In the second of a series of four, Portfolio Manager, Jeremy Podger looks at the impact of technology stocks on global equities in recent times. He explains why it’s not necessarily straight forward to assess if the sector is overvalued and looks at whether the current market leaders can continue to justify their value.

With last year’s amazing performance of technology stocks, people have rightly asked whether this is an overvalued area. Here the answer is not straightforward. Technology cannot be narrowly defined, and now permeates every industrial sector to a greater or lesser extent. It is rare to see a single sector stand out to the extent that technology did last year. However, aggregate technology profits were also much stronger than for the market as a whole.

Thus the sector’s relative valuation based on forward earnings estimates barely shifted. If we want to ask whether this is an overvalued area, we need to find other angles to look at because - in sharp contrast to the state of affairs in the tech bubble of 1999/2000 - earnings-based valuations are not polarised compared to other sectors.

One of the key problems within technology is the concentration of market value in the biggest beasts within the sector (Facebook; Amazon; Netflix and Google (FANGs) and Baidu, Alibaba and Tencent (BAT). These companies all saw strong earnings growth and share price rises last year and thereby became far jmore significant weights within broad market indices. For these stocks it is probably best to test reasonableness on a case by case basis.

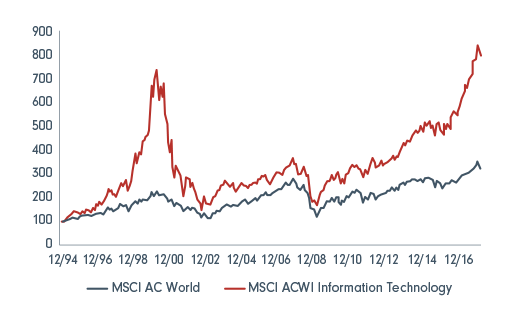

MSCI AC World vs MSCI ACWI Information Technology

Source: Fidelity International, Thomson Reuters Datastream, 31 March 2018. Indices rebased to 100 as at 1 January 1995.

| Past performance (%) | March 13/14 | March 14/15 | March 15/16 | March 16/17 | March 17/18 |

| MSCI AC World | 6.2% | 18.4% | -1.2% | 32.3% | 2.4% |

| MSCI ACWI Information Technology | 12.8% | 30.2% | 5.3% | 43.6% | 15.4% |

For example, the market value of Alphabet (Google) and Facebook, both of which derive their revenue from and dominate digital advertising, is around US$1,200bn - which compares to an estimated total global advertising spend of around US$500bn. Amazon has a market value of around US$700bn. Walmart has far bigger sales and historically better margins but you pay around US$3.9 for a dollar of sales at Amazon and a little over 50 cents at Walmart.

We know it is fair to pay for growth - but we have to keep asking how much is fair to pay for it - can these companies justify their value in terms of the profits they will eventually earn when they are fully mature? It is worth observing that high growth companies often see sharp de-rating in their shares when their growth rate slows, even if they are still growing faster than the broad average.