|

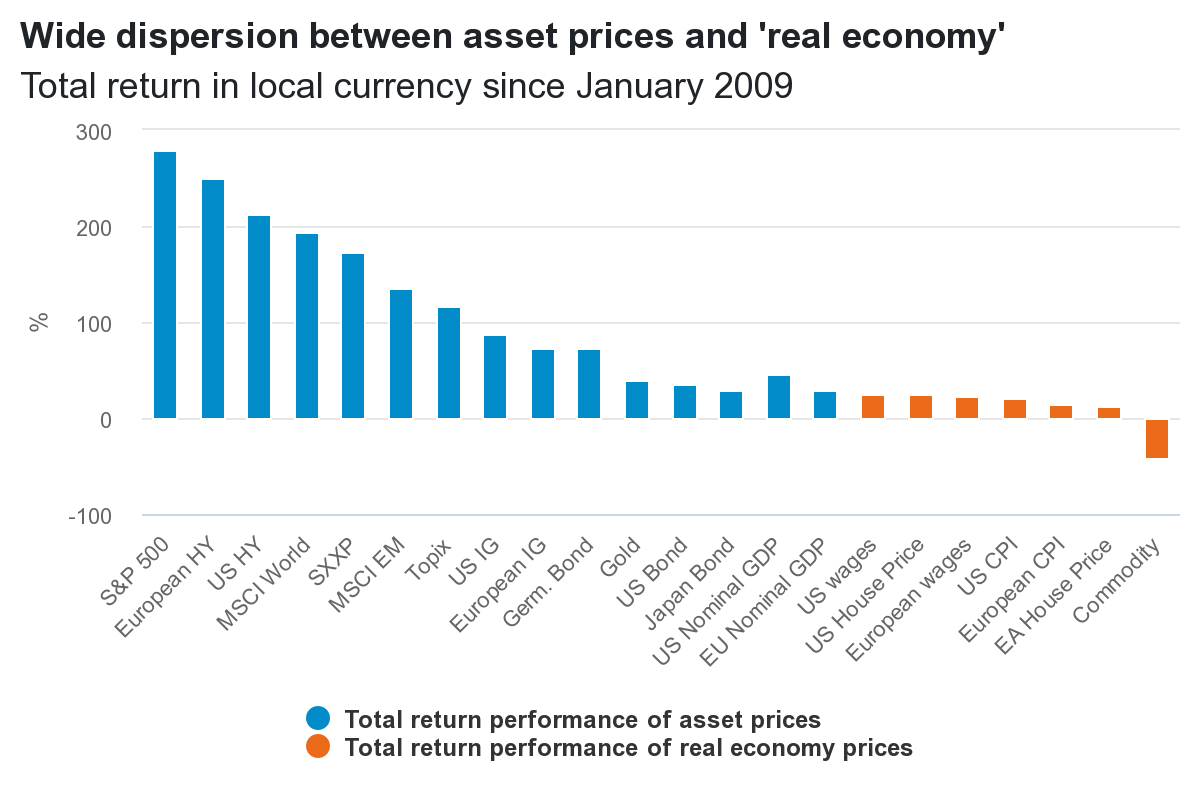

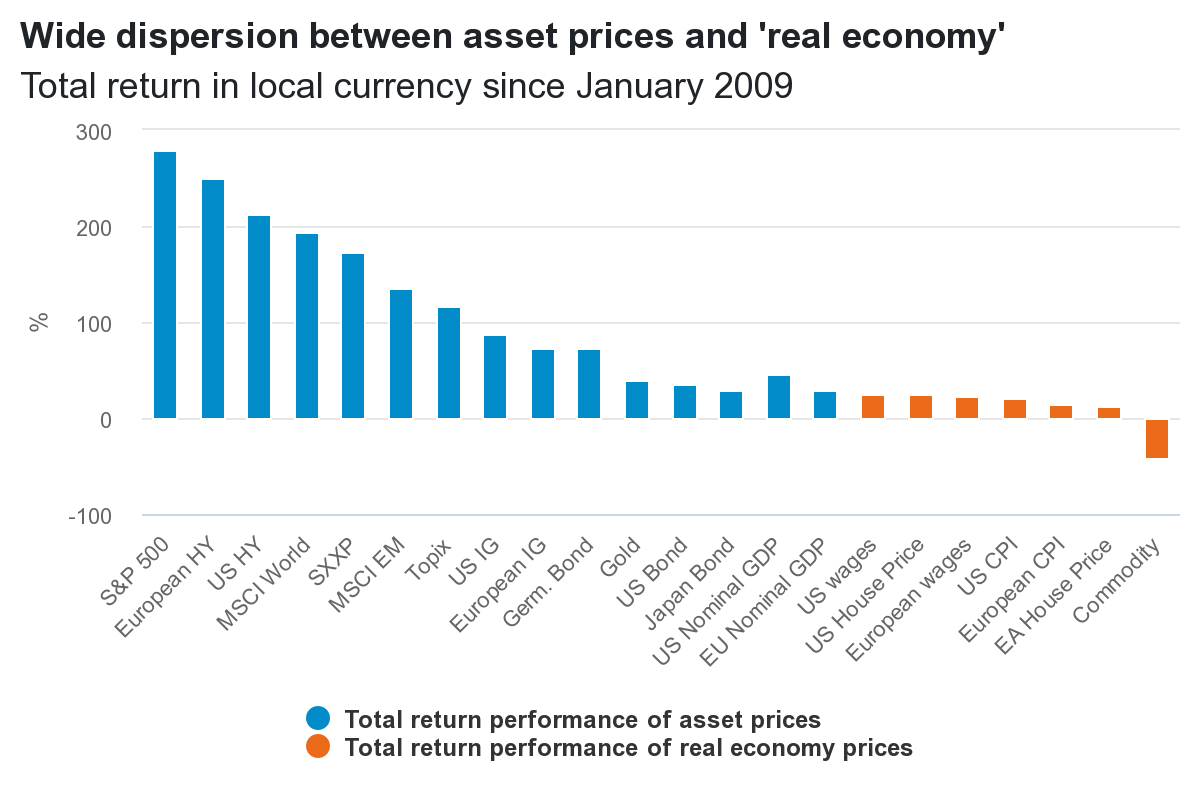

I’d argue that the political tensions we’re seeing today are rooted more in the financial policies of recent decades than in the current debate around globalisation. The irony is that some politicians are searching for solutions within protectionism instead of addressing monetary and fiscal policy dogmas.

The result is that we see clear examples of the misallocation of capital across different regions and markets. We once accused economies like China of misallocating capital with its ‘State Capitalism’ system. But the same is evident across free markets; whether that’s venture capital funds investing in ‘disruptive’ projects that don’t add economic value, runaway real estate prices in China, Canada and Australia, or a preponderance of expensive but unprofitable disruptors with no clear timeline to profitability such as Tesla, Uber and Revolut. In its IPO document, Uber even warned that it ‘may not achieve profitability’, ever!

‘Japanification’

The consequence of this delinking between prices and value is a sort of ‘Japanification’ of developed markets, so-called because of the high debt, low growth and low inflation that’s characterised Japan for the past 30 years following the post-war boom. Today, Japan still suffers from ‘zombie’ companies, which only survive because of the availability of cheap refinancing.

The challenge to traditional public companies is not so much from the rise of China - it’s already captured the lion’s share of industrial output - but rather from venture capital funds that have the financial firepower to confront and defeat incumbents. This Schumpeterian revolution of ‘creative destruction’, where economic progress means turmoil, is unfolding before us. One example is the gutting of high street retail grandees by online upstarts.

'Slobalisation'

What is certain is that globalisation is slowing. When Donald Trump became US president in November 2016, global trade started to reaccelerate, but that’s now slowing down, most likely due to a simple case of economic gravity rather than intended policy. We are in a late cycle environment, which, combined with a declining working age population, will restrict growth potential.

For investors, this is uncharted territory. Any direct comparison with the past is problematic because there are few historical reference periods with similar dynamics - for example, an economic review finds no meaningful instances of negative interest rates back to at least 2000 BC.

The rising market could continue, and it’s tempting to sit back and enjoy the ride, but that shouldn’t be done naïvely. The markets are bathing in blissful complacency, which usually foreshadows a rude awakening. So far, we have muddled through these unprecedented conditions, but as asset managers we must factor in the risks. We have to look forward, favour a quality bias and be ready to act swiftly for whatever the result will be.

|