After a tumultuous 2020, we identify four main trends that will drive real estate this year and in the decade to come. Capital in search of yield should support current pricing, while specialist segments like laboratories will catch the eye of mainstream investors. Environmental concerns will spur more property refurbishment. Finally, political and inflation risks make knowing one’s tenant a cornerstone of sustainable returns.

1. The ‘gravity’ of yield

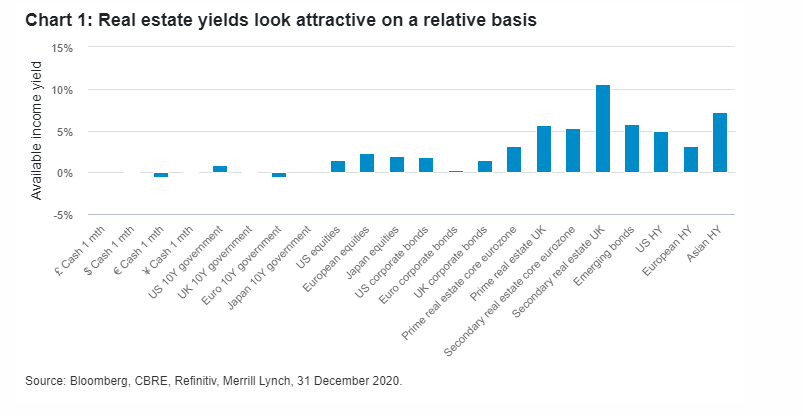

The continued monetary support for economies around the world has made bonds yielding more than one per cent ever scarcer. At the end of 2020, only 38 per cent of global A-rated financial bonds and 45 per cent of A-rated industrial bonds offered more. In contrast, yields on prime real estate assets are around 3 to 4 per cent, often with long, secure income streams from the same companies whose bonds trade well below one per cent.

While some of the yield discount compensates investors for real estate’s illiquidity and depreciation, we believe the real yields on direct real estate will continue to be attractive to many investors relative to other asset classes. This should support continued inflows of capital to real estate markets, particularly the most liquid and transparent markets such as Germany, France and the Netherlands. This capital, when combined with investment deferred from last year, will exert further downward pressure on yields for assets in sectors such as logistics and residential.

The UK may benefit from this trend in 2021. The completion of a free trade deal with the European Union (EU) has removed some perceived risks, particularly around currency. And the roughly 100-basis-point spread between prime assets in the UK and those in similar-sized markets in continental Europe is likely to attract cross-border capital to the UK. Subsectors like last-mile logistics and regional offices are viewed as less exposed to trade disruption and may receive a bigger boost. The impact of non-tariff barriers to trade, however, still needs to play out.

2. Specialist real estate goes mainstream

Mainstream investor interest in specialist real estate sectors, such as data centres, self-storage, life science and healthcare had been growing in the mid-2000s before the 2008 financial crisis reversed much of this activity. But since then these segments have become well established in the real estate investment trust markets. The conditions are ripe for them to benefit from structural trends, such as demographic change and the use of technology, that will act as headwinds for the more traditional sectors of office and retail, which have also been impacted by Covid-19.

This is not without its challenges. Investors stepping into this area face competition from specialist investors and operators, lot sizes that are either at the small or very large end of the spectrum, as well as risks of obsolescence where building specifications are highly specialised. Nevertheless, assets in these sectors should provide diversification and good growth prospects for investors and we expect to see allocations to these specialist sectors steadily increase.

3. ESG becomes a disruptor

Buying new buildings with excellent green credentials is no longer enough. The industry needs to focus urgently on renovating and modernising the existing stock of buildings. Buildings are responsible for 40 per cent of energy consumption and 36 per cent of CO2 emissions in the EU. To meet the Paris Accord targets, commercial real estate will need to reduce its CO2 by more than 80 per cent by 2050.

For the real estate industry, the Global Real Estate Sustainability Benchmark (GRESB) rating framework has been key in driving real estate investors to put in place environmental, social and governance (ESG) policies, institute good practice, and capture data on utility use and waste recycling. However, there are growing concerns about ’greenwashing’ and investors are focusing on evidence of clear impacts. We expect new frameworks and targets to emerge to help measure impact, changing the way assets are assessed, monitored and managed.

This shift to a focus on impact may also provide some opportunities. There is evidence that pricing currently reflects a ‘brown discount’ for older assets with no ESG certification, but these properties could potentially deliver measurable impacts if they can be refurbished to good sustainability standards.

4. The importance of ‘know your tenant’

The pandemic focused minds on rent collection and tenant defaults. It showed the importance of a ‘know your tenant’ - or KYT - investment approach for delivering sustainable income. The quality of the asset and the length of the lease are no substitute for a well-capitalised tenant with a good business model in a resilient sector, which will be key to delivering attractive performance throughout the 2020s.

This is because some longer-term themes are coming into view as the focus turns to the reopening of economies. Most immediate is the growing political risk in the eurozone. The resignation of governments in the Netherlands and Italy, a change of leadership in the ruling party in Germany, and preparations for elections in France in 2022 all create uncertainty. The impact of political risk on the way governments chart a path out of lockdown, deliver a fast and effective roll-out of the vaccines and continue to support the economy will affect the speed of recovery.

Inflation is a further risk that may occur within three to five years, following a combination of supportive fiscal and monetary policy, a shift in central banks’ inflation targeting methodology and deglobalisation. Real estate investors need to consider the implications of these risks for portfolio construction, particularly when looking at lease lengths and indexation clauses.