In this latest From the desk of, Fidelity Global Demographics Fund portfolio manager, Oliver Hextall, considers what an ageing global population means for investors and explores how the Fund is gaining exposure to the ‘longer lives’ theme. We look at some of the companies taking advantage of the implications of this demographic shift, from rising demand for health care and the beauty products aimed at the ‘silver generation’, to the need for automation to solve the problems associated with a declining working age population.

Declining birth rates in focus: The demographic shift accelerates

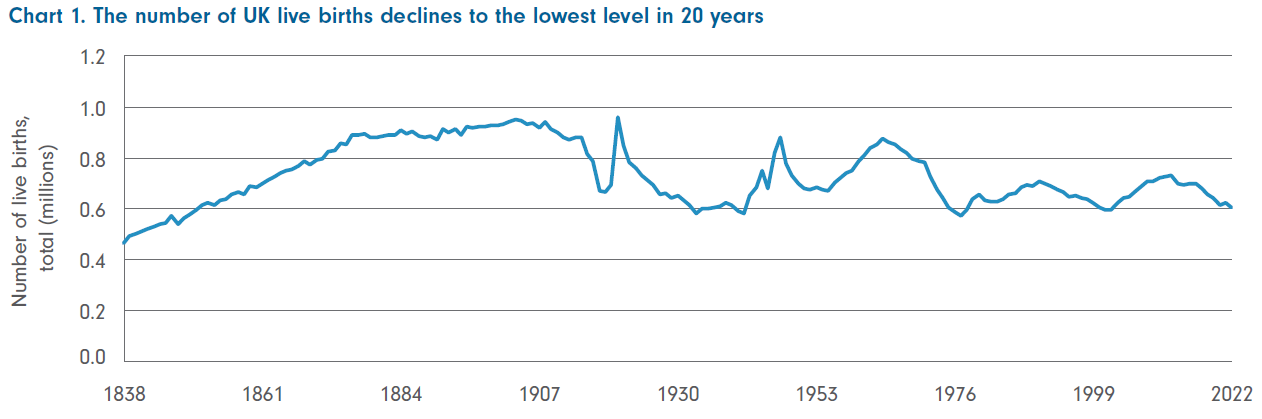

Data released earlier this month showed that the number of live births in the UK has declined to the lowest level in two decades (see chart 1). The numbers released by the UK’s national statistics agency were stark. Although the ONS didn’t publish a total fertility rate for 2022, HSBC Global Research thinks that if the current trajectory continues, then the UK’s total fertility rate could fall below 1 child per woman by the end of the next decade, which would result in the population halving over the course of a generation.

Chart 1. The number of UK live births declines to the lowest level in 20 years

Source: ONS, Births in England and Wales: 2022, 17 August 2023.

This is by no means a story unique to the UK and is one common to developed economies across the globe. Although the UK’s fertility rate is below that of France and Sweden, it is still better than Spain and other countries across southern and eastern Europe. And the problem is becoming increasingly apparent in developing countries, too. China is a notable example, and population growth in the world’s second largest economy has peaked and is now on a downward trajectory. Over the past 70 years the global fertility rate has halved, and this phenomenon is expected to accelerate in the coming years across developed and developing countries alike.

Declining birth rates have coincided with longer lifespans, and we are seeing the global population shift from a pyramid structure, with a higher proportion of children, young and working-age people, to that of a beehive, with fewer young people and a greater concentration around the middle aged and elderly segments of society. According to the United Nations (UN), the world is undergoing a period of ageing that ‘is without parallel in the history of humanity’.

Longer lives: A broad-based investment opportunity

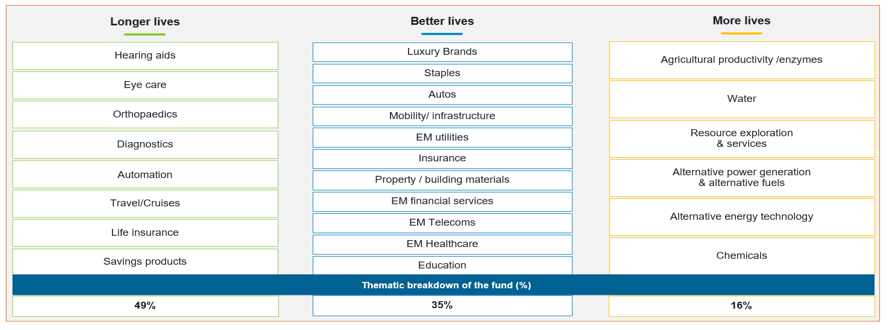

So, what does this mean for companies and investors? Just as there will be a considerable economic impact, the shifting structure of the global population will have huge implications for companies, representing both risks and opportunities. The theme of ‘longer lives’ is one of the three key demographic trends we look to exploit in the Fund, along with ‘better lives’ and ‘more lives’ (see chart 2). We see numerous opportunities to invest in the theme of ‘longer lives’, including in companies producing hearing aids, eye care, and health care diagnostics, but also the businesses enabling automation to tackle the need for better efficiencies given declining working age populations, and the beauty companies supplying products for the ‘silver market’.

Chart 2. ‘Longer lives’ is a broad-based investment opportunity

Source: Fidelity International, 30 June 2023 (updated quarterly). Thematic breakdown exposures are for illustrative purposes only.

The span of opportunities shows just how broad and widely applicable this theme is, and as of the end of June, companies aligned to the theme accounted for just under half of the portfolio. We now explore three areas where we are currently seeing the most exciting opportunities: health care, beauty, and automation.

Healthcare: An ageing population will drive demand for products and services

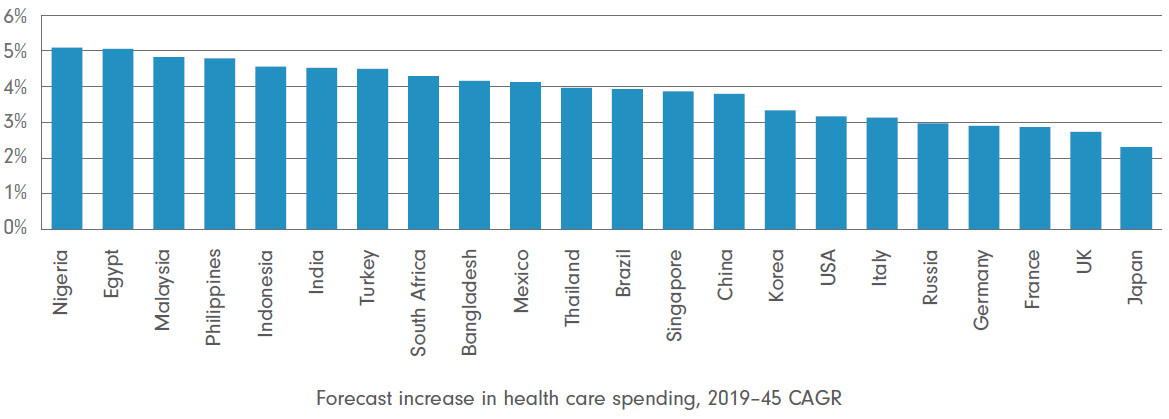

With longer life spans, there is a longer period where the functionality of the human body declines, increasing demand for and spending on a wide range of healthcare products and services (see chart 3). As more people move into older age brackets, total spending on healthcare will continue to rise, creating opportunities for companies that serve these customer groups, from orthopaedic manufacturers to private hospitals, care services and drug manufacturers. Given the increasing wealth and disposable income of the older population, they will also purchase discretionary treatments such as ophthalmic and audiology products, which can improve their quality of life.

Chart 3. Healthcare spending set to increase

Source: HSBC Global Demographics, February 2021.

One example of a company catering to this ageing demographic is portfolio holding EssilorLuxottica, a prescription glasses provider and one of the world’s leading producers and distributors of eyewear products. Prescription glasses account for 70% of the company’s revenues and it should see increased demand from an ageing population. EssilorLuxottica is now also focusing on building its lenses brands that targets more mature consumers suffering from presbyopia with innovation through its Varilux brand. With presbyopia growing in prevalence, the company is set to benefit from strong demand as the global population ages.

Laboratory products supplier Thermo Fisher is another example of a portfolio holding that should see higher demand due to the ageing population. The company provides a range of products from basic lab equipment to specialised machinery and is a best-in-class provider of services and instruments to the pharmaceutical and biotech industries. Thermo Fisher provides services for areas like cell and gene therapy, which should see considerable growth over the following decades as ageing populations and a rise in chronic conditions drive increased spending on diagnostics and therapies.

Beauty: The silver economy opportunity

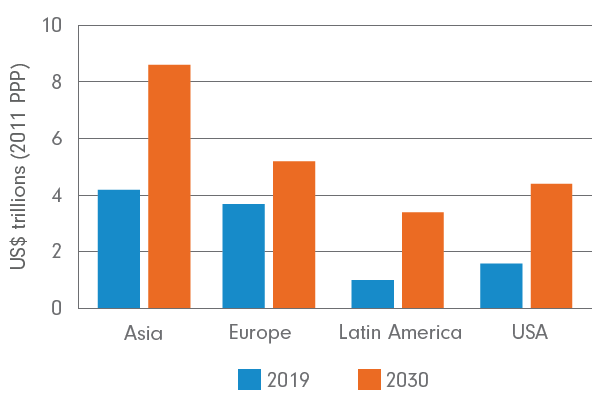

The older cohort is becoming a major consumer group and now represents a multi-trillion dollar market, which is only set to get larger (see chart 4). This group tends to have more spending potential given its high income compared to younger cohorts and higher personal care needs. The beauty industry has the potential to offer significant opportunities for investors and many businesses have started hiring older models to authentically appeal to wealthy older customers, with initiatives targeting mature consumers becoming far more commonplace in recent years.

Chart 4. Silver economy spending power set to rise

Source: World Data Lab, IDC, Morgan Stanley Research, 2021.

French beauty company L’Oréal is one holding in the fund that is exploring this ‘silver opportunity’. The company has a strong collection of diversified premium brands and primarily provides exposure to our ‘better lives’ theme, given that the growing middle class in emerging markets is a big growth engine for L’Oréal. However, it is also aligned to our ‘longer lives’ theme through its initiatives aimed at an older customer base. L’Oréal not only provides skincare and beauty products for older customers but is increasingly targeting this cohort of women with its marketing activity, and earlier this year enlisted ten influencers from the age of 45-84 for a social media marketing campaign to promote one of its ageing skincare products. As populations age, L’Oréal should benefit from the growing desire of its customers to stay healthy and attractive for longer.

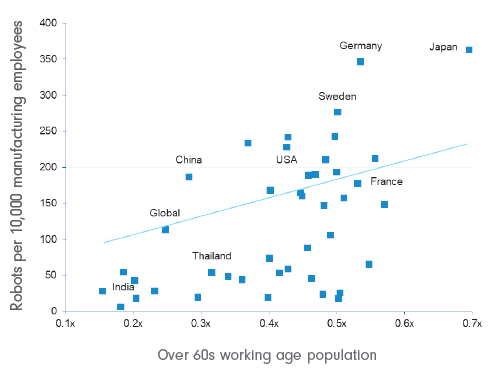

Automation: The need for efficiency gains as working age populations decline

The ageing population is also driving the need for automation. As the reduction in working age populations reduces the labour supply (see chart 5), it can create opportunities for companies operating in the automation/robotics space, as employers continue to offset labour risks and a structurally shrinking workforce through automation and technologies aimed at enhancing productivity. Sustainability considerations are also a key focus, because as the global population grows, making more sustainable use of our finite resources while meeting rising needs remains paramount.

Chart 5. Automation can plug the labour supply gap and deliver cost savings

Source: UN, Morgan Stanley Research, July 2021.

We are exploring the theme of automation through portfolio holding Keyence, a Japan-listed global enabler of factory automation that supplies products like sensors, measuring systems, and machine vision systems. The company helps manufacturers become more efficient by providing them with automation technologies, but importantly also provides the solutions to solve customers’ problems through its team of engineers. Keyence’s products can be broadly used across industries and its ‘no customisation’ criteria for product development means the company’s solutions have broad applicability across industries and regions. As companies increasingly look to plug the labour supply gap and deliver cost savings in an environment where inflation could remain higher for longer, Keyence should benefit from its technological leadership position.

The ‘longer lives’ theme offers clear investment opportunities

The world is changing rapidly as the structure of the global population continues to shift. We are living longer lives, both due to declining birth rates and improving life expectancy, a trend that came into focus earlier this month following the release of data showing that the decline in live births in the UK is gathering pace. As a trend that is increasingly prevalent in both developed and emerging economies, the economic impact and resulting investment opportunities are huge. ‘Longer lives’ is an incredibly broad-based investment theme and one that offers opportunities to gain exposure to innovative companies across sectors that are coming up with solutions to this fast-accelerating demographic shift.

Net returns as at 31 July 2023

|

Timeframe |

1 yr |

3 yr |

5 yr |

7 yr |

10 yr |

Since inception |

|

Fund |

16.11 |

10.08 |

10.33 |

11.61 |

13.07 |

15.12 |

|

Benchmark |

16.92 |

12.73 |

10.38 |

11.75 |

11.80 |

13.96 |

|

Active return |

-0.81 |

-2.65 |

-0.05 |

-0.14 |

1.27 |

1.16 |

Total net returns represent past performance only. Past performance is not a reliable indicator of future performance. Returns of the Fund can be volatile and in some periods may be negative. The return of capital is not guaranteed. Benchmark: MSCI All Country World Index NR. NR at the end of the benchmark name indicates the return is calculated including reinvesting net dividends. The dividend is reinvested after deduction of withholding tax, applying the withholding tax rate to non-resident individuals who do not benefit from double taxation treaties. With effect from 18 July 2022 the fund changed its characteristics due to changes in the investment objective. Before this date the performance was achieved under other circumstances that no longer apply.