(and the truth behind them)

With sustainable investing and environmental, social and governance (ESG) issues being a relatively new phenomenon in the investing world, it’s no surprise that there are many myths, misinformation and misconceptions associated with it.

Here, we debunk five common myths and detail why the reality of sustainable investing is far different from what some claim.

Myth #1 – Sustainable investing strategies produce lower returns

There’s a saying that goes, ‘sustainable investing is good for values, but unsuitable for value’. This is understandable. When we go to the market to buy “sustainable” products, such as organic food, they always seem to cost more than their conventional counterparts. It trains us to associate “sustainable” with “more expensive” (which means “lower returns” in an investment context).

The reality is the complete opposite. Extensive data has shown that sustainable investing strategies have delivered higher, not lower returns. The most recent data comes from the Covid-19-related global sell-off in February/March 2020, where companies that scored highly on ESG ratings outperformed the broader market.

This trend of outperformance is not just limited to the recent market retreat or sourced from our own proprietary research.

- A Morningstar report studying almost 4,900 European mutual funds from 2009 to 2019 found that 59 per cent of surviving sustainable products outperformed their conventional counterparts. Furthermore, 72 per cent of sustainable funds survived the 10-year period, compared to just 46 per cent of traditional funds. Sustainable offerings also exhibited superior returns throughout the Covid-19 sell-off.

- A 2019 Morningstar study, this time analysing ESG-screened market indices, found that 73 per cent outperformed their non-ESG peers since inception.

- A 2015 study by global index provider MSCI discovered that ESG strategies outperformed their global benchmarks over an eight-year period.

Of course, past performance does not guarantee future returns. But a glance at historical data proves that it is indeed possible to do well by doing good.

Myth #2 – Sustainable investing involves only excluding “sin stocks”

The next common myth about sustainable investing surrounds its methods. There is a widely held belief that all sustainable investing does is exclude “sin stocks”, such as those associated with gambling or tobacco, from their portfolios.

There is some truth to this. This exclusion process, known as “negative ESG screening”, is a staple sustainable investing strategy. But it is also the most basic strategy – and far from the only one.

For instance, many portfolio managers also use something called ESG optimisations. Here, companies, which demonstrate high ESG metrics, receive greater portfolio weights.

Another strategy, thematic investing, invests in companies that stand to benefit from specific ESG-related themes – for example, renewable-energy companies.

A close cousin of this is impact investing, which aims to generate specific positive ESG effects in addition to returns. Common impact investing areas include healthcare, renewable energy, and education.

Finally, there is active ownership. Under this model, large owners, such as institutional investors, engage with company management to improve the company’s ESG standings. Analysis has shown that seven out of 10 asset managers exercise active ownership from an ESG standpoint.

Therefore, to claim that sustainable investing “only” does negative screening is patently false. It is but one of many sustainable investing strategies.

Myth #3 – Sustainable investing only works for equities

It is true that the evidence of the outperformance of sustainable investing strategies is mostly sourced from equity markets. There is a simple reason for this: equities are the most popular and liquid asset class, which results in rich datasets that can be easily mined for research purposes.

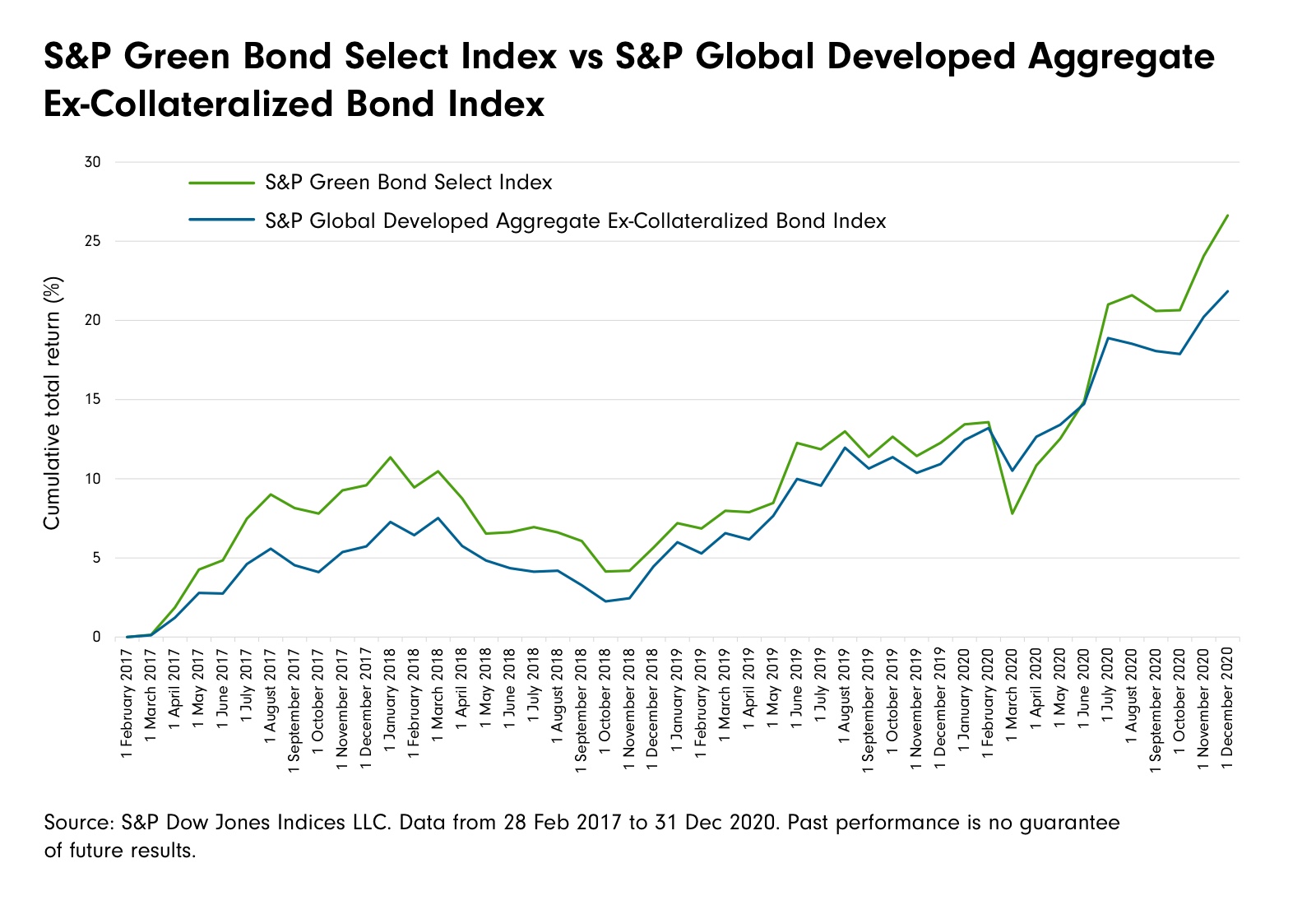

Let’s look at the “green bonds” space – where the proceeds go toward funding environmentally-friendly projects. This is a market which has seen impressive growth. In 2019, US$258 billion in green bonds were issued, a 51 per cent growth from 2018. Although they are a newer instrument, historical data indicates that they generally outperform, or at least match, the benchmark index.

Then, there are the alternative asset classes. Even here, sustainable investing strategies still apply. In fact, in some cases, they may be even more relevant. Consider the private equity space. Unlike liquid public equities, investors’ funds are locked up for years. On top of that, regulatory requirements are also less strict. This means ensuring that these companies are more robust against ESG-related risks are of greater importance.

As the sustainable investing universe grows, we will undoubtedly see sustainable investing strategies expand to more and more asset classes.

Myth #4 – Only millennials and institutional investors are interested in sustainable investing

Change has typically been associated with the younger generations. Therefore, the illusion that only the young are interested in sustainable investing should come as no surprise. Many cynics would allege that institutional investors are only doing so for branding or marketing purposes.

Millennials are undoubtedly the most interested in sustainable investing. Recent studies have shown that 87 per cent to 95 per cent of high-net-worth millennials were interested in sustainable investing. The exploding number of ESG funds clearly shows that institutional interest has never been higher.

Interestingly, when Morningstar surveyed US investors, it found that the majority – 72 per cent – of all investors were interested in sustainable investing. And surprisingly, it also found that millennials had a statistically equivalent interest level as Gen-X (currently aged 40 to 55) and only a slightly stronger preference compared to baby boomers (currently aged 56 to 71).

Myth #5 – Sustainable investing is nothing but a fad

We saved this myth for last because the preceding evidence quickly disproves it. Money has been pouring into ESG funds, and the younger generations are nearly unanimous in their support for sustainable investing. Sustainable investing is not a fad; it is the future. Its adoption has only been accelerated by the Covid-19 pandemic.

Plus, the investment theory for sustainable investing remains solid. Its historical returns have demonstrated both long-term and recent outperformance. ESG issues also present material investment risks that must be considered as part of a robust investment analysis process. Climate-related damage and falling valuations in specific sectors (such as coal) are just a couple of examples of potential risks to be accounted for.

In short, unlike other myths, there is absolutely zero basis to this one. As a trend, sustainable investing has only ever moved in one direction – up.

As the world realises why sustainability matters, sustainable investing and investing may soon become one and the same.

.PNG)