Fixed income portfolio managers may each have their own distinct investment approach, but if there’s one factor they all scrutinise, it’s interest rates. Why? Here’s a look at the relationship between interest rates and bonds, and how portfolio managers protect investors from interest rate risk.

At a glance: interest rates

To understand the careful attention that bond investors pay to interest rates, we need to take a step back and consider the significant role that interest rates play in the global economy. Interest rates, usually set by a country’s central bank, influence the cost of borrowing and the return on savings.

Policymakers at central banks use interest rates to influence inflation and economic growth. In Japan, for example, inflation has been depressed for a long time. The authorities there have targeted low interest rates in the hope that people will borrow more and spend more, helping the economy to grow and inflation to increase. Conversely, if inflation becomes uncomfortably high, policymakers can raise rates to cool the economy down.

Now, let’s consider how interest rates affect bonds. The yield of a bond is largely composed of two parts: interest rate and credit spread. While credit spread reflects idiosyncratic risks associated with individual issuers, the interest rate is the base rate for all bonds denominated in a certain currency and compensates investors for their baseline economic risks.

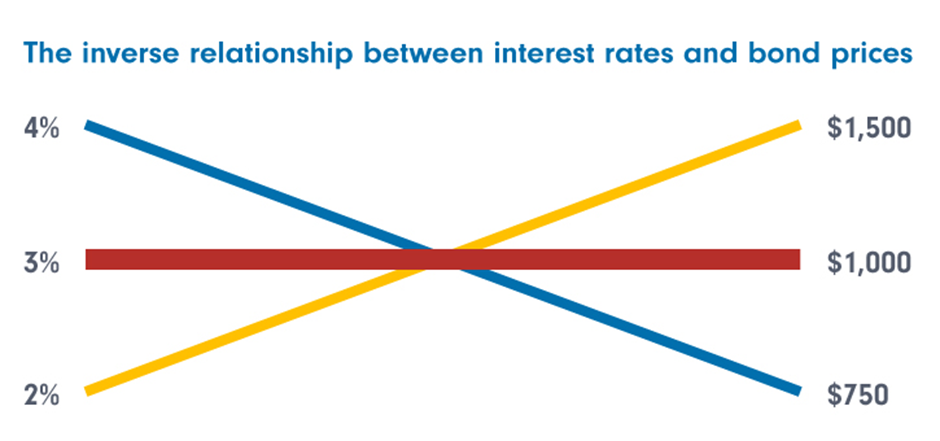

Hence if the market expects interest rates to rise, then bond yields rise as well, forcing bond prices, in turn, to fall. The reverse also applies. This inverse relationship between interest rates/yields and prices is the reason why fixed income portfolio managers take great pains to understand the drivers of the global economy and to gauge the future path of interest rates.

An example – interest rates fall

To explore this critical relationship further, let’s consider an example. Say a portfolio manager invests $1,000 in a government bond that matures in three years and pays a coupon of 3%. The manager purchases this bond at its face value, and so will receive annual interest of $30, plus the return of the $1,000 when the bond matures. However, in three months from now, interest rates are cut to 2% – perhaps to encourage economic growth. In this scenario, the bond paying 3% is more attractive than a new issue paying an interest rate of 2%. Investors may be willing to pay more than $1,000 for the 3% bond to earn the better interest rate. When this happens, we say the 3% bond is ‘trading at a premium’ – and it is obviously a good position for a portfolio manager already holding that bond.

Inflation expectations

Apart from interest rates, portfolio managers also pay close attention to inflation expectations. Often called the ‘enemy of the bond investor’, rising inflation erodes the value of bonds and makes their coupon payments less appealing, if interest rates remain constant or rise. In bond markets, inflation expectations are measured by the difference in yield between an inflation-linked bond (whose value rises and falls in line with inflation) and a regular, or nominal, bond of the same maturity. This is called the ‘breakeven’ rate and allows managers to gauge inflation expectations in the market and position their portfolios accordingly.

Mitigating interest rate risk

Both inflation and rising interest rates can have a detrimental impact on an investor’s fixed income portfolio. The manager’s job is to mitigate these risks, and one of the most common ways to do this is via adjusting duration. Duration measures how sensitive a bond is to a change in interest rates. We tend to express a bond’s duration in terms of years, but it is not the same as the maturity date. Typically, bonds that have the longest maturity dates and the lowest coupons are the most sensitive to interest rate changes – and so have higher durations.

Duration can be calculated for both individual bonds and a whole portfolio of them. If a manager is worried about rising interest rates, he or she might decide that a portfolio’s overall duration needs to be shorter. Consequently, the manager might sell some of the longer-dated and low-coupon bonds, thereby shortening duration. As well as selling physical bonds, portfolio managers can use derivatives to mitigate interest rate risk synthetically – a strategy that aims to make the portfolio more resilient if interest rates were to rise. This flexibility is key to navigating markets and benefits investors.

Want more to read and watch?

Explore our other fixed income articles