Key points

- There was little focus on environmental, social and governance (ESG) before the onset of the 2008 global financial crisis.

- In the last decade, we have seen a number of key ESG-related developments, including the UK Stewardship Code, while investors are also putting this into practice.

- The relationship between ESG and alpha-generation isn’t always clear, but in the long-run companies with strong ESG principles should deliver superior outcomes than those that don’t.

Before 2008 there was little focus on ESG. Although Socially Responsible Investing already existed, it had a much narrower scope with more specific targets. While non-governmental groups have been promoting ESG factors for decades, the capital markets largely ignored them. The only standard for them had been returns or alphas.

Then came the crisis, and the power balance shifted. Many blamed the banks for the crisis, and said that financial institutions had become too greedy and lacked governance. The public and the government issued a strong voice asking the financial markets as a whole to revise their capital allocation policies. They wanted them to allocate more to areas to solve problems such as social or environmental issues more effectively, while using higher governance to oversee their overall activities.

Number of integrated reports surges

Investors increasingly put this perception into practice. Globally, assets under management in portfolios with elements of sustainable investing have grown to an estimated US$23tn, an increase of more than 600 per cent over the past decade, according to a Morningstar Research estimate earlier this year.

Key ESG-related policies came in the wake of the crisis, such as the UK’s Stewardship Code and Kay Review, Sustainable Development Goals, and the rise of integrated reporting among corporations to include non-financial information.

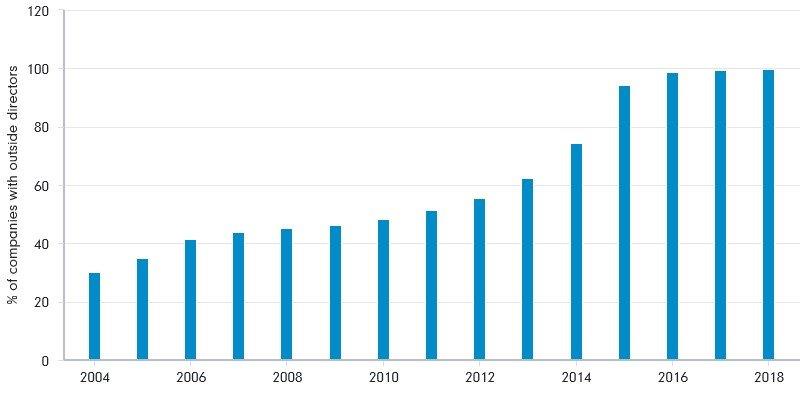

In Japan, for example, only a dozen firms released integrated reports in 2008, which surged to 341 last year, according to data from KPMG Japan. 10 years ago, only 45.2 per cent of companies listed on the first section of the Tokyo Stock Exchange appointed outside directors, and that has grown to 99.7 per cent.

More Japanese companies appoint outside directors

Source: Tokyo Stock Exchange, August 2018. Percentage of TSE 1st Section-listed companies with outside directors.

Collective awareness in capital markets

Institutional investors in particular have a fiduciary duty to act as managers of client assets and to grow them. Simply speaking, as active managers, we have to focus on alpha generation, so we had to ask ourselves, can ESG create alpha? The answer was clearly affirmative.

The relationship between ESG and the alpha-generating share price performance of a company is not always clear, and can be hard to quantify, but companies that act according to ESG principles should deliver superior long-term outcomes than those who do not. If a company concentrates solely on profits, and pays no attention to issues such as pollution or labour problems, then it will face delayed costs someday and consequently won’t be sustainable.

The global financial crisis was a dark cloud for capital markets, but the rise of ESG was a silver lining for investors. There is now a collective awareness in capital markets that fiduciary duty can co-exist with ESG principles to mutual benefit.