The job prospects are still gloomy for young people in China, and the picture may get worse before it gets better. Youth unemployment is expected to see a seasonal spike this summer, as more than 10 million university students graduate. To create more openings, policymakers may still have some work to do.

China’s growth engine is firing again, surprising the market with a better-than-expected GDP report for the first quarter. But despite some clear signs of a turnaround, the job prospects for young people remain gloomy - a sign that policymakers may still need to do more to support the recovery from the pandemic’s economic drag.

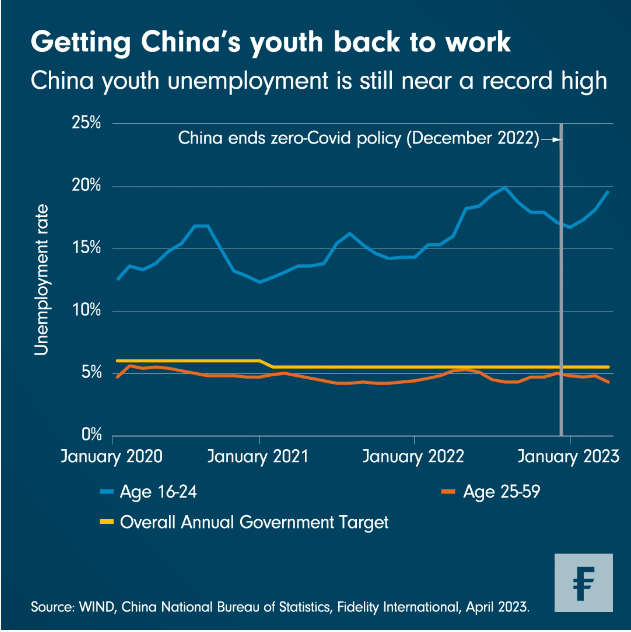

This week’s Chart Room shows that China’s surveyed unemployment rate for people aged 16-24 climbed to 19.6 per cent in March, only slightly lower than the all-time high of 19.9 per cent recorded in July 2022, according to data released by the National Bureau of Statistics. In contrast, the jobless rate for the older group (aged 25 to 59) eased to 4.3 per cent, from 4.8 per cent in February.

There are several structural reasons for the elevated youth unemployment. On the demand side, these reasons include that property, internet, and education sectors, which absorb a large portion of university graduates every year, are still coping with the residual impact of the regulatory clampdowns of the last few years. Also, many smaller businesses that closed during the pandemic haven’t reopened.

On the supply side of the labour market, a record 11.6 million university graduates are expected to swarm the job market this summer, almost six times the 2.1 million who entered the workforce two decades ago.

The rising pressure on the labour market may continue to weigh on China’s consumption-led economic recovery. Young people who aren’t able to find jobs may curtail spending; so may their parents, who may feel the need to hoard cash to support their kids.

Still, we don’t think China will resort to widescale stimulus measures like issuing cheques to the general population. Instead, we expect authorities to maintain the current accommodative policy to support the private sector, and to rely on this feeding through to the real economy in the form of improved activity that revives employers’ confidence. On the fiscal policy front, the pace of local government bond issuance may still maintain a gradual and stable momentum to support infrastructure investment. In terms of monetary policy, we expect that easing will still focus on supporting corporate and consumer sectors, but that the focus may shift slightly from broad-based credit supply to targeted interest rate cuts.

From here, we think policymakers will take a wait-and-see approach for signs the measures are feeding through to the job market. As the Q1 GDP data suggested, the broader consumption trends and the real estate sector are showing positive signs. In most cases that should result in an improvement in the job market and a corresponding reduction in the youth unemployment rate. But not right away.