Asset preferences are shifting

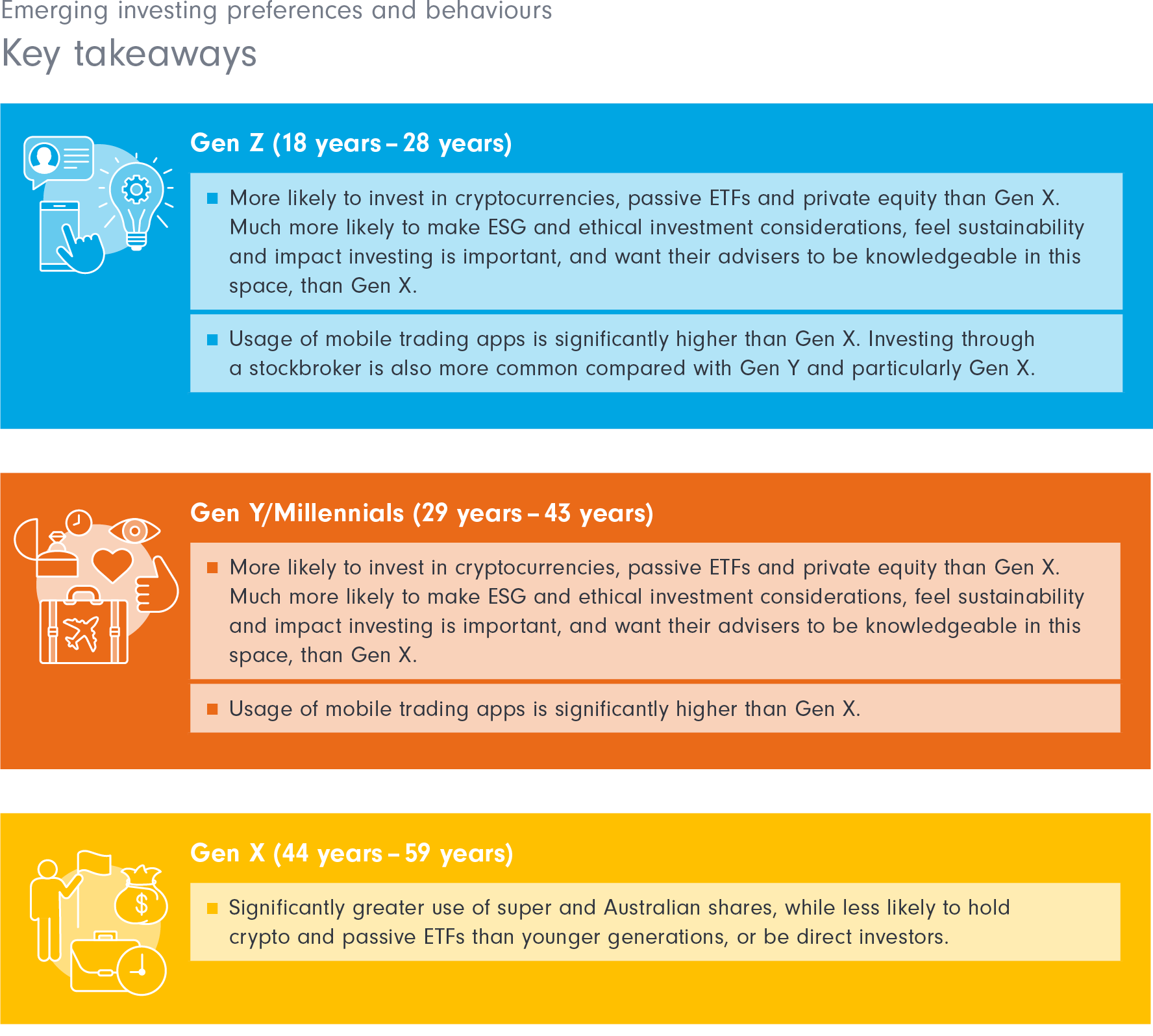

There is a significantly greater use of super and Australian shares among Gen X, while they are less likely to hold crypto and passive ETFs than are younger generations. Conversely, next gens are less likely than Gen X to use super and more likely to invest in cryptocurrencies.

Active ETFs are increasingly appealing among younger gens

Gen Y are the most likely to find active ETFs appealing, followed by Gen Z, while Gen X are relatively the least likely. The most attractive features include ease of monitoring, simplicity of transactions, lower minimum investment, and transparency.

Alignment with personal values is becoming increasingly important

More than 4 in 5 next gens feel that it is important to align their investments with their personal values, and the younger the investor the greater the importance.

Around 1 in 5 Gen Z and Gen Y are likely to make social and ethical investment considerations, compared to about half as many Gen X. One in 2 Gen Z and Gen Y are likely to consider ESG factors in future investments compared to around 1 in 3 Gen X. Gen Z and Gen Y are more likely to feel that sustainability and impact investing is important, which means they are more likely to want their advisers to be knowledgeable in this space. Around 3 in 4 next gens feel that it is important to have sustainability and impact investing that aligns with their values, compared to 3 in 5 Gen X.

However, when it comes to actual investing, only around 2 in 5 of Gen Z and Gen Y have made an investment specifically due for sustainability or social impact, compared to 1 in 5 Gen X.

These preferences translate to required advisers’ capabilities, as close to 4 in 5 Gen Z and 3 in 4 Gen Y think it’s important for advisers to be knowledgeable in the ESG space compared to 2 in 3 Gen X.

The rise of direct investing is apparent

Mobile trading apps are used by close to 2 in 5 of those with investments, and online brokerage accounts by 1 in 4.

Usage of mobile trading apps is significantly higher among the next generation, with close to 1 in 2 using them compared to half as many Gen X.

Investing through a stockbroker is more common among Gen Z compared with Gen Y and particularly Gen X. This, along with increased desire for self-improvement and financial education, suggests that they are increasingly likely to take a more hands-on approach.

This has strong implications for how advisers manage their client relationships and the needs they will need to meet. They may be more likely to want to play a greater role in the decision-making process and bring their own ideas to the table.

Download the full report now or explore our other articles