We engaged with a number of key financial companies about their approach to gender diversity. Overall, we were satisfied that most had gender diversity targets, used recruitment shortlists with at least one female candidate, trained staff in unconscious bias and had other complementary policies in place. But while we saw high levels of diversity at the junior levels and increasingly on the board, there is a drop off at the management and executive layers. This is where embracing a mix of policies could help companies do better.

Gender diversity: a no-brainer

The business case for gender diversity is compelling. Logically, if we want the best people to be in the most influential positions, we need to provide equal opportunities for all groups at all stages of their careers. Whilst it may be difficult to isolate its impact, multiple studies show that improved financial performance is linked to diversity over time. One such example is a recent study by McKinsey1 that found companies in the top quartile for gender diversity on executive teams were more likely to have above-average profitability than companies in the fourth quartile. The study also notes that the case for ethnic and cultural diversity is equally compelling. As investors, it’s important that companies are adopting policies to boost diversity.

Through the second half of 2020 we engaged with the key financial holdings in our portfolio about gender diversity. We picked financials - a mix of banks, insurers and insurance brokers - because these industries are traditionally male-dominated, so this is where we suspected the most work needs to be done. We wanted to initiate ongoing dialogues about how companies are addressing the issue, facilitate a sharing of best practices, and nudge the laggards to raise standards.

The gender diversity funnel

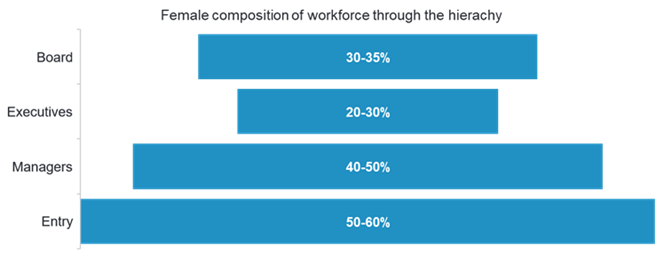

While some companies have gender mix aspirations or specific targets, these are typically at the board level. At the same time, many organisations have diversity recruitment programs for university graduates and entry level staff. This results in strong gender mix at the junior level and improving diversity in the boardroom. But it’s the middle and executive management ranks that are given less attention and where we see a sharp drop off in female representation.

What we saw at the financial companies we surveyed is a gender diversity funnel shape that is best represented by the picture below. Businesses define roles differently, so categorisation is not straight forward, but the pattern is clear. Once companies get women through the door, they need to create policies and practices to not just retain but also enable women to progress through their organisations. This is where our dialogue subsequently moved on to.

Gender diversity falls at the management and executive levels

Source: Fidelity International, March 2021.

Policies to maintain diversity through the hierarchy

The funnel shape of diversity has been observed in a number of industries, so companies should be aware of it and addressing it. All the companies we spoke to acknowledged that there is a lot more to do to improve gender diversity and many of the policies they have adopted have only been in place for the past couple of years, suggesting that the benefits should become clearer in the next few years.

Our discussions focussed on a number of policies but three stood out as most widespread: gender diversity targets, recruitment shortlists and unconscious bias training.

Targets for gender diversity

Just over 50% of our companies had some form of targets. Most of these targets were at the board level, aiming for 30-35% female members - a figure that most companies in our engagement achieved. While boardroom diversity is an important signal of intent, boards are generally comprised of only around a dozen people so they may not reflect diversity at the firm-wide level. That is why we believe other policies are needed. Below the board, most companies we talked to aspired to increase female representation in the senior cohorts by implementing a range of policies at the manager level.

Recruitment shortlists

Around 70% of our companies have recruitment policies where they ensure that their hiring candidate shortlists feature at least one woman. Two companies went further, requiring at least two candidates or half of them to be women. These kinds of policies can be very effective because they focus on the management layers where the funnel constricts most dramatically and therefore can have the greatest impact. However, having female candidates in the shortlist does not necessarily mean they are getting hired, so other actions are needed.

Unconscious bias training

Unconscious bias training is required to give women and other groups equal opportunities to be hired and progress through an organisation. The training helps staff recognise that they may have inherent biases that give certain groups unfair advantages or disadvantages and provides staff with tools to address the problem. We found 70% of the companies in our dialogues offered unconscious bias training either company-wide or for managers.

Other policies

We also saw other policies. There were formal and informal mentoring schemes for managers, flexible working arrangements, diversity officers, diversity among interviewer panels, pay gap monitoring and initiatives such as fostering networks for women.

Companies need a mix of gender diversity policies

All these programmes are useful, but it’s unlikely that any one of them individually will produce dramatic results. Instead, companies need to adopt a range of policies that work in tandem. These policies combined with an authentic business culture that supports diversity and inclusivity can create an open and welcoming work environment and could lead to tangible and sustained progress.

Gender diversity is also just one piece of the broader diversity puzzle. While our work focused on gender diversity in this engagement, companies can adapt and tailor some of these policies to address other vital diversity initiatives in their workplaces.

Overall, we were pleased by the extent that the financial companies in the portfolio have embraced measures to promote diversity but there is scope to do more and fine tune current policies. Many of these policies have been adopted only quite recently and meaningful changes will take time to surface. We are really excited to work with our portfolio companies on this journey.

______________________________

Companies we engaged with: Zurich Insurance, RSA, Admiral Group, Marsh McLennan, Arthur Gallagher, US Bancorp, PNC Financial