Back to school for European real estate

A line appeared to be drawn under tariff uncertainty at the end of July with the US-EU trade deal being struck, just as the European real estate market entered its traditional summer lull. As real estate investors returned to their desks in September, many were pondering the question, where do we go from here?

The lens through which we look forward has been shaped by more than just global trade announcements, however, with developments in the interest rate cycle and tangible signs of recovery in the office sector being among the other important summer preludes of what to expect in real estate over coming quarters and years.

Sector allocation, which was the key determinant of outperformance in the last cycle, is expected to be much less influential in this cycle. Instead, we expect performance to vary much more at an asset level within sectors, as occupiers become more uncompromising on the green credentials of the space they occupy and consolidate their presence into higher quality space both in terms of location, and amenity value. A sharp analysis of asset and micro-location fundamentals will be more important than ever in differentiating between the winners and the losers.

Nevertheless, we still expect the dynamics at a sector level to vary, with a mix of cyclical and structural factors at play. It is, therefore, important to delve into the nuances between the sectors, and to think more deeply about how new disruptive influences, such as the relentless rise of artificial intelligence, will shape the use case for and value of different types of real estate in the future.

Still all about the economy?

The macro environment has de-risked since the summer break but has not been radically transformed for the better. Growth rates across Europe are expected to remain modest at best (1.2% in 2025 and 0.8% in 20261), and the fallout from trade disruption and investment during the four months of Liberation Day induced uncertainty are likely to stay with us for rest of the year.

Another summer milestone was the European Central Bank’s last, or possibly penultimate interest rate cut of this cycle, concluding 200-bps of interest rate cuts over the last year. Government bond yields have stabilised at c.300-bps above their pandemic lows and swap rates indicate that this new paradigm of interest rates is here to stay. This is the first major economic driver that will shape the performance of the real estate sector, with yield driven capital growth unlikely to play the same role in this cycle as it did in the post-GFC era. This cycle, therefore, is expected to be defined by the top line, i.e. rental growth prospects, rather than yield compression.

One significant positive development in a European context that could act as a meaningful support to medium to long-term rental growth potential is German fiscal expansion. The March ‘bazooka from Berlin’ got lost in the maelstrom around tariffs not long after it was announced, but the €1tn of fiscal stimulus unlocked for defence and infrastructure investment is of historic proportions and is worth returning to, now that tariff uncertainty has largely been mitigated.

This capital investment for rearming the German military will drive the build out of significant new manufacturing capacity for the defence industry in Europe, with Savills recently estimating that an additional 37 million square metres of European warehouse space may be required to facilitate this increase in output2.

On the infrastructure side, investment is expected to target civil engineering projects like roads and railways, schools, and green energy as the country seeks to address years of underinvestment in essential infrastructure. The economic impact of the capital investment will not be felt overnight, as it takes time for the money to be allocated to projects, but it is expected to take Germany from effectively no growth at present, to growth averaging 1.8% per annum by the end of the decade1. This will not only be a large boost to the German economy through to the 2030s but will have positive spillovers for the wider European economy.

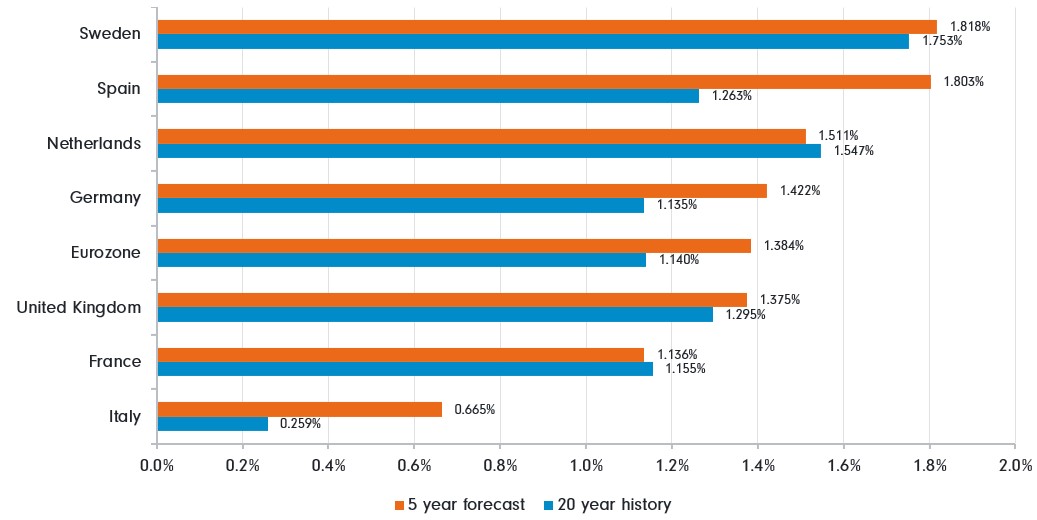

Germany’s announcement is also being seen as the starting gun on further investment and deregulation efforts being undertaken by European Union member states, e.g. Ireland followed up the German announcement with a €200bn infrastructure package of its own over the next 10 years. Consequently, fiscal expansion is expected to be an important macroeconomic theme that will potentially drive growth rates to levels well above the average of the past 20 years in most of Europe’s major markets (figure 1), creating new opportunities for European real estate investors.

Figure 1: Forecast economic growth offers some upside on recent history

Source: Oxford Economics, Q3 2025

Artificial intelligence - Ripple effect on real estate

As it stands, the only major sector that has seen a new surge of investor interest based on the opportunities from artificial intelligence (AI) has been the data centre sector. The market has far from fully digested what the impact of AI will be on the rest of the market, with investor focus primarily on near term cyclical factors.

However, it would be naïve to ignore the significant effects that AI may have on office, industrial, retail, and potentially even the residential sector over the long term, if projections about its role in future life are to be relied upon.

Indeed, the long-term time horizon over which these impacts may feed through should not provide too much comfort to investors making portfolio allocation decisions today. We have seen repeatedly in real estate that once a narrative around a sector is formed, it can be engrained quickly, and slow to unwind. The most recent example being the post-Covid “death of the office,” which has lingered despite resilient vacancy rates and accelerating prime rental growth in most major markets.

We are in the early stages of AI catalysing job losses, but this has not yet had a meaningful impact on office-based employment. The rise of the internet brought similar fears around job losses, but the reality has been more nuanced, with many lower value-added job losses being substituted by the creation of new, relatively high value roles, in firms that ended up spearheading the evolution of the prime office as we know them today (think of Google).

Undoubtedly there will be some of this type of dynamic at play as AI embeds into corporate strategy. The latest research suggests the net effect on office-based employment will lean to the negative side, which means the relationship between office-based employment growth and growth in the general economy may not be as strong as it has been in the past.

A similar trend in terms of job losses could be seen in the logistics sector, where supply chain optimisation and prediction, as a result of AI, facilitates more efficient utilisation of warehouse space on the one hand, and encourages much more automation/robotics for processes like picking and packing. This could become increasingly appealing to companies in the logistics sector as European demographics and the political pushback against migration are likely to result in more acute labour shortages over time.

Location has long been the primary consideration for warehouse occupiers - not only for market access, but also for access to labour. However, the increased adoption of automation could have a meaningful impact on the employment density of warehouses, thereby decoupling them from the dependence on nearby labour pools. At the same time, the automation and electrification of vehicle fleets may over time also erode the benefits of proximity to markets as factors such as working time regulations for drivers and fuel costs become less important in determining site selection. Yet despite these technological advances, customer expectations around rapid delivery remain a key constraint, ensuring that proximity to end markets will still be valued by many occupiers.

In London, one dynamic attributed to the rise of AI has been the loss of 800,000 square metres of land that had been earmarked for logistics development to the data centre sector3. This is a trend that is likely to affect other major European data centre markets like Paris, Frankfurt, Amsterdam, and Dublin, and will in turn enhance the value of the standing logistics stock in and around these clusters.

The retail and residential sectors are not immune from AI-led revolutions, but the impact is likely to be more indirect. These will be topics for further research in the future as we try to quantify and predict the nature of the effects AI will have on our markets.

Sectors in transition

Offices - early signs of a thaw

Zooming in on the current performance trends and outlook for the sectors, the summer was notable in that it brought the first tangible signs of a turnaround in sentiment towards offices. In June, City of London office yields compressed by 25bps, the first time City office yields have compressed since 20214. This shift was catalysed by increasing transaction volumes in the sector, up 100% year-on-year, with twelve assets trading for more than £100m in H1 2025, up from only four in H1 20245.

It is not just a London story, with Paris offices, particularly in the CBD seeing an uptick in transaction activity, the largest deal being the Trocadero office acquired by Blackstone for €700m. In Germany, momentum has been slower, mirroring the economic backdrop, but several large office deals of between €150m - €700m in size have recently been brought to market in Frankfurt and Berlin, which will act as important bellwethers of demand.

Financing costs have been a key barrier to deal flow at the large ticket end of the office market as deals of this scale are rarely done without debt. The relative underperformance of many lenders’ office loan books has made them reluctant to price office asset risk over the last four years. The emerging liquidity we see today is an indication this may be changing, and this shift will be key for unlocking further office transaction activity.

On the occupier side, 2025 has been a reasonably good year for office leasing activity, with vacancy rates stabilising and prime rental growth accelerating to c.3% - 4% p.a. across major markets like Paris, London, and Amsterdam6.

There are even signs of shifting fortunes for what have recently been the most out of favour office markets like Canary Wharf in London and La Défense in Paris. In the former, new lettings to HSCB and Visa, plus the commitment from JP Morgan to keep their HQ at Canary Wharf, have highlighted the appeal of the considerably lower rents on offer than in London’s City or West End office markets, while retaining strong connectivity. La Défense is seeing a similar renaissance, with take-up rising 60% year-on-year in 2024 to 14% above the long-term average7.

There are certainly still challenges of obsolescence in the office market and the high capex required to maintain current occupier standards, compounded by occupiers’ expectations around lease flexibility. All these need to be adequately priced. We therefore favour net zero carbon focused value add opportunities in the sector at present, where supply shortages, strong occupier demand and growing investor interest should generate good investment performance.

We expect to see the gradual thawing of investor sentiment towards offices continue as we head into 2026 as further evidence of resilience in the sector draws the sector’s long stint out in the cold nearer to an end.

Logistics - from expansion to efficiency

The logistics sector has been most exposed to global trade uncertainty given the vulnerability of the occupier base to changes in consumer and manufacturer sentiment. Many occupiers have taken a wait-and-see approach through H1 2025 with leasing across Europe declining by 5% in H1 2024. This has pushed vacancy rates higher, currently averaging 6.7% across Europe8, and they could edge modestly upwards next year as a combination of below average (even by pre-Covid standards) demand and new supply come to the market. Nevertheless, we should now be through the worst for the sector, and we enter the next stage of the cycle with supply levels supportive of modest rental growth and demand set to benefit from economic recovery over the next two years.

However, the leading surveys on occupier and investor sentiment in the sector, produced by CBRE and Savills, illustrate a common theme of consolidation into the most efficient, best located space being a key part of occupiers’ current warehouse strategy, rather than the focus on footprint expansion that dominated in the previous cycle.

In the last cycle, shortages of space helped deliver strong performance across the sector. However, a return to more normal levels of vacancy in the sector is now providing occupiers with a level of choice that was almost completely absent when vacancy was less than 2%. This is expected to deepen the performance divide between assets in the sector, reinforcing the importance of factors such as asset quality, efficiency, and sustainability. Energy security is also emerging as a key priority amid grid constraints and competition for power, particularly from data centres. So, our focus is on energy resilient assets by either acquiring modern, energy-efficient logistics assets in prime locations or upgrading older logistic properties into low-carbon facilities - integrating solar arrays and battery storage where viable - across the most established logistics clusters in Europe.

Residential - resilience amid shortage

Rental growth expectations are looking most well underpinned in the residential sector. Across the Eurozone, permits for new residential construction are at the lowest levels in 20 years, which gives high conviction in the robust 3.2% annualised prime rental growth that is forecast out to 2030 on average across the major markets of Germany, France, the Netherlands, Spain, and Austria9.

While population growth in Europe is negligible, household formation is higher as people marry later in life, get divorced more often, and live longer. Current estimates suggest household growth of 2.5% by the end of 2030, which is the equivalent to 3.9 million additional households10. This is compounded by structural changes in the tenure mix, as affordability constraints on home ownership are ensuring people stay in the rental market for longer before buying a home, or perhaps even remaining in the rental market permanently. This means that demand for purpose built rental accommodation is growing, even as demand and price growth across other tenures moderates in some markets.

While a return to sub 3% and even 2% prime yields in European residential markets is not expected any time soon, we believe there are good prospects for long term capital value appreciation as consistent rental value uplifts, capitalised by the keenest yields in European real estate, should deliver value growth that underpins the attractiveness of the sector’s risk adjusted returns.

Conclusion - A clearer path ahead for European real estate

As we look forward, an additional source of comfort as we navigate still uncertain times ought to be the relative outperformance of the listed real estate sector between Liberation Day and the EU-US trade deal being signed. This was driven in part by the lowering of interest rate expectations but was also a recognition of the defensive growth characteristics of the real estate sector, which have sustained rental growth despite the dismal macroeconomic backdrop.

This is linked to an evolving theme of increasing investor attention on Europe from countries like Japan and Canada. In the first half of 2025, Japanese investors deployed a record high level of capital into European real estate, whereas their investment in the US fell 45% year-on-year in the same period1. This could prove to be a fleeting trend, but as more investors have been spurred into doing due diligence on European markets, we expect many of them to recognise the value on offer, thereby improving market liquidity and providing further support to the nascent recovery.

So, while the recent challenges were indeed another bump in the road to recovery for European real estate, the direction of travel remains clear. The medium to long term outlook is promising, driven by the supply-demand backdrop, and underpinned by expectations of a more dynamic European economy.

Sources

1- Oxford Economics, September 2025.

2 - Savills, August 2025.

3 - Savills, September 2025.

4 - CBRE, Monthly Yields Report, June 2025

5 - MSCI Real Capital Analytics, Q2 2025

6 - CBRE, IPF, September 2025

7 - Savills Lettings Market Ile-de-France Offices Spring 2025

8 - Savills European Logistics Outlook, Q2 2025

9 - CBRE European Forecasts, Q3 2025

10 - Oxford Economics, September 2025