On 1st May this year, we completed our fourth year working as a co-portfolio manager (PM) team on the Fidelity Global Demographics Fund (Managed Fund). Given this milestone and the eventful period for markets our tenure has overseen, we thought this was a good opportunity to review how we work as a team, Fund performance, the themes we are investing behind, and the outlook.

The Team

Although we knew each other well before working on the Fund, we would all say we know each other much better after four years of fairly bumpy markets! Although we have fine-tuned how we work throughout this period, the key principles remain the same.

We each focus on our core areas of competence with a shared focus on quality businesses and growth driven by demographic trends; then, as a co-PM team - any material decisions must be unanimous. In practice, this means working individually and as a team, with our internal analyst teams and external experts, to uncover themes, stocks, and other key trends. We then discuss these ideas at a weekly team meeting to make decisions or to determine what further work needs to be done.

This combination of individual and joined-up work enables us to cover more ground as a team and to bring our shared experience to each investment decision.

Fund Performance

The past four years have been an extremely volatile period for markets, with multiple external shocks and significant shifts in the macroeconomic backdrop. The COVID pandemic saw markets fall >30% in just over a month in early 2020 before fully recovering six months later. Since then, we have had persistently higher-than-expected inflation, one of the steepest rate hike cycles in history, war in Europe and banking crises in both the US and Europe. Most recently, we have seen a potentially generationally-significant technological shift with advances in artificial intelligence (AI) and machine learning driving big moves in share prices across many different sectors.

In the Fund, we are focused on bottom-up, fundamental analysis and stock picking while acknowledging these macro shifts. For us, this means focusing on the key demographic trends that we see shaping the world around us and identifying the sectors and stocks that are best positioned to benefit from them. We do this with the help of 259 Fidelity research analysts around the world, all of whom are experts in their respective industries and coverage companies. These trends are long-term, slow-moving, highly predictable, and hard to change. Under almost any macro scenario, it is very difficult to alter the ageing dynamics of a given population, for example. As such, we believe that investing behind these themes can drive strong performance over the long term that is not reliant on any particular market backdrop, particularly as the slow-moving nature of these trends can mean they are lost in shorter-term noise, often presenting attractive entry opportunities.

In this regard, it is pleasing to see this has been borne out in our tenure so far. It has been a relatively volatile period for the Fund as well as for markets as we outperformed strongly during COVID but then gave much of this back in the reflationary more value-driven rally that followed, which is always likely to be a challenging environment for this type of strategy given our long-term growth focus. However, it is reassuring to see that despite the huge shifts we have seen during this period, the fund has outperformed, giving us increased conviction in the trends we are investing in. They are very much intact and can outweigh other shorter-term gyrations.

Net returns as at 31 May 2023

| Timeframe | 1 yr % | 3 yr % p.a. | 5 yr % p.a. | 7 yr % p.a. | 10 yr % p.a. | Since inception (30/11/12) % p.a. |

|---|---|---|---|---|---|---|

| Fund | 18.21 | 9.93 | 10.63 | 11.08 | 13.69 | 15.11 |

| Benchmark | 11.796 | 11.00 | 10.16 | 10.74 | 12.14 | 13.63 |

| Active return | 6.42 | -1.07 | 0.47 | 0.34 | 1.55 | 1.48 |

Total net returns represent past performance only. Past performance is not a reliable indicator of future performance. Returns of the Fund can be volatile and in some periods may be negative. The return of capital is not guaranteed. Benchmark: MSCI All Country World Index NR. NR at the end of the benchmark name indicates the return is calculated including reinvesting net dividends. The dividend is reinvested after deduction of withholding tax, applying the withholding tax rate to non-resident individuals who do not benefit from double taxation treaties.

Our Themes

As a reminder, there are three main themes that we are playing in the Fund:

- Longer Lives - a play on ageing populations around the world and the pressures that creates, particularly on healthcare provision and productivity.

- Better Lives - focused on the growth of the middle class in emerging markets and the demand that growth will create for a range of goods and services.

- More Lives - a play on the absolute level of population growth worldwide over the coming decades and the need to sustainably provide already scarce resources - such as food, water, and energy - to match this growth.

These themes have not changed since we have been working as a team. If anything, the trends they play into have strengthened over the past four years. As Edward Parker, global head of research for sovereigns and supranationals at Fitch Ratings Agency, commented recently, “While demographics are slow-moving, the problem is becoming more urgent.”1

This comment is related to the fact that current higher interest rates have only increased the pressure on governments by raising the cost of healthcare provision to a growing elderly society, which plays strongly into our “Longer Lives” theme. The fund includes many companies that are looking to alleviate this same pressure. However, there are many areas where we see our themes strengthening:

1. Population growth rates continue to deteriorate

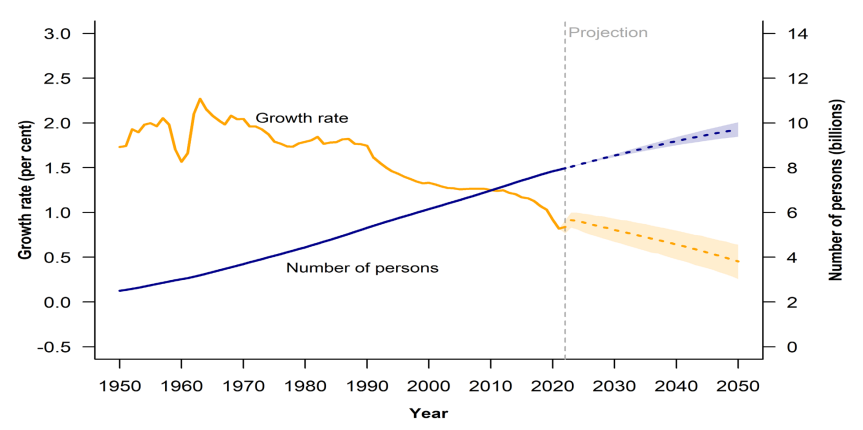

In 2022, the United Nations (UN) released its latest population projections (Figure 1). Due to the continued reduction in fertility rates, the global population is now expected to peak at around 10.4bn (vs 10.9bn estimated in 2019). The UN also now estimates there is a 50% chance the global population will peak before 2100 (vs 27% chance in 2019), which will only exacerbate existing ageing population dynamics around the world.

Figure 1: Global population size and annual growth rate: estimates, 1950-2022, and medium scenario with 95 per cent prediction intervals, 2022-2050

Source: United Nations Department of Economic and Social Affairs, Population Division, 2022, World Population Prospects 2022: Summary of Results, Figure I.1.

2. The return of inflation has further emphasised the need for productivity improvements

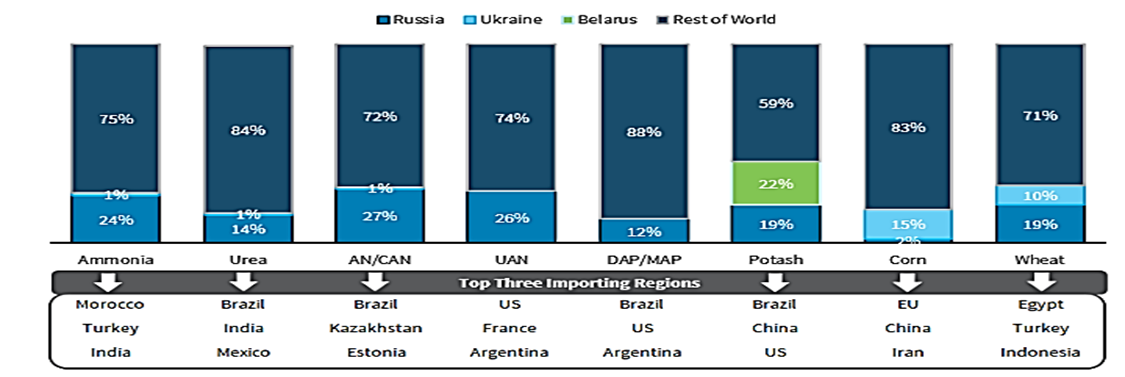

Both ageing populations (Longer Lives) and the need to sustainably provide scarce resources to meet a growing population (More Lives) create the need for productivity and efficiency improvements. This can come through the automation of factories and other manufacturing processes, agricultural advances, less wastage of water and more renewable energy, amongst other areas. The return of inflation in labour and goods over the past few years has created further pressure to find more efficient ways of doing things. Shortages following the invasion of Ukraine in 2022 emphasised the need for greater productivity and well-diversified supply chains (see Figure 2 for the reliance of the agriculture and fertiliser markets on the affected regions), but it is true across many other goods, and also labour, where prices have increased. The economics of investing in new factory automation have become particularly attractive in the context of rapidly rising wages and increasingly disrupted supply chains, for example.

Figure 2: Russia, Belarus and Ukraine are key market participants in agriculture and fertilizer

Source: Barclays Special Report, May 2023, Extreme Weather The rise of food insecurity, Figure 9.

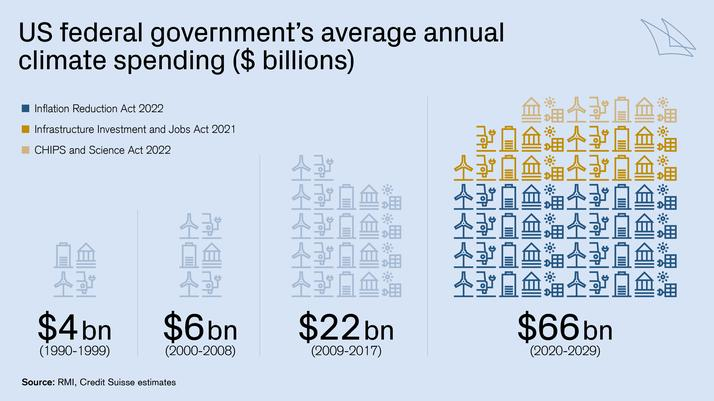

3. The need to combat climate change has received significant government support

Over the past few years, we have seen numerous initiatives announced by governments around the world to combat climate change - see below (Figure 3) for the US as an example. This presents enormous opportunities for companies that can address these needs. Within the Fund, this provides strong tailwinds to our More Lives theme through our renewable energy, electric vehicle, and other greenhouse gas (GHG) emissions-reducing holdings.

Figure 3: US federal government’s average annual climate spending ($ billions)

Source: Credit Suisse, Nov 2022, US Inflation Reduction Act: A catalyst for climate action.

Outlook

The ongoing strengthening of our themes gives us tremendous confidence when looking to the future, particularly over the long term. Still, we cannot avoid the macro outlook being highly uncertain in the short term. Despite widespread expectations of a recession, the market has been resilient this year and continues to trade on relatively high multiples vs longer-term history. It isn’t clear, though, that market expectations for rates to start to fall later this year will prove correct, and leadership has become increasingly narrow. In this context, we take comfort from the fact that the themes we are investing in are resilient to shorter-term market concerns, as discussed above. Our focus on high-quality businesses with high and defensible returns on capital, strong free cash flow generation and structural growth support also reassures us.

We think these companies are well-positioned for an uncertain future and have typically outperformed in periods of weaker markets. The Fund has generally outperformed during down markets. The only significant exception came during the unusual bear market last year, which saw historically steep rate rises off the back of a period where growth had become particularly expensive, a very different starting point given where rates are today.

Footnote

1: Ageing populations ‘already hitting’ governments’ credit ratings | Financial Times (ft.com)