Cement is one of the dirtiest industries for greenhouse gas emissions and China pours more than half of the world’s new concrete each year. The sector’s vast carbon footprint means there’s scope for even small adjustments to have an amplified impact in the real world, and we see huge environmental value in helping to set a top Chinese cement producer on a greener path.

Driverless trucks are humming about in this eastern China factory, where high levels of automation, swaths of greenery and a sparsity of workers all ooze with vibes of a tech firm. Yet this is a cement plant owned by Anhui Conch, a top Chinese producer of the building material, which Fidelity International analysts recently visited to carry out research into sustainable investment practices.

Since 2020, we have been engaging with Conch as one of our investees, advising it on how to improve across several environmental, social and governance (ESG) factors. In our most recent dialogue, Fidelity analysts met Anhui Conch CEO, Qunfeng Li, in Wuhu city in November.

The cement industry is one of the world’s worst polluters. Production of this key ingredient in concrete contributes about 7 per cent of annual global greenhouse gas emissions. China, in turn, pours more concrete each year than the rest of the world combined, with an estimated output of 2.1 billion tonnes of cement in 2022 compared with a global total of 4.1 billion tonnes.

But new innovations in production mean that cement may start to be a bit less polluting - or potentially someday start to bring net environmental benefits. In Europe, new technologies are emerging as scientists seek to revolutionise how concrete is made. Novel processes are being developed that could not only reduce cement’s carbon footprint but could potentially turn it into a carbon negative material.

In China, cutting emissions in the cement industry is crucial to the national drive towards net zero. Chinese leaders have pledged to hit peak carbon emissions by 2030 and to achieve neutrality by 2060. In line with these priorities, Fidelity analysts began speaking to Anhui Conch’s management about emissions targets in November 2020.

Even before our engagement started, Conch’s management had shown a strong desire to improve the company’s ESG practices, and progress has become more tangible over the last two years. Reflecting some of the improvements, MSCI raised Anhui Conch’s sustainability rating to B in July 2021 from CCC and further raised it to BB in August 2022.

More recently, Chinese cement prices have been trending down this year, with demand from homebuilders slowing as the property market slumps. Meanwhile, rising coal prices are putting another squeeze on the profit margins of cement production. These industry headwinds add to the difficulty of pushing through a decarbonisation agenda, especially for China’s smaller or more weakly capitalised producers.

However, Anhui Conch has indicated that it aims to stay the course on cutting emissions and sticking to its sustainability targets, aided by a balance sheet that is among the strongest in the sector.

“Even in a downturn, we as an industry leader will try to maintain industry stability as well as our good image,” Anhui Conch CEO, Li, told our analysts in the November meeting. “In the current downcycle, our ESG spending will only increase, and this will add to our competitive edge,” he added.

Hard gains

Cement production relies heavily on coal-fired power plants, with each tonne of output typically emitting 0.6 tonnes of carbon. In addition, the mining of lime, a key cement ingredient, can be highly pollutive, and cement itself, once turned into concrete structures, can contribute to urban heat effects.

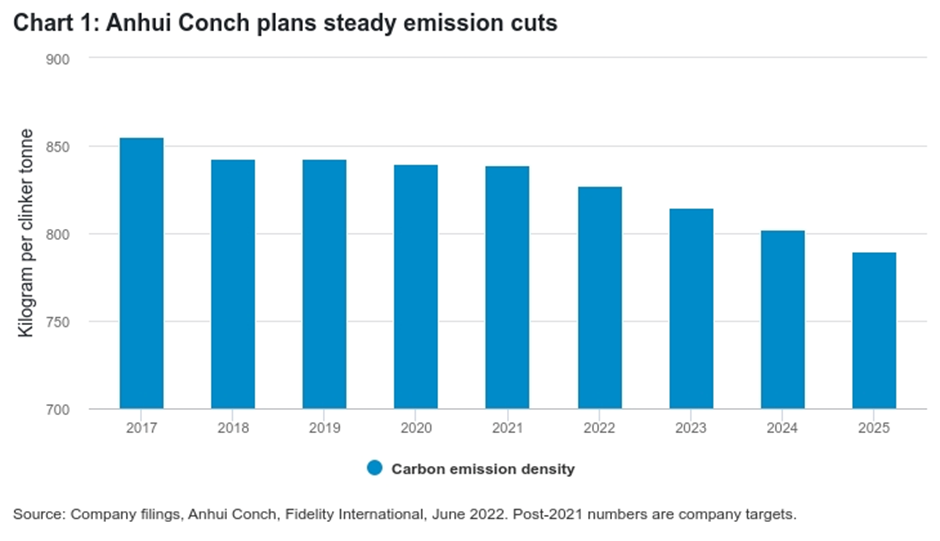

To cut its own emissions, Anhui Conch has focused on limiting the use of coal and electricity per tonne of cement, as well as boosting its overall operating efficiency. It is switching to biomass fuel, capturing carbon dioxide, and reusing waste heat to generate electricity. As a result, emission density has dropped to 839 kilograms per clinker tonne in 2021 from 855 kilograms in 2017. Clinker, the main material for making cement, typically contributes to 80 per cent of cement’s weight. Anhui Conch has set a very specific target - 6 per cent total reduction in emission density in the five years through 2025, when it aims to achieve 790 kilograms per clinker tonne. Currently, the world’s biggest cement producer, Lafarge Holcim, emits about 743 kilograms of carbon dioxide per clinker tonne.

In addition, Anhui Conch plans to follow Lafarge in adopting more biomass fuel, which could eventually help to cut emissions by another 10 to 20 per cent. The company’s first biomass plant began operating in late 2020, with a capacity to consume 300,000 tonnes of plant material each year, which can replace 75,000 tonnes of coal and help reduce some 200,000 tonnes of carbon emissions. A second and larger biomass plant is under construction.

Pursuing sustainability at the expense of short-term margins, the company has bumped up its annual environmental spending to 2 billion renminbi (around US$300 million). Domestically, the company has achieved the lowest emission density among large cement producers when measured by unit of output.

Open dialogue

Anhui Conch was already working to improve its sustainability performance before Fidelity’s engagement began. But as our analysts drilled into the details, they realised that the cement maker was selling its efforts short based on how it was disclosing and benchmarking its emissions data, and that some global sustainability rating agencies had been judging the company based on its emissions per million dollars of revenue. This ignores one of the basic dynamics of the global cement industry: prices are highly localised because of the high costs of shipping such a heavy material over long distances. The result in China is that cement is typically 40 to 50 per cent cheaper than in the West.

Fidelity analysts realised that applying revenue-based emissions metrics would by nature severely disadvantage the Chinese company when compared with its global peers. Anhui Conch agreed with our view that it would be more accurate for making cross-border comparisons - and a better reflection of its efforts to reduce carbon footprint - to switch to volume-based metrics that capture emissions per unit of actual cement production.

Moreover, the company has taken it upon itself to find new ways to reduce its emissions of carbon and other harmful greenhouse gases. For example, it has developed an efficient system to curb nitrogen oxide emissions, which in many cases could cause more global warming than carbon emissions. Based on an old technology known as selective catalytic reduction, the system uses special catalysts to convert nitrogen oxide into harmless nitrogen gas and water vapour that can be safely released into the atmosphere.

To reduce its reliance on electricity from coal-fired plants, which still account for most of China’s power supply, the firm has started building solar power plants with a total planned capacity of 1 gigawatt. The solar plants would be able to meet nearly one tenth of Anhui Conch’s electricity needs, based on its power consumption in the last two years.

Anhui Conch also recently formed a dedicated ESG committee to supervise decarbonisation and other sustainability issues, while Fidelity’s own engagements with Anhui Conch have also extended beyond environmental issues to include areas such as corporate governance.

A crucial front in decarbonisation

While Chinese cement producers are making some progress in cleaning up their act, the industry remains a huge polluter and one of the most difficult to decarbonise. Cement production still accounts for some 12 per cent of China’s total carbon emissions, compared with an estimated global ratio of about 7 per cent, given the outsized role that the sector plays in the economy.

Times may be changing. Over the last few years, China has carried out supply-side reforms to its cement industry, shutting down numerous small and pollutive plants, or directing state-owned cement giants to acquire them as part of an industry consolidation. In the autumn of 2021, nationwide power curtailment driven by soaring coal prices and other bottlenecks in the energy supply chain further reduced cement output.

There are signs that other large cement makers in China are starting to follow Anhui Conch’s lead in ESG commitments, as the government pushes ahead with nationwide decarbonisation targets. We believe the drive toward net zero, combined with serious engagement by investors, will help eventually firm up a greener path for China’s cement industry.