Download PDF

Demographics supports diversification and thematic purity

In this piece, Oliver Hextall, Co-portfolio Manager of Fidelity’s Global Demographics Fund (Managed Fund), reflects on the benefits of investing in the theme of demographics. Demographics is a specialised approach, and a portfolio built around this theme will look different to other strategies. But because demographic drivers are so pervasive across industries, investors are generally able to maintain diversification without compromising thematic purity, potentially making the strategy an appealing building block for client portfolios.

The start of 2022 has proved challenging for many investors with the broad-based MSCI All Country World Index falling by 5.4% over the first quarter. Beneath the surface were some significant sector and style rotations against a backdrop of rising inflation and interest rates. In this environment, investors favoured value and cyclical companies at the expense of longer-duration growth assets. As a result, energy and materials stocks were the standout market performers while most of the other sectors ended in negative territory. Fidelity’s Global Demographics Fund (Managed Fund), which I manage alongside Alex Gold and Aneta Wynimko, was not immune to these headwinds given our focus on high-quality growth names and structural underweight to these more cyclical pockets of the market, and as such has lagged the index year to date.

Exploiting market myopia

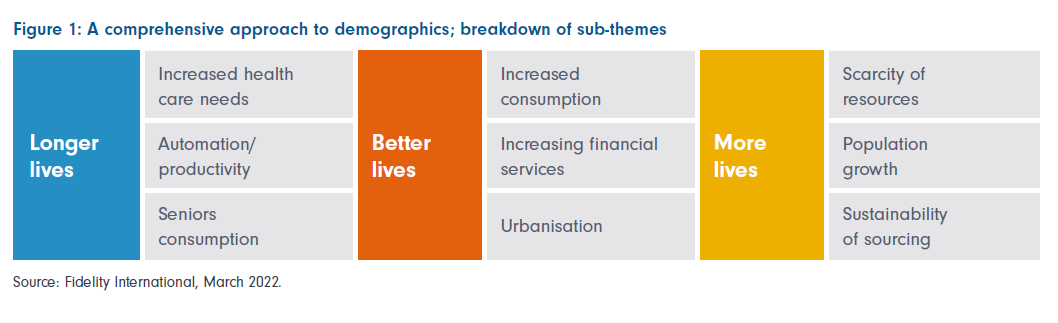

While some degree of volatility is likely to persist as we progress into the year, it is important to distinguish between near-term and long-term drivers for the market. Markets tend to be myopic and overemphasise recent events when making investment decisions. This creates inefficiencies that, as thematic investors, we can exploit by identifying earnings growth compounders exposed to structural growth themes such as demographics. As a team, we remain confident in the long-term demographic themes that underpin this portfolio: rising life expectancy and ageing population, expansion of the middle class and population growth (Figure 1).

These structural growth trends are highly predictable but also slow-moving, meaning their cumulative impact is often missed or underestimated by markets. We expect them to continue to drive strong long-term growth for our holdings. The Fund’s emphasis on quality should also help drive outperformance over time. Quality companies are well equipped to withstand a more difficult economic backdrop thanks to their robust fundamentals and sustainable practices.

Diversification within demographics

As demographic investors, we have a powerful theme to invest in that is naturally broad enough to build a diversified portfolio. This breadth gives us flexibility across industries and demographics trends. All the demographics trends are powerful and persistent, and affect the nature of market demand and the products and services businesses supply. These trends are also multi-faceted, with each exerting a range of effects. For example, the growing cohort of older people means more demand for automated solutions to offsethe loss in productivity from relatively fewer workers, different types of holidays for retirees, and a greater need for discretionary healthcare treatments aimed at boosting quality of life.

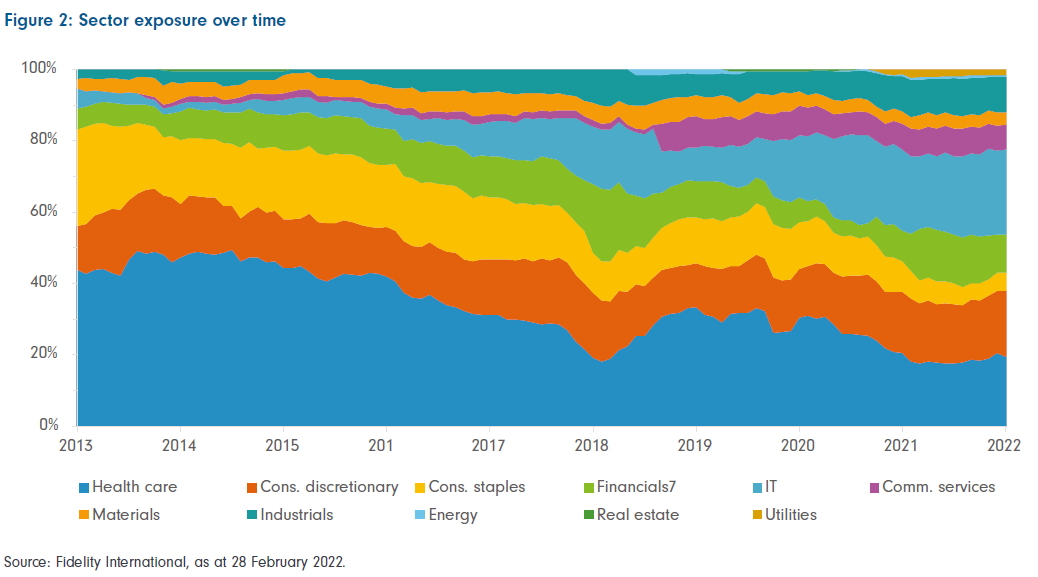

The theme’s breadth means that we have a diverse investment universe at our disposal that enables us to construct well-balanced portfolios suitable for different market conditions. Since we started managing the Fund as a team in mid-2019, this has been an explicit area of focus and, as illustrated in Figure 2, translated into a more balanced portfolio. In 2016, nearly 75% of the Fund was concentrated in healthcare, consumer discretionary and staples; last year the average combined weight of these sectors was down to 41%.

Financials is a good example of how we can gain demographics exposure while still being sensitive to market conditions. Over the past 18 months, it was clear that we were on a path towards higher yields in anticipation of tighter monetary policy amid rising inflation; this in turn would benefit sectors sensitive to higher rates, including financials. This was a sector where we felt valuations also looked attractive versus the broader market, and where there were opportunities related to the theme. Financial companies are an important part of demographics because as the middle class expands and populations age, they will need banking and wealth management services. Therefore, we materially increased our exposure to the financials sector through selective holdings in thematically appropriate companies that met our investment criteria, such as Charles Schwab and Morgan Stanley, which contributed to the fund’s relative performance. This demographic theme’s flexibility differentiates it with other thematic strategies that tend to be more narrowly focused.

Diversification, but not at the expense of thematic purity

Importantly, we can build a diverse portfolio without sacrificing thematic purity. A high degree of thematic purity is at the core of Fidelity’s thematic investing philosophy in order to ensure clients achieve their desired exposures without unwanted correlations. Every name in the portfolio will need to fall into at least one of the three sub-themes and, from a portfolio construction perspective, we aim for 50% and 70% exposure to demographics at the individual stock and overall portfolio level, respectively.

To calculate demographic exposure, we separate the revenue streams of a business and categorise whether any fit into one of our three sub-themes. Then we value each business line independently and calculate the total economic exposure of the company to demographics. We weight these findings to establish a figure for the portfolio. This is a time-consuming, bottom-up exercise, which requires a thorough understanding of companies, but it’s a worthwhile process that protects the integrity of the theme. Other thematic funds in the industry tend to adopt a more binary approach, where companies are either demographically exposed or not. We believe our more granular method better controls for thematic purity.

Outside of the more obvious demographic areas such as healthcare and consumer sectors, we find many interesting areas such as financials and tech. For example, within financials, Morgan Stanley illustrates well of how we assess the demographic exposure of a company. The bank has undergone a strategic transformation in the past few years with wealth management and asset management acquisitions (Eaton Vance and E*Trade); these operations now account for c.60% of the group’s profit before tax compared to just 25% in 2010. The company is actively seeking to tap into the retirement wealth and savings of their customers and generate more recurring fee revenues. We calculate that Morgan Stanley has an economic exposure of 75% to demographics, reflecting that these divisions are a key

driver of its improving returns. In Q1 2022, we sold out of the position, reflecting a strong run and full valuation. Importantly, the bank was a top 10 contributor for 2021.

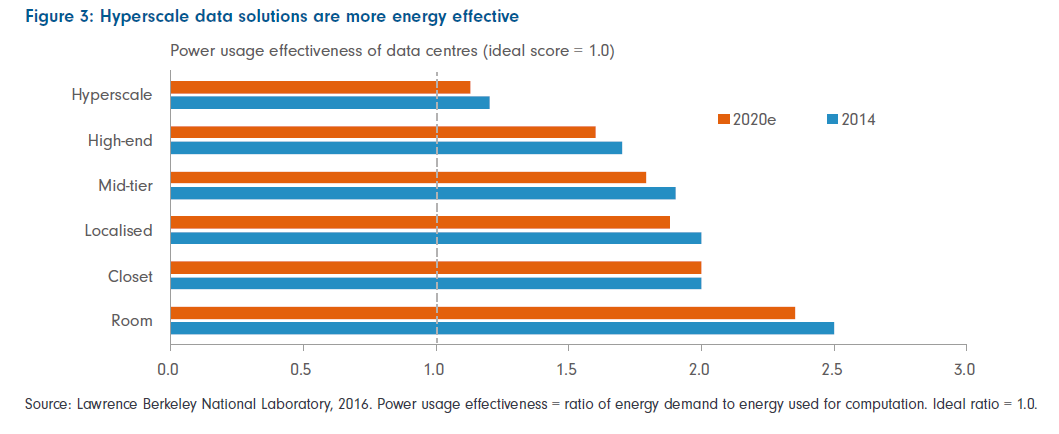

The technology behemoth Microsoft is also a good example.The company has 60% exposure to demographics. The key driver of Microsoft’s growth is its Azure cloud unit. Azure generated US$44 billion in revenues last year and is growing at a breakneck speed of 40% annually as businesses all over the world transition their workloads to the cloud. Microsoft’s cloud operation fits squarely into the demographics theme as it enhances productivity for its customers. As populations grow and consumption rises, it becomes increasingly important to use resources efficiently and sustainably. Hyperscale cloud solutions are up to a staggering 90% more energy efficient than on-premises data centres, helping to support the growing world.

Microsoft also has a secondary exposure to demographics. Ageing populations are putting pressure on the aggregate productivity of the workforce. This can be offset by more efficient and automated solutions, which Microsoft is at the forefront of. In fact, Microsoft’s stated corporate mission is to help make people and organisations more productive and efficient.

Demographics: A sweet spot for diversification and thematic purity

It’s important for an investment theme to be clearly defined and sufficiently specialised to ensure investors are truly getting the right exposure. Demographics as a theme is somewhat of an outlier given its natural breadth and potential to diversify without sacrificing thematic purity. This diversification helps limit its vulnerability to sell offs, unlike other more narrowly focused themes that can disproportionately suffer when their industries fall out of favour. Demographics is a powerful, relatively predictable and secular trend, that complements a quality, growth and sustainability focus.