IPG Photonics (IPG) has a Ukraine-shaped problem. Before 25 February 2022, the world’s biggest producer of industrial fibre lasers had built a decade of success from three main production sites - one in Germany, one in the United States, and one in Russia.

Cheap Russian labour, allied to the talent coming out of the country’s technical universities, both cut costs and aided a competitively advantageous vertical integration of technology and production that removed the need for outside suppliers.

That all imploded with the swift imposition of sanctions after Russia’s invasion of Ukraine. The Russian plant, based just outside Moscow, supplies components to the German and US operations. Unable to export those parts, production volumes at both could fall, and replacing the supply from external providers will take months of work while eroding the vertically integrated structure on which the company has built its success.

Like many multinationals in the early days of the war, IPG’s management sat tight - perhaps hoping that the war would be over swiftly and the sanctions somehow eased. Its history probably helped: founded by two Russian physicists after the fall of the Berlin Wall, the US-based company still has Russian-born leadership.

Yet two months on, it has been forced to capitulate, announcing this week it would be relocating Moscow production elsewhere. Markets, which have hammered the company’s stock, applauded, but the year ahead still looks daunting.

“They have to move a lot of things.” says a Fidelity US-based analyst who looks at the company. “The scientists, the workers who know how to operate machinery. I think it will take a long time.”

Changing mood

IPG’s story is not entirely typical of how companies have dealt with the effects of the war on Russian operations, but it illustrates the difficulties some are finding in extricating themselves from the country and, in some cases, navigating the divided loyalties involved.

Almost half of the Fidelity analysts who reported direct impacts on their companies in our latest analysts’ survey say the changes companies have made to their Russian operations are likely to prove “enduring”, “lasting” or “decades-long”. More than a dozen analysts say that corporate withdrawals from the country will be permanent.

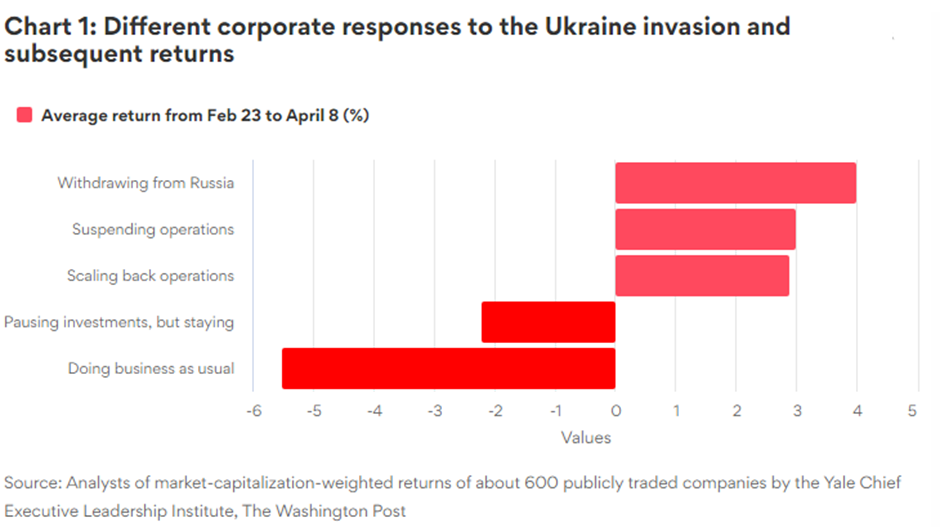

While the commodity companies most commercially affected by the conflict are trying to hold steady, managers at many global companies have come round to believing that association with the world’s newest pariah state is simply not worth the risk.

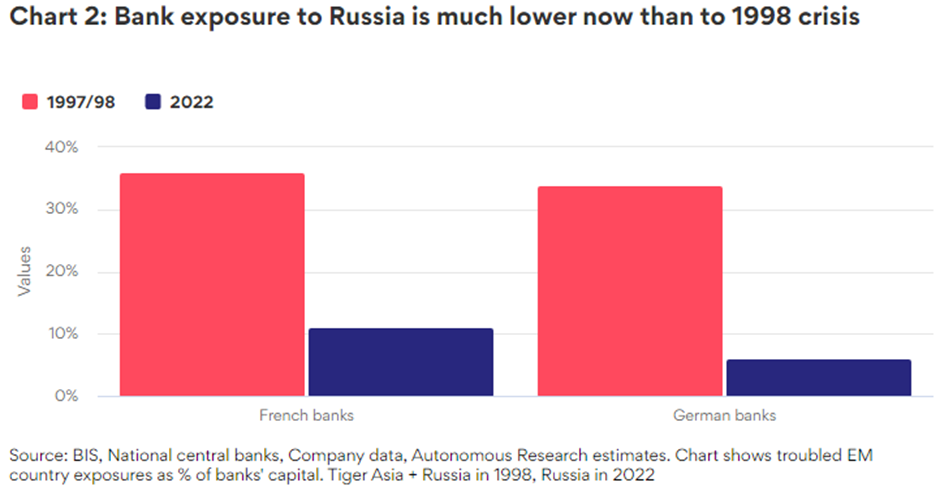

Global banks, for example, were initially reticent about leaving, but have now swung towards selling or winding down their remaining Russian operations. Many had already reduced their commitment to Russia, focussing only on servicing big global customers with subsidiary operations in the country. But some of these customers still have large operations or investments that need to be managed, written off, or sold.

Other banks have more practical problems. Deutsche Bank has a global technology centre in the country whose operations would need to be transferred elsewhere. It employs 1,500 staff, many - of them software developers who are in short supply everywhere - and much more expensive to recruit elsewhere.

The main example of outright disposal so far is Societe Generale’s sale of Rosbank to an oligarch, Vladimir Potanin. Signs of approval of the deal by regulators in both jurisdictions suggest the way is clear for other transfers of assets to Russian oligarchs at what would hitherto have been knockdown prices.

The reality in most areas is that there will be no other buyers. Another owner, Oleg Tinkov, said in May 2022 he was forced to sell his stake in online bank TCS Group to Potanin for around 3 per cent of its real value after the Kremlin threatened to nationalise it in response to Tinkov’s criticism of the war.

“Markets are encouraging banks to exit the country but that either means closing offices and laying off employees or selling on the cheap to oligarchs, resulting in large-scale wealth transfer,” says a Fidelity analyst who watches many of the banks involved.

“Initially people thought they might just wait it out, but the narrative has changed quite quickly to identify Russia as a country with which you can no longer morally do business.”

All tyred out

Across the manufacturing, pharmaceutical and retail industries, there are other challenges.

Tyre maker Nokian is in a similar operational position to IPG. Its plant in Vsevolozhsk near St Petersburg, in which it invested EUR€150 million in the mid-2000s, employs 1,600 people, and can produce 17 million tyres annually - around 70 per cent of Nokian’s global production. Replicating it elsewhere will take a lot of time and effort, and hundreds of millions of dollars.

Nonetheless, the company has halted exports of the heavy tyres it makes in Finland to Russia because they have potential military applications and has begun to make announcements about plans to change the rest of its business model.

The Russian factory, whose net sales in Russia and Asia of almost US$380 million are just a fraction of the company’s global numbers, continues to operate but will need to be replaced somewhere else in the region.

What you sell and who you sell it to

Drug companies, meanwhile, are relocating medical trials from Russia, a move several analysts believe will be long term and is unlikely to be reversed. However, both pharma and consumer companies have chosen to keep supplying essentials to civilians in Russia. Pepsi has halted imports of soft drinks, but not of infant formula.

“To withdraw medical services or products would leave Russian patients without potentially life-saving treatment. Where goods do not reach this threshold, companies have stopped supply.”

In the consumer and retail sectors, things are less clear cut. Several analysts say they believe companies would like to return to business as usual as soon as possible, either if the war ends, or if sanctions are eased.

“My sense is that many of the companies themselves would be happy to sell into Russia because they don't want to punish the Russian consumer,” says another Fidelity analyst who covers luxury and sporting goods names. “They won't because the reaction elsewhere would be very negative, and they are aware their products are entirely non-essential.”

The big exception is the commodity sector where, even with the sanctions, Russian material - not just gas supplies - is finding its way into foreign markets. According to one US-centric Fidelity analyst, oil infrastructure providers who have had to find other sources for steel piping will return to their Russian suppliers as soon as that becomes possible.

“Russia is a huge supplier,” said another Fidelity European energy sector analyst. “As and when the conflict de-escalates, I would expect Russian volumes to return to the market if they haven't before then.”

Hard to de-globalise

While on the surface the major economic effects of the war have been via the commodities channel and resulting price turbulence, many global companies have tough choices to make about products, employees, customers, and supply chains.

The conflict may also affect how firms think about their cross-border capital investments more broadly, and the kinds of ethical, social and reputational risks that these now carry, as well as the effects of withholding from a particular marketplace.

As our survey shows, many firms would rather just walk away from Russia for the longer term. Yet individual stories show it can still be hard for them to de-globalise.