Corporate treasurers are shoring up their businesses in preparation for a tougher funding environment. That’s a finding from Fidelity International’s 2023 Analyst Survey, which draws on the work of 152 analysts worldwide.

Six out of every ten analysts report that the companies they cover will have a high focus on strengthening their balance sheets in 2023, while 46 per cent also cite increasing cash reserves as a resilience measure they expect companies to take.

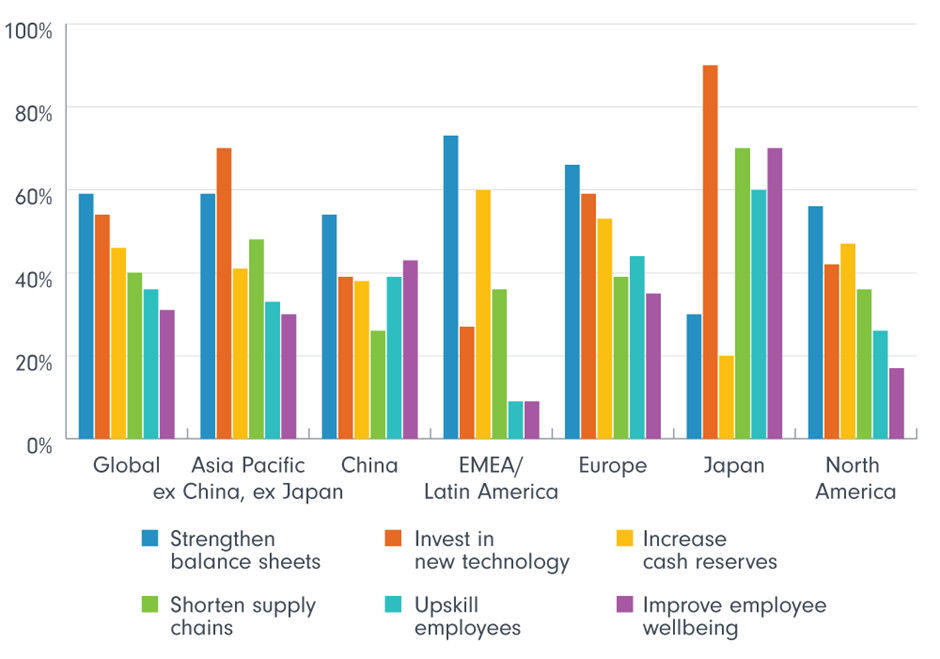

Chart 1: Strengthening balance sheets is companies’ top focus

Question: “To what extent do you expect the following resilience measures to be a focus for your companies over the next 12 months?” Chart shows the proportion answering 5-7, where 1 means not a focus at all and 7 means very high focus. Source: Fidelity International Analyst Survey 2023.

Prioritising balance sheets emerges as the number one focus across almost every region and almost every sector too, with the exceptions of consumer staples and information technology, where analysts report a higher focus on investment in new technology.

“Companies are fairly disciplined now,” says one pharmaceuticals analyst covering Asia Pacific, “and are trying to be conservative with their balance sheets.”

Analysts expect less M&A in 2023

This disciplined approach appears to be influencing companies’ expansion plans. For the first time in recent years a majority of analysts believe that mergers & acquisitions (M&A) will become less prevalent in the next 12 months. There is now no region where the average analyst response suggests an increase in M&A.

Look at individual sectors, however, and it is clear that some appetite for deals remains:

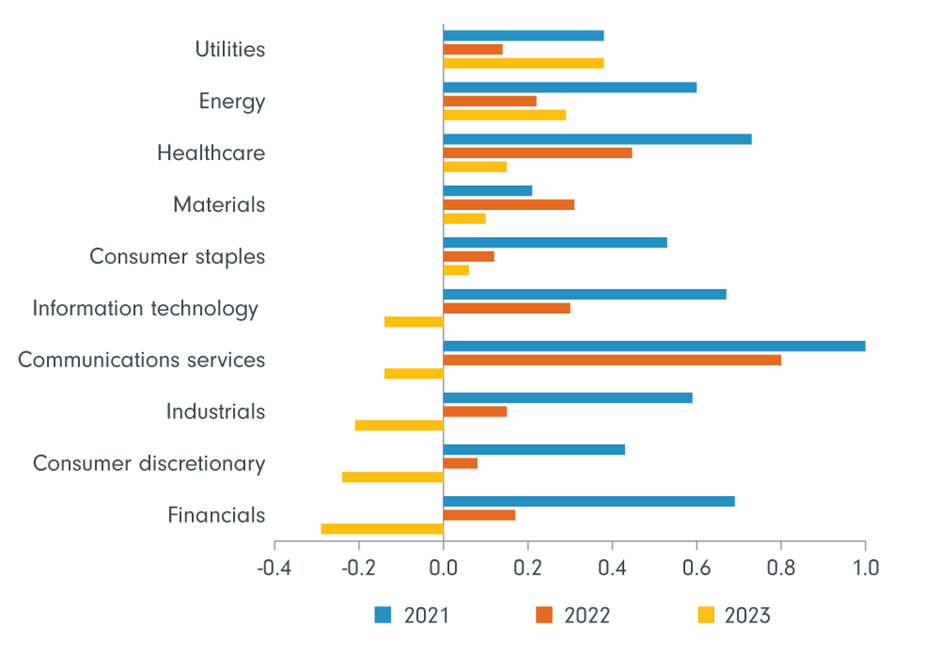

Chart 2: Utilities and energy firms among those still hunting for acquisitions

Question: “Do you think M&A will be any more or less prevalent amongst your companies over the next 12 months?” Chart shows proportion of responses expecting M&A will be more prevalent minus those expecting it will be less so. Strong positive and strong negative responses receive a double weighting. Higher values show analysts on balance expect M&A will be more prevalent. Source: Fidelity International Analyst Survey 2023.

“Utilities have abundant investment opportunities and capex related to renewables, resilience, and maintaining the infrastructure,” says one North America-focussed analyst covering that sector.

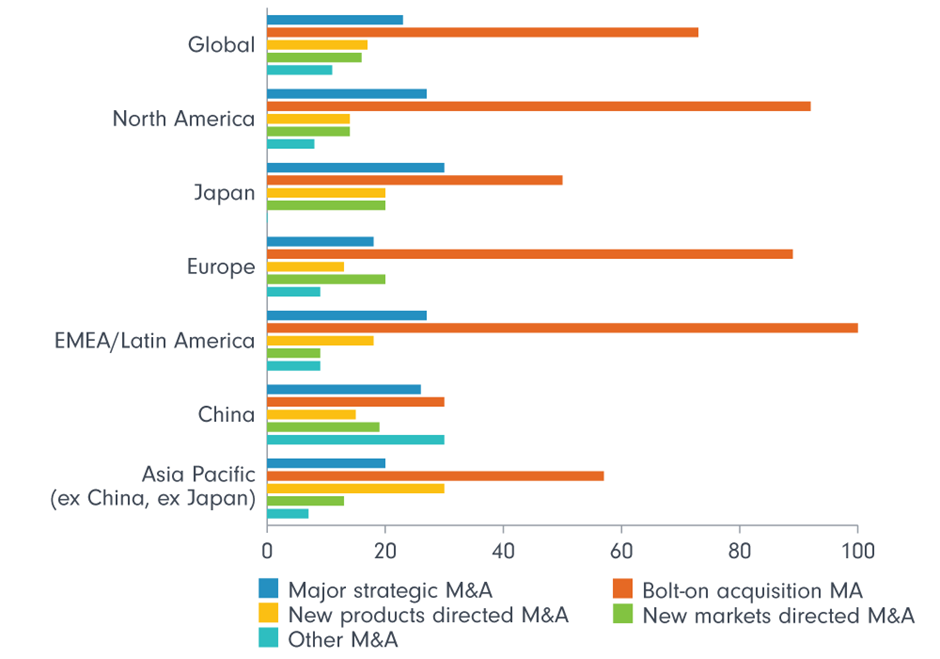

Some analysts also note that the weakness in global equity markets could mean there are opportunities for take-private acquisitions. Overall, though, as one equity analyst covering healthcare firms in North America puts it: “Any M&A is likely to come from bolt-on deals rather than huge, transformative acquisitions.”

“Debt has become more expensive, and there’s still a valuation disconnect between buyers and sellers,” he adds.

Chart 3: Most M&A deals will be bolt-on acquisitions

Question: “Where you are seeing M&A, what type is it?” Chart shows percentage of analysts who expect a given type of M&A. Source: Fidelity International Analyst Survey 2023.

Many companies will face higher funding costs this year

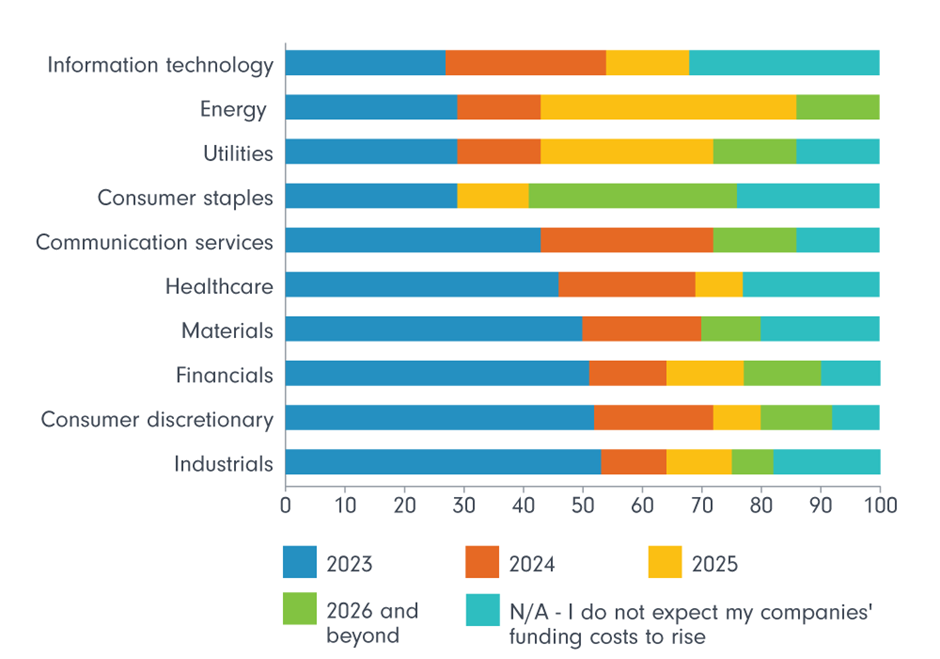

The increased cost of debt, while anticipated for some time, is now a tangible or imminent reality for many companies. Of the analysts responding to this year’s survey, 72 per cent anticipate that the funding costs of the companies they cover will rise materially before the end of 2025. Across every sector, at least a fifth of our analysts believe that funding costs will step up materially in the next year.

Chart 4: Coming soon: higher funding costs

Question: “When do you expect the funding costs of the majority of your companies to rise materially?” Chart shows percentage of analysts. Source: Fidelity International Analyst Survey 2023.

There are likely to be some firms that struggle in this environment of higher financing costs. Our analysts expect the default rate to increase across every region except China, which has already undergone a spate of defaults led by the property sector.

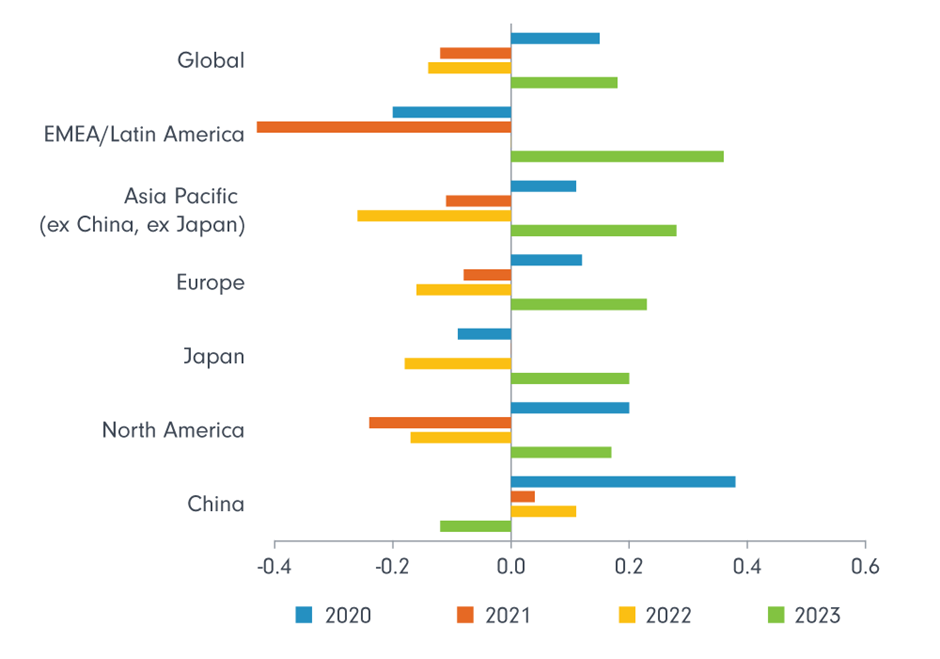

Chart 5: Defaults expected to rise everywhere bar China*

*X-axis = Weighted net responses

Question: “What do you expect to happen to the level of default rates in your sector over the next 12 months?” Chart shows proportion of analysts who expect default rates to rise minus those who expect them to fall. Strong positive and strong negative responses receive a double weighting. Higher values show analysts on balance expect default rates will rise more prevalent. Source: Fidelity International Analyst Survey 2023.

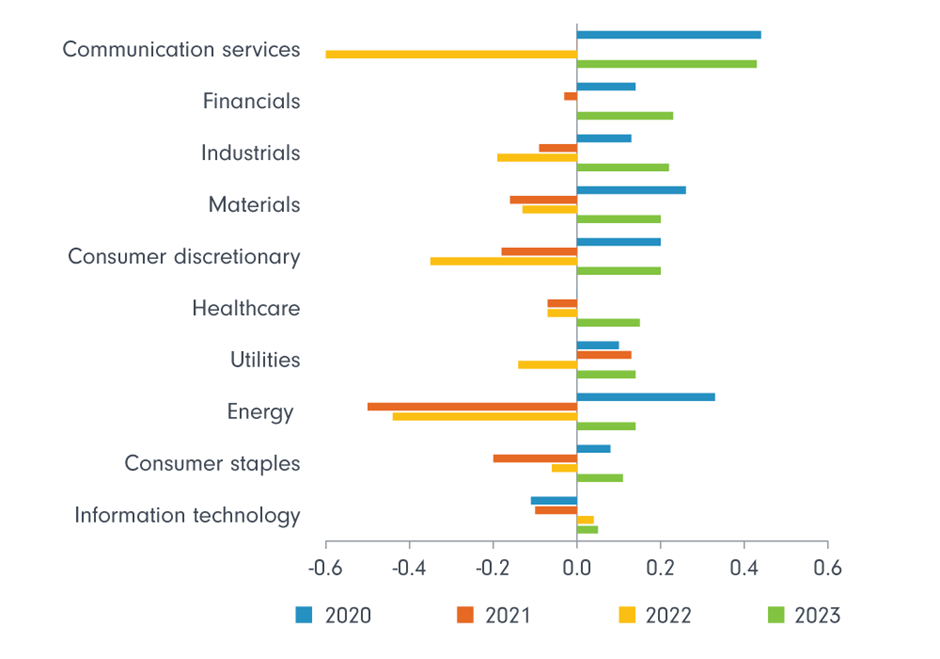

Analysts also expect the rate of defaults to increase across every sector. Though this default risk is deemed to be priced in across certain products in some regions (for example in the European leveraged loan market), elsewhere fixed income markets may not have taken such a pick-up in default rates fully into consideration yet.

Chart 6: Rising default rates expected across all sectors*

*X-axis = Weighted net responses

Question: “What do you expect to happen to the level of default rates in your sector over the next 12 months?” Chart shows proportion of analysts who expect default rates to rise minus those who expect them to fall. Strong positive and strong negative responses receive a double weighting. Higher values show analysts on balance expect default rates will rise. Source: Fidelity International Analyst Survey 2023.

Of course, companies face not just higher funding costs but also a challenging economic environment. As one European financial sector analyst observes: “Supply shortages would result in corporate clients of my banks having margins come under further pressure and hence possibly an increase in corporate defaults (or expected defaults) which would increase risk provisioning,” although he adds that for banks themselves, buffers still in place from the Covid pandemic could be used to absorb some of this increase in expected defaults.

While these findings initially look concerning, they suggest markets are returning to normal. For over a decade, companies have been able to enjoy historically easy access to capital, with prices – and default rates - artificially kept low by rock bottom interest rates and a strong technical bid for paper.

How companies plan to adapt

While this high tide of liquidity lifted all boats in the past, now conditions are on the wane, companies with weaker credit structures will feel the most pressure. As one fixed income analyst who covers discretionary retail notes: “I expect the companies I cover to put an increased focus on liquidity and potentially also debt reduction given the increase in funding costs.”

Elsewhere, many analysts report that their firms will try to reduce their reliance on debt markets.

“Most companies will try to refinance less if possible, using cash on the balance sheet to repay some debt and [raising funds through] selected disposals,” says a fixed income analyst focussing on European communication firms.

“Some will try to reduce the size of their debt, although that’s difficult for those that need to keep cash,” adds one analyst who covers consumer staples in EMEA and LatAm. “Costs are elevated in both the bond and bank markets, and most private equity firms are not interested in putting in additional equity unless it’s absolutely necessary from a liquidity perspective.”

As well as relying more on available cash, some managers are also firmly in cost-reduction mode. Some 17 per cent of our analysts expect their companies will reduce capex to deal with rising funding costs.

Down but not out

Although the cost of financing across capital markets is expected to rise, a quarter of our analysts say their companies are still likely to raise capital from equity or bond markets this year.

“I expect the increased cost of funding will ultimately be passed through to consumers or absorbed by the companies to maintain their market position,” says one fixed income analyst covering consumer discretionary companies in Europe.

Of those analysts expecting their companies to tap capital markets, a third say it will be for routine liability management to refinance upcoming maturities. However, 30 per cent of these analysts state the reason for their companies raising capital will be to grow their business, while another 8 per cent say new funding will help companies expand into new markets.

Many treasurers will also be rethinking how they access the capital needed for growth, with 30 per cent of analysts saying that their companies will primarily turn to traditional bank loans rather than issuing bonds or equity to deal with the higher cost of funding.

Our analysts’ insights illustrate how companies are readying for the change in the financing backdrop. Rather than a panicked response to an unprecedented crisis, the picture emerging is one of companies making a sober and uncomfortable - but necessary - return to what used to be classed as normal.