Our analysts see tentative signs that companies’ cost pressures may soon ease, but the pressure on central banks will nevertheless remain high.

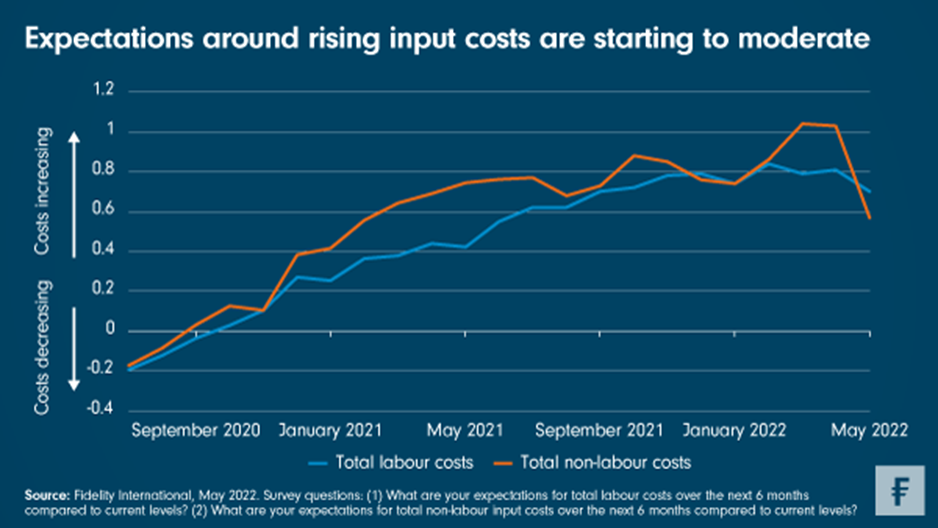

Expectations around input cost rises have begun to moderate, according to Fidelity International’s latest analyst survey. On average, our 161 analysts surveyed worldwide expect both labour and non-labour costs will increase over the next six months, but to a lesser degree than in previous months, suggesting that inflationary pressures may be starting to ease.

The weighted average of analysts’ non-labour cost expectations fell last month in every sector except healthcare. Within certain sectors, there are even expectations of falling costs: a small proportion of analysts looking at materials and information technology companies expect a moderate decrease in non-labour costs over the next six months.

Any sign of easing costs would be embraced by economies which have faced 18 months of consecutive price increases, with cost bases now much higher than they were pre-pandemic. It would also give central banks some wiggle room when setting monetary policy. Even if inflationary pressures do abate, however, a weak global growth outlook means stagflation remains a realistic prospect.

Moreover, our survey shows that expectations around labour costs are moderating more slowly than non-labour costs, while the recent positive non-farm payroll figures in the US show labour markets remain tight, increasing the risk of rising wage pressures.