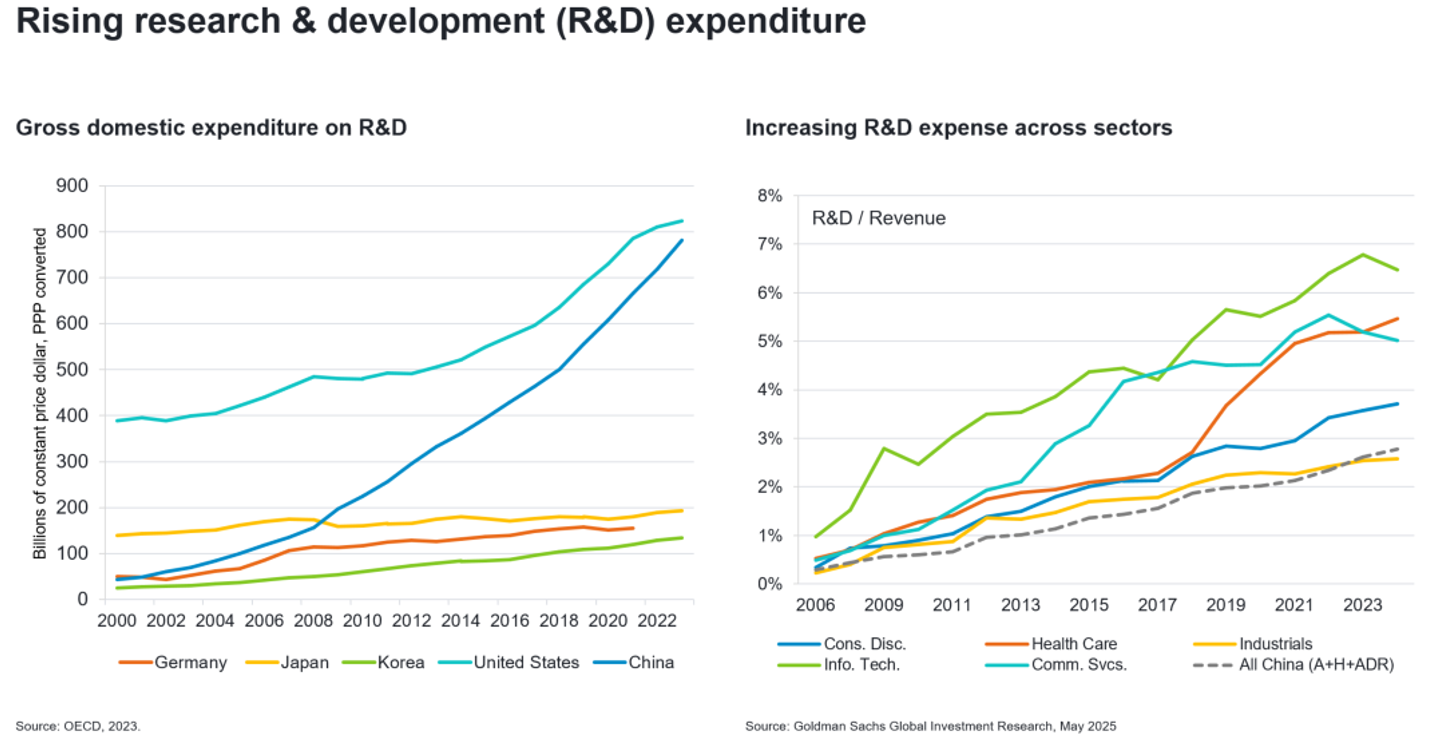

- Sustained investment signals broader trend of innovation in China

After a strong rally in Chinese equities, investors are increasingly focused on distinguishing durable signals from short-term noise. Market performance provides useful context, but it does not answer that question on its own.

Last year, the MSCI China Index rose 31.4%, outperforming both US equities and global markets. Innovation-led themes, particularly technology and AI, were central to that rebound following the announcement of DeepSeek’s AI model early in the year. Momentum has continued, reflected in several Chinese AI and technology listings in Hong Kong towards the end of 2025, which attracted strong investor interest.

The more relevant issue, however, is whether this strength reflects improving fundamentals or represents a sentiment-driven re-rating in a market where valuations were extremely low only 12-18 months ago.

What has changed: capability, cost, and economics

Since DeepSeek, China’s domestic AI capability has continued to improve across a broader range of applied use cases. Performance gaps with leading global peers appear to have narrowed. At the same time, Chinese AI models are mostly “open source”, often deployed at meaningfully lower cost, with more competitive token pricing that supports broader adoption across enterprise and consumer applications.

However, much of the market narrative remains concentrated on a small number of headline names. That focus risks understating the breadth of the opportunity and undermining the structural progress being made across China’s technology landscape.

What has not changed: innovation beyond a single moment

The success of DeepSeek should be viewed not as an isolated event, but as the outcome of sustained investment and a broader trend of innovation in China. Private Chinese corporates have increased research and development spending by over 20% annually over the past 15 years, steadily improving competitiveness across a wide range of industries. This depth of investment is increasingly visible in global innovation metrics and early commercial outcomes. Progress extends well beyond large language models into areas such as robotics, autonomous driving, next-generation mobility and advanced manufacturing.

One area where Chinese companies are leading the way is LiDAR (light detection and ranging) sensor solutions, which enable advanced perception across a range of applications, including autonomous vehicles, industrial automation, and robotics. We see significant long-term potential driven by the increasing adoption of LiDAR in the automotive sector and by expanding use cases in industrial and humanoid robotics.

From enthusiasm to fundamentals

One year on from the DeepSeek moment, the pace of innovation in China shows no sign of slowing, which underlines the importance of our disciplined bottom-up stock picking strategy. In an environment where sentiment can move quickly, and the dispersion between winners and losers is increasing, the detailed assessment of opportunities on a company-by-company basis, with a focus on long-term growth, competitive positioning, returns on capital, and execution capability, is vital.