China's fiscal policy will do the heavy lifting to pick up growth

A surprise cut to banks’ reserve requirement ratios shows China’s central bank is ramping up support for the economy. But it’s fiscal policy that’s likely to take the leading role in driving growth in 2024.

There’s been an unexpected Lunar New Year gift from China’s central bank: a cut to banks’ reserve requirement ratios, pumping around 1 trillion renminbi (USD $140 billion) of liquidity into the financial system. It’s the kind of monetary policy stimulus markets had been hoping for. But with the wide interest rate differential between the US and China limiting the People's Bank of China’s (PBoC) room to ease, we think it’s fiscal policy that the government will be leaning on more heavily to generate growth this year.

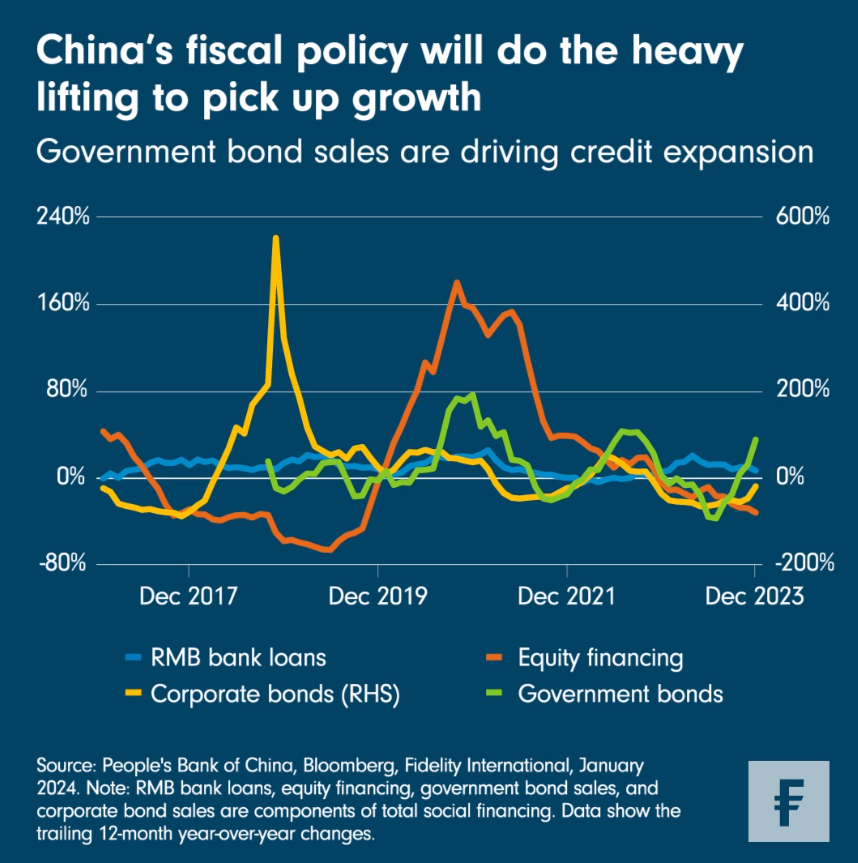

This week’s Chart Room shows how the government is already boosting its fiscal firepower. Issuance of bonds by both the central and local governments in December became the dominant driver for growth in total social financing - a measure of credit and liquidity in the broader economy. Meanwhile, despite falling borrowing costs, growth in bank loans and corporate bond sales remained subdued because of companies’ weaker willingness to invest.

In its next fiscal push, the central government is expected to leverage up as local authorities face mounting debt burdens and sliding revenues from land sales (a knock-on effect from a troubled property sector). And it is already doing so. The government took a rare decision in October 2023 to issue RMB 1tn of additional sovereign bonds. That move increased China’s official fiscal deficit ratio for 2023 to 3.8 per cent of gross domestic product, breaking through the 3 per cent ceiling set by the government in March. Even so, the likelihood of large-scale stimulus remains low given Beijing’s determination to avoid inflating any debt-fuelled bubbles.

The PBoC is constrained in its monetary easing until the Federal Reserve pivots. Aggressive interest rate cuts in China would put more pressure on the renminbi, which weakened around 2.8 per cent against the dollar last year. Moreover, while corporate and households’ demand for credit is weak, fiscal spending on bridges, roads, and new infrastructure - such as 5G network, urban village renovation and electric vehicle charging stations - is more effective in stimulating the economy than moderate interest-rate cuts.

Monetary easing will continue at a steady pace, but the PBoC is likely to focus on structural tools to channel credit to targeted areas in the real economy. One example is the provision of low-cost funding via the pledged supplementary lending (PSL) program to finance urban village renovation.

The hope is that such initiatives should help stabilise China’s economy when combined with more forceful fiscal policies. This latest round is just the beginning.