The journey

On June 30 the Fidelity Australian Equities Fund turned 15 years old, although it feels like only yesterday we were setting up the Fund and the Australian investment team!

There’s a saying that you always over-estimate what you can get done in 12 months but under-estimate what you can get done in 10 years. This definitely feels true looking back on what we’ve achieved over the last 15 years. Indeed, if you’d invested $10,000 in the Fund back in June 2003, this would now be worth over $57,000. You’d have made almost six times your money. By comparison, the index (ASX 200 Accumulation) has delivered $39,447 or if you’d kept the same $10,000 in cash you’d now have $18,648.1

Chart 1: Value of $10,000 invested at inception, versus index and cash (as at 30 June 2018)

.png)

Source: Fidelity International, 30 June 2018. Index: S&P/ASX 200 Accumulation Index. Performance is in AUD terms, net of fees. Total net returns are calculated in Australian dollars with distributions reinvested. The return of capital is not guaranteed. Inception date: 28 June 2003.

Aside from strong returns, I’m also proud that we’ve delivered a strategy that is both cost and tax effective. Throughout the Fund’s duration, turnover has remained at around 20% which effectively means we hold stocks for five years. This relatively low turnover and focus on long-term investing has translated to lower trading costs and better tax-effective outcomes for investors.

One of the most important lessons of investing is the power of compounding and reinvesting your returns back into your investment. The chart above clearly demonstrates that by achieving a few extra percentage returns each year this can add up to a lot of extra money over a prolonged period. As a portfolio manager it’s both an incredible honor and a huge responsibility to manage people’s money and I’m acutely aware of what this money can mean - more money for a child’s education or a better standard of living in retirement. It’s something that’s always in the back of my mind.

The lessons

While I’m extremely proud of the outperformance the Fund has been able to achieve over the last 15 years it definitely doesn‘t mean we’ve always made correct investment decisions. On the contrary we’ve made some poor ones. But the trick to good long-term performance is to make more good decisions than bad and have larger amounts invested in the good ones! Our investment approach is to build conviction in companies over long periods of time which hopefully ensures that if something goes wrong, it goes wrong when the investment is still relatively small.

Looking back over the past 15 years the biggest detractors to the performance of the Fund have been investments in Billabong and Iluka. Billabong was a great lesson in the importance of balance sheet strength and also how quickly working capital can deteriorate. Iluka was a lesson in how not to invest in a cyclical business. We also suffered from not investing in Aristocrat and Transurban which have both been great compounding businesses. While detractors are disappointing I’m pleased that even the worst of these were less than half the size of the tenth best performing stock. This means that our best performing stocks have been very good while our worst performing stocks have been relatively small.

On the positive side the strongest contributors to performance have been Dominos, Seek, CSL, Sydney Airport, Rio Tinto and Goodman Group. I’ve owned most of these companies over that 15 year period and consider them all great businesses.

Stick to your knitting

There’s a lot of noise in financial markets and the stock market is very emotional. I find the best way to deal with this is to focus on the long-term. For me it comes down to one simple question; is this going to be a better more profitable business in five years’ time? Screening out noise and sentiment and really concentrating on the facts is the key to good investing. Andrew Bassatt, the CEO of Seek, has been vocal in the media regarding the dangers of short-term decision-making by both companies and investors. He maintains that having a long-term investor like Fidelity as a major shareholder has created an environment that has allowed his management team to focus on the more valuable ‘long term business decisions’.

If there’s one piece of advice I’d give investors is that it’s important to know yourself and what you’re like as an investor. What are your strengths? What are your weaknesses? I think about this all the time, and you really want to focus on your strengths. I try to avoid the macro side of investment which is largely driven by sentiment and is very short term in nature. I don't feel as if I have a strong advantage there. Where I do have a strong position and Fidelity has an incredibly strong position is that we understand individual companies; we understand their strengths, we understand what drives them, we understand how they make money. Last but not least, have conviction. Whether you’re managing 1million or 6 billion - stay true to your process. If you stick to your knitting and play to your strengths -you'll invest well.

Thank you…

On this our 15th birthday I also wanted to take this opportunity to thank all of our clients for sticking with us all of these years! Hopefully your faith in long term investing, Fidelity and the fund has delivered great results to you and your clients. As I am sure you all know, I have 100% of my superannuation in the Fidelity Australian Equities Fund and it remains a very significant personal investment for me. I think this is the right approach as I very much take the ups and downs with my clients and demonstrate my personal faith in Fidelity and our investment approach. Thank you!

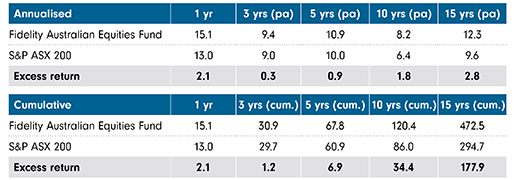

Table 1: Standard period returns net of fees, AUD (%)

Total net returns represent past performance only. Past performance is not a reliable indicator of future performance. Returns of the Fund can be volatile and in some periods may be negative. The return of capital is not guaranteed. Source: Fidelity International, Benchmark: S&P ASX 200 Accumulation Index.

1 Source: Fidelity International, 30 June 2018. Index: S&P/ASX 200 Accumulation Index. Performance is in AUD terms, net of fees. Total net returns are calculated in Australian dollars with distributions reinvested. The return of capital is not guaranteed. Inception date: 30 June 2003.