Macro factors driving volatility, but do not negate Japan’s structural transition

The Japanese equity market has navigated a volatile start to 2025, with a pronounced correction and a sharp recovery reflecting both external headwinds and domestic strengths. Near-term risks remain on the horizon, from trade disputes and global macro pressures to currency swings and rising geopolitical tensions. Despite these immediate challenges, several domestic structural drivers offer a positive outlook for Japanese equities over the medium to long term.

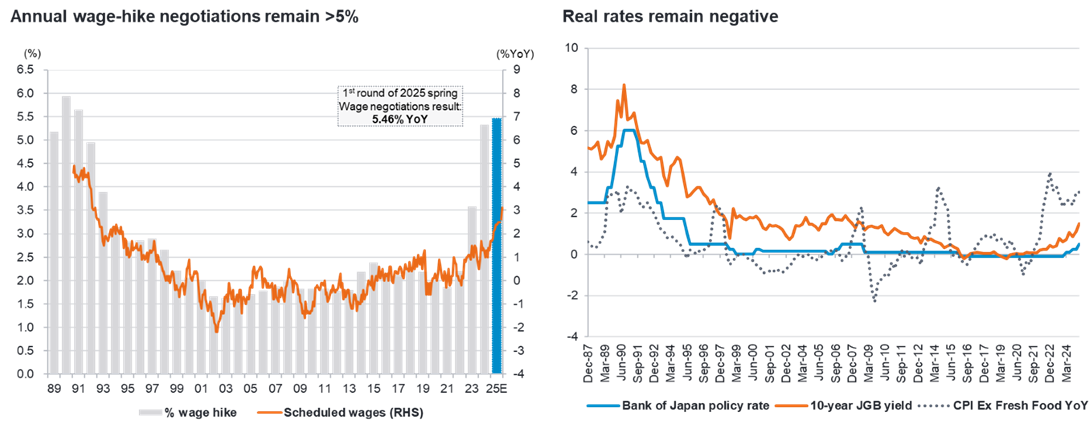

Reflation and wage cycle

At the macro level, Japan is experiencing a structural shift toward moderate inflation. Labour shortages, demographic shifts and stricter overtime regulations have given rise to meaningful wage pressures that appear increasingly entrenched. Employers are granting the most substantial pay rises in three decades: the 2025 spring labour negotiations delivered a second straight year of >5% wage growth. While past inflationary episodes were driven by imported costs and external shocks, today’s wage and service price growth reflects real structural tightness in the domestic labour market.

Source: (1) Fidelity International, MHLW, JTUC, Bloomberg, SMBC NIKKO. 1st round of 2025 Shunto result as at 13 March 2025. Notes: % wage hike defined as ratio of agreed hike (incl scheduled salary escalator) to current baseline. The scheduled wages refers to contractual cash earnings and excludes overtime allowance. (2) Fidelity International, Bloomberg. Rates as of 31 March 2025.

This wage-led inflation dynamic is changing corporate behaviour: managements once rewarded for hoarding cash are now incentivised to invest in productivity-enhancing automation and software, or to return surplus capital to shareholders. Meanwhile, The Bank of Japan (BoJ) projects inflation to average around 2–2.5% in the coming years, marking a definitive break from Japan’s deflationary past. This is materially positive for nominal GDP, corporate earnings, and tax revenues.

Monetary policy normalisation

The BoJ currently maintains a cautious yet incrementally tightening monetary policy stance. While inflation has surpassed BoJ targets, driven notably by higher electricity and food prices, the central bank views these pressures as potentially temporary, expecting a pause in inflation. However, recent data indicates sustained inflationary momentum across goods and services, challenging the BoJ's conservative assumptions. Consequently, the central bank is expected to revise its inflation outlook upwards and resume rate hikes, although timing remains uncertain due to global economic developments and tariff policies affecting market confidence.

Governor Ueda has emphasised resilience in Japan’s economy despite global tariff disruptions, suggesting a commitment to policy normalisation through incremental interest rate increases and continued QT. Geopolitical factors, including July Upper House elections in Japan and rising tensions in the Middle East, add further uncertainty but reinforce the need for careful monetary policy adjustments. Thus, overall, a steady approach with moderate tightening is anticipated over the medium term.

Meanwhile, corporate Japan’s earnings sensitivity to currency swings has diminished: exporters’ offshore production blunts the impact of a firmer yen, so the central bank’s cautious normalisation poses less threat to corporate margins than in prior tightening cycles.

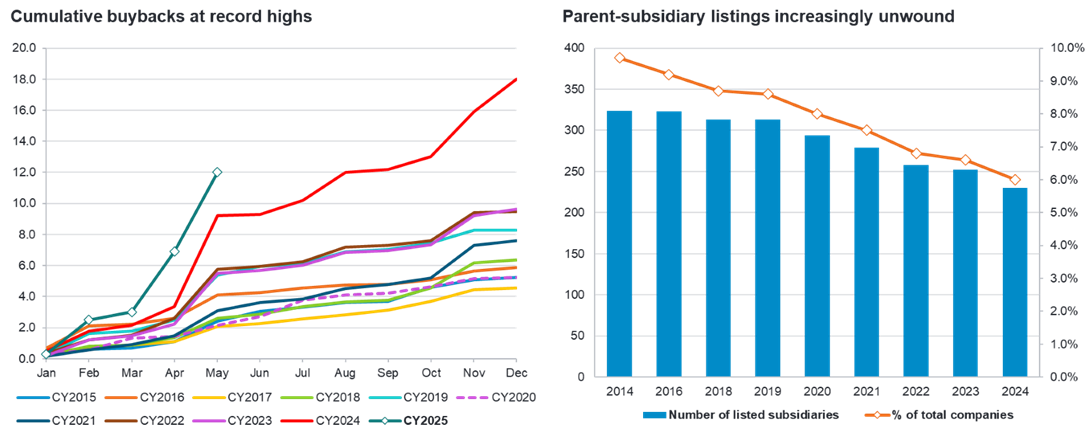

Corporate governance transformation

The Tokyo Stock Exchange’s cost-of-capital initiative forced companies with sub-par price-to-book ratios to articulate credible plans for improvement. Japanese corporate behaviour is now changing more broadly, with a heightened focus on capital allocation and shareholder value across the market.

Against this backdrop, we are seeing a notable increase in shareholder returns. Japanese listed companies have significantly increased their share buybacks, reaching a record ¥12 trillion in the first five months of this year. Dividends are rising in parallel, resulting in a total shareholder yield of around 4%.

Source: (1) Fidelity International, Quick and company data, May 2025. (2) Fidelity International, TSE as of 31 December 2024.

Beyond distributions, strategic reforms such as the unwinding of inefficient parent-subsidiary listings, reductions in strategic cross-shareholdings, and greater focus on core businesses are improving capital allocation efficiency. Such governance reforms not only enhance transparency and investor confidence but also lay the groundwork for sustainably higher returns on equity (RoE), a critical factor for attracting long-term investment.

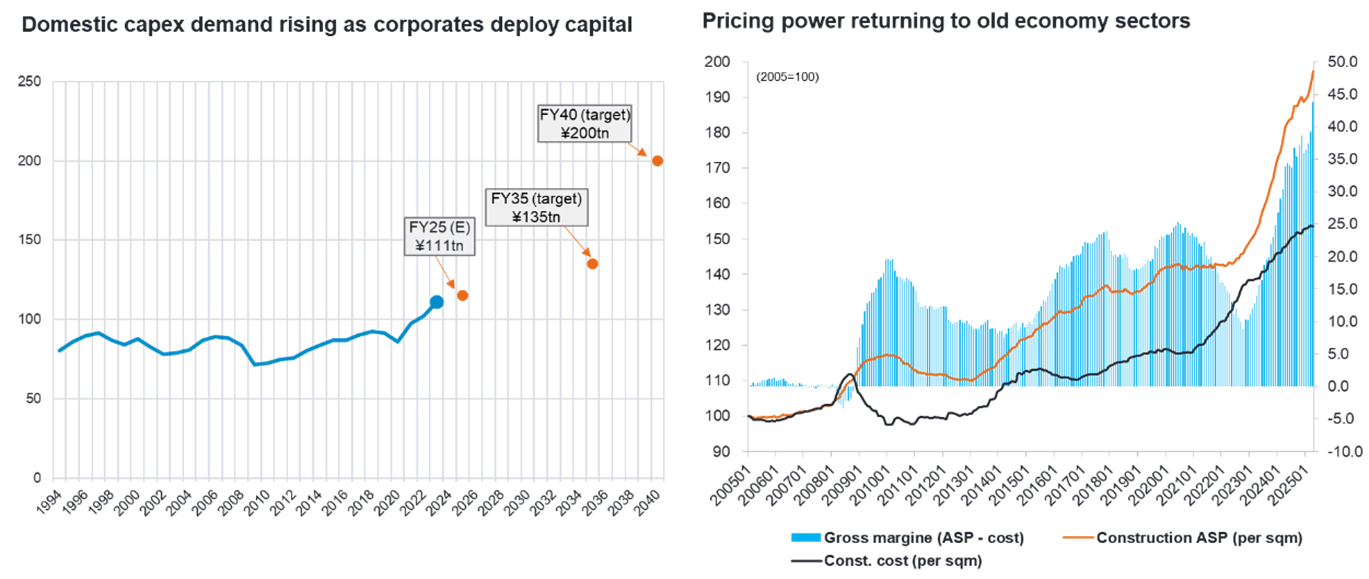

Meanwhile, Japanese companies remain committed to increasing capital investment despite uncertainties over US trade policies. Spending momentum is particularly notable in areas such as semiconductors, automation, power infrastructure and tourism-driven services. Historically, periods of heightened capital expenditure in Japan have coincided with improvements in profitability and returns on assets. Moreover, further gains are expected as firms pursue efficiency through significant balance-sheet restructuring initiatives.

Investor sentiment and market participation

From a valuation perspective, Japan remains attractive. The TOPIX trades at 13.9x forward earnings, near its historical average, and looks outright cheap at 1.3x PBR. However, RoE is rising, driven not by leverage or currency effects, but genuine improvements in profitability and capital allocation.

Sentiment towards Japanese equities has improved, driven by increasing engagement from both foreign and domestic investors. Overseas investors were net buyers of Japanese equities in both April and May, marking the strongest such streak since mid-2024, with many viewing Japan as a potential diversification destination away from the US. Domestically, historically conservative investors are becoming increasingly involved in equity markets, encouraged by higher inflation expectations and supportive financial policies such as the expansion of tax-exempt investment accounts (NISA). This shift has the potential to provide a strong structural demand underpinning for the market.

Constructive outlook

While external challenges remain a near-term headwind, Japan’s domestic structural drivers - reflation, robust corporate governance reforms, monetary policy stability, and increasing domestic investor engagement - create a constructive medium- to long-term outlook for Japanese equities.

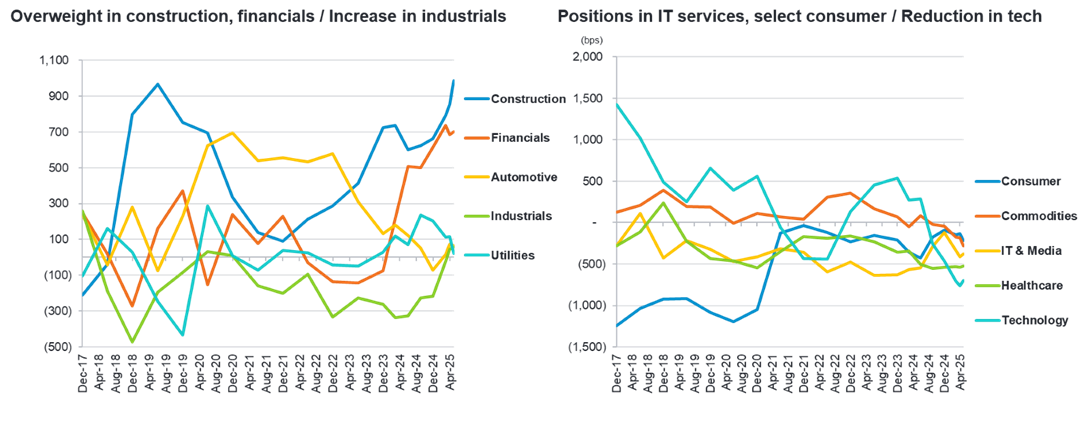

Fidelity Japan Equities Fund: Positioning update

Against this backdrop, the fund is tilted towards businesses whose earnings are relatively insulated from global macro swings and which benefit from domestic reform tailwinds. Core overweight exposures are in construction, financials, industrials and utilities – sectors enjoying steady pricing power as labour shortages, digitalisation and infrastructure demand drive order books. These holdings account for the bulk of active risk and have relatively limited sensitivity to US tariff outcomes.

Source: Fidelity International. Data as of 31 May 2025. Index: Tokyo Stock Exchange TOPIX Total Return Index. Construction: Contractors, homebuilders, building materials. Financials: Banks, insurers, real estate, securities. Utilities: Electric & gas utilities, telecoms. Auto: Auto OEMs, auto parts, tires. Industrials: Conglomerates, general machinery, components. Consumer: Food & beverage, retail, goods & apparel, travel & leisure. Commodities: Oil & gas, chemicals, metals & mining, trading companies, shipping. IT & Media: Internet, IT services, content & media. Healthcare: Devices, pharmaceuticals. Technology: Semis & equipment, automation, electronic components.

Within construction the Fund owns sector leaders such as Kinden and Obayashi, whose pipeline of public-works and private redevelopment projects supports mid-teens return on equity and rising payout ratios. High-frequency bid data show unit prices firming for the first time in a decade, supporting the thesis of margin expansion independent of cyclical swings.

Source: (1) Cabinet Office, Japan Business Federation (JBF) as of 31 January 2025. FY25 estimate by Cabinet Office, FY35 & FY40 target by JBF. (2) Fidelity International, Ministry of Land, Infrastructure, Transport & Tourism as of 30 April 2025.

A second structural pillar is digital transformation: Japanese corporates are racing to automate workflows in the face of an ageing labour force, and our stakes in NEC and Hitachi monetise that spend through system-integration and cloud migration contracts. Recent earnings results confirmed that demand for software in the domestic market remains strong and defensive in nature amid growing uncertainty over the outlook for the global economy.

Financials remain overweight in the fund, but the exposure has been marginally re-balanced. We have reduced positions in the mega banks and redirected to Concordia Financial Group, a regional lender with a high sensitivity to rates, a strong customer base, the scope for higher shareholder returns and minimal currency risk. The banking sector reacted negatively to the initial tariff announcements as it raised questions over the BoJ’s appetite for further rate hikes. However, the price action was excessive and, while we may see further volatility in the short term, we maintain the view that the persistency of domestic inflation, underpinned by a tight labour market and rising wages, will lead to a higher policy rate over the medium term. Meanwhile, insurance companies represent an attractive play on the conversion of cross shareholdings to higher distributions.

A newly emergent theme is defence spending. Tokyo’s pledge to lift military outlays to two per cent of GDP is already feeding through to order books at Kawasaki Heavy Industries and Mitsubishi Electric, both of which are held in the fund; NEC provides complementary exposure on the cyber-security and systems side. Should tariff negotiations sour, political pressure for an even larger defence budget would extend that earnings runway.

The Fund remains underweight in key exporting sectors such as semiconductors and technology hardware - segments of the market that are among the most vulnerable to US tariffs. It also shows a negative skew towards foreign sensitivity versus the index. This positioning has helped performance YTD, but represents a potential risk factor if the global semiconductor and manufacturing (capex) cycles reaccelerate from here - this is an area that we continue to monitor for opportunities.

In terms of incremental action, we have not done much intentionally as what the market is quickly pricing in is not due to changing real economic data, but in anticipation of it due to Trump’s announced tariffs. At the margin, we have added further weight to positions in domestic-oriented sectors such as retailing and construction, as well as in defence-related segments of the market. On the other hand, we have taken some profits in large active positions that have outperformed in recent months and closed some smaller positions in industrials where the investment thesis had played out.

In short, the Fund is positioned for a Japan that is finally being re-priced for self-help and shareholder discipline, yet it retains ample dry powder to buy pro-cyclical businesses cheaply should sentiment over-shoot on trade fears.

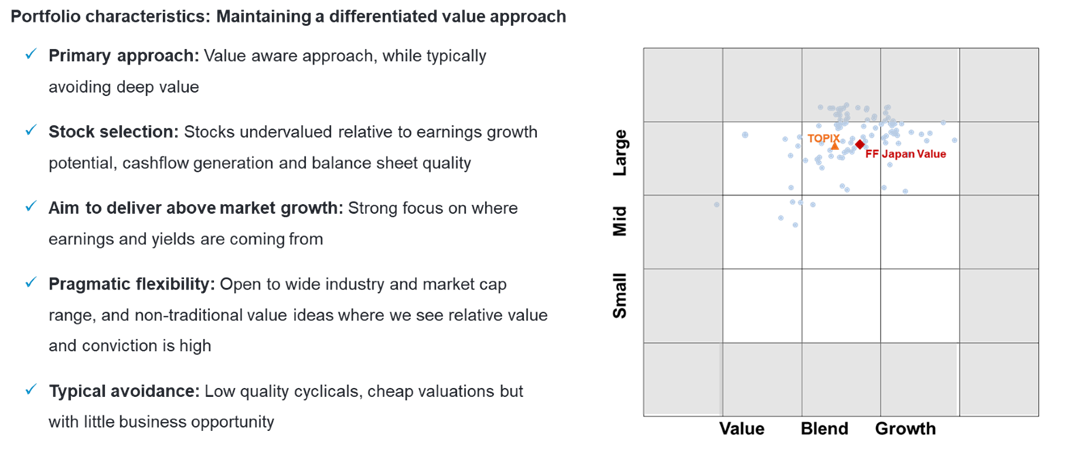

Fund style recap

Source: Fidelity International, Morningstar. Data as of 31 May 2025.