With investment returns from traditional equities and bonds challenged in the current environment, and with many emerging market economies reopening faster than their developed world peers post COVID-19 shutdown, the case for investing in these jurisdictions has never been stronger. But finding the opportunities at a country, sector and individual stock level requires selectivity and time in the market.

Emerging markets have been growing rapidly in recent years. In fact, they now contribute over 50 per cent of global growth and are expected to contribute more than 60 per cent by next year. Clearly it is a sector that SMSF investors should be considering.

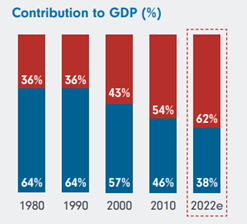

With the changing landscape and growth of emerging markets, emerging market economies are beginning to account for a much higher percentage of global GDP. The IMF World Economic Outlook Database showed that in 1980 these nations had a combined GDP of less than half that of advance economies. By 2010, the two were close to level.

Emerging markets are a significant contributor to global GDP

Source: IMF, World Economic Outlook Database October 2017. Fidelity International and MSCI ACWI and MSCI EM Index as at 30 September 2020.

However, by 2022, it’s estimated that emerging economies will have an output that is larger than the developed world. In just four decades, emerging markets will have gone from a peripheral position in the world economy to a central one.

Despite this, they still account for just a fraction of most Australian investment portfolios, and an option that has been overlooked by many SMSF investors. However, that could be set to change.

Defining EM

Once dominated by agriculture, mining and low-cost manufacturing, emerging market countries are now home to some of the world’s fastest-growing economies and most innovative companies, including those in the technology sector. Needless to say, global investors have taken note and have been eager to capture this growth trajectory.

An emerging market is characterised by the transitioning from low-to-middle to high income per capita. These economies share some characteristics of developed markets, including a functioning stock exchange, access to debt and, in most cases, predictability of government regulation.

Global indices will classify emerging markets differently, however it’s universally accepted that the likes of China, India, Indonesia, Brazil, Taiwan and Korea are core emerging market economies, and some that waiver between emerging and developed, such as Argentina, Hong Kong and Singapore.

Another defining characteristic of emerging markets is the degree of demographic and social change, with a large proportion of these populations having younger generations about to become middle-class workers and consumers. Between 2009 and 2030, China alone is expected to add 850 million people to its middle class, taking it from 12 per cent to 73 per cent of its population.

With this increased affluence comes more consumption – not just of consumer goods such as cars, technology and electrical goods, but of more sophisticated products and services. China’s healthcare industry, for example, grew four-fold between 2006 and 2016.

COVID-19 driven changes

Within the context of emerging markets, SMSF investors need to be aware that they’re operating in a more fluid environment than is the case in other asset classes.

In the 12 months prior to the global outbreak of COVID-19, there was lot of concerns around currency devaluation, whereby the US dollar had been very strong and the Federal Reserve was raising rates which, in turn, was putting pressure on the cost of capital for emerging markets.

However, by the end of 2019, much of these concerns had dissipated and there were tentative signs the trade wars were starting to abate and support the emerging markets asset class.

But then, COVID-19 hit. In Q1 2020, emerging market equities recorded their worst quarter since the global financial crisis.

Interestingly, however, for many emerging market economies, while the human side of the event was catastrophic, infrastructure spending from stimulus measures presented a number of opportunities in less favourable sectors at the time such as industrials. This sector was attractive from a valuation perspective and, coupled with commodity prices, demand started to pick up.

The pandemic has also led to a genuine ‘at home’ culture, whether it be in the form of working, schooling, shopping or even the burgeoning area of telehealth. Emerging markets that can capitalise on this trend, especially those with established technology sectors, are likely to see strong growth for the foreseeable future.

In China, for example, working from home has boosted the need for cloud-based service which is in its infancy and ripe for expansion; mobile phone time surged to over five hours per day and time spent gaming on Tencent titles – Honour of Kings and Game for Peace – surged to two to three times the prior monthly run-rate.

The rise of the internet and persistent technological advancement have been increasingly important drivers of emerging markets. China, which was traditionally the powerhouse of global manufacturing for decades, today rides the wave of digital innovation with the success of the BAT tech giants – Baidu, Ali Baba and Tencent.

Some of the largest e-commerce, gaming, social media and hardware manufacturers reside in emerging markets and the changing nature of the index shows just how much this changed over a decade.

Other changes in society and consumer habits will emerge from the pandemic, some semi-permanent and some permanent, such as a greater focus on health, lifestyle choices and financial planning.

COVID-19 has also emphasised the rising purchasing power of emerging market consumers across a range of segments. Structurally sound companies operating across an array of sub-sectors, going beyond purely internet-related names to include autos, sportswear and cookware are ones to watch, as well as those that can perform well despite lower levels of international trade. These include leading domestic hardware manufacturers.

Where to from here?

The equity markets of China, Taiwan and South Korea in particular however, pose an interesting proposition for SMSF investors. While these economies reopened relatively quickly post shutdown, the risk of further outbreaks - even with promising vaccine developments - adds heightened uncertainty.

As sentiment towards hardly hit Latin America and EMEA regions improves, supported by a pick-up in activity as well as pricing support for commodities driven by inflation, investors should anticipate a sharp re-rating, emphasised by the historically low valuations.

As these markets attract flows, this could also translate into a risk as there could likely be significant downward pressure on more extended parts of the universe, such as China and broader North Asia.

Heightened levels of industry consolidation throughout emerging markets are also likely to materialise, with larger brands – such as those within the aforementioned consumer and technology sectors - set to benefit.

Importantly, while the pandemic has served as a further catalyst for digitalisation, with internet/tech-related names likely to benefit from this, structural growth drivers such as urbanisation, financialisation and lifestyle changes persist and will continue, indicating opportunities also across a range of more traditional domestic businesses.

Inflationary and interest rate considerations could have potential implications for resources and financial-based stocks respectively.

Given the inflationary backdrop and economic recovery, exposure to commodities, including copper, steel and Platinum Group Metals (PGMs) should be done on a selective basis. Financial stocks are another area of relative caution, particularly in an ultra-low interest rate environment that is likely to remain that way for some time.

But the potential for growth is great. With disruption of supply chains during the COVID-19 pandemic, emerging market economies with large domestic consumption are expected to benefit in the short to medium term. The rise of regional economic centres, where growing demand from a large economy like China or India, will fuel growth in other developing countries nearby. Coupled with strong domestic consumption driven by a rising middle class and the evolution towards growth industries, it makes for a compelling case for SMSF exposure to emerging market economies.

EM and sustainability

ESG considerations will continue to drive investment decisions and emerging markets are no exception. There is now a strong correlation between companies that score highly in terms of their approach to ESG and higher than average returns for investors.

Key to this will be maintaining a focus on identifying businesses with best-in-class practices that are reflected in clear ESG policies. Company management and boards also need to be able to stand by these policies, and demonstrate the company’s commitment to ESG through its strategy and operations.

COVID-19 has highlighted the importance of investing in high quality names, characterised by sound balance sheet structures that enable them to weather more challenging environments and come out stronger from the volatility than peers. A focus on governance and capital structures therefore has to remain paramount, in avoiding permanent loss of capital – an important consideration for SMSF investors – particularly those approaching , or in, retirement.

There are many reasons for self managed super fund investors to remain optimistic towards emerging market equities, which are set to benefit from long-term structural growth drivers and more recent global developments, namely those relating to technology and the new stay at home phenomenon.

Greater diversification across countries, sectors and companies affords investors the ability to take into account the varying impacts of COVID-19 on emerging market economies, the sectors and the companies themselves.

However, as volatility levels remain elevated, selectivity remains paramount. Against this backdrop, a focus on identifying companies characterised by robust corporate governance and balance sheet structures is key.

Because of the risks associated with emerging market economies, they often generate higher-than-average returns for investors. Not all are good investments, but for those investors willing to research and focus on identifying high quality names, emerging markets will remain an attractive proposition for some time yet. And for self managed superannuation fund investors, who are investing for the long term, they have the long term timeframe needed to ride through the emerging market peaks and troughs.