From the push for sustainable air fuel to mining workers’ rights and deforestation, Fidelity analysts’ engagements with companies over the past year show the conversation on climate and sustainability is deepening. There is no silver bullet, but our role as investors is to stay the course.

Fidelity’s second annual ESG survey, based on almost 200 responses from equity and fixed income analysts,[1] shows corporate managers are struggling with the challenges generated by the war in Ukraine and a global slowdown, but that the focus on climate transition and social factors has not gone away. This is partly due to increasing investor engagement on the issues, alongside growing regulatory intervention and government incentives.

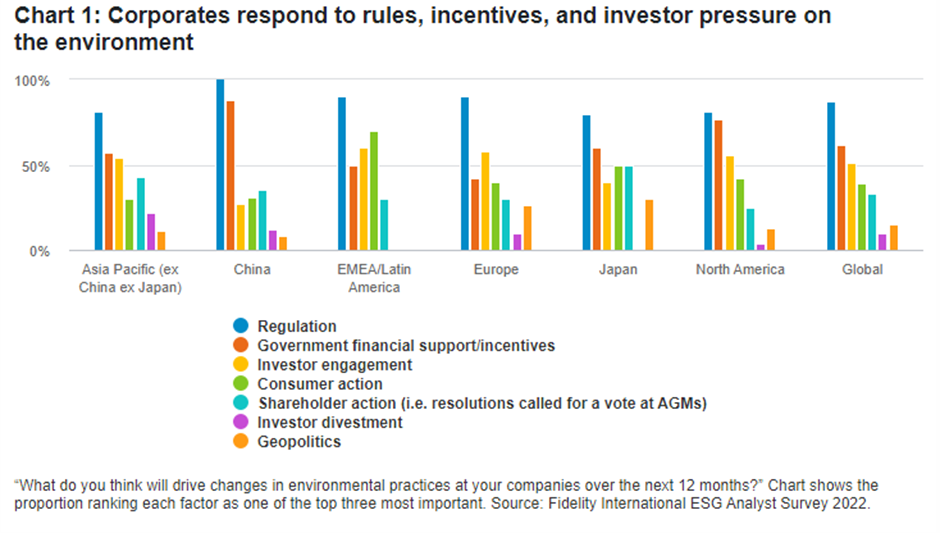

There are clear regional distinctions. In China, where many companies are still early in their sustainability activity, government initiatives and regulation dominate, and investors are only just becoming a deeper part of the process. The first year of the Biden administration sees analysts point to regulation and government support as the biggest drivers of an acceleration in change in the US, too, while in Europe, further ahead in the process, investors play a more significant role, alongside regulation.

“At this stage the focus is very much around relationship building and encouraging greater disclosure,” says one analyst who covers the financial sector. “That's particularly the case for US companies which are less advanced with their ESG plans compared to companies in Europe.”

Hothouse topics

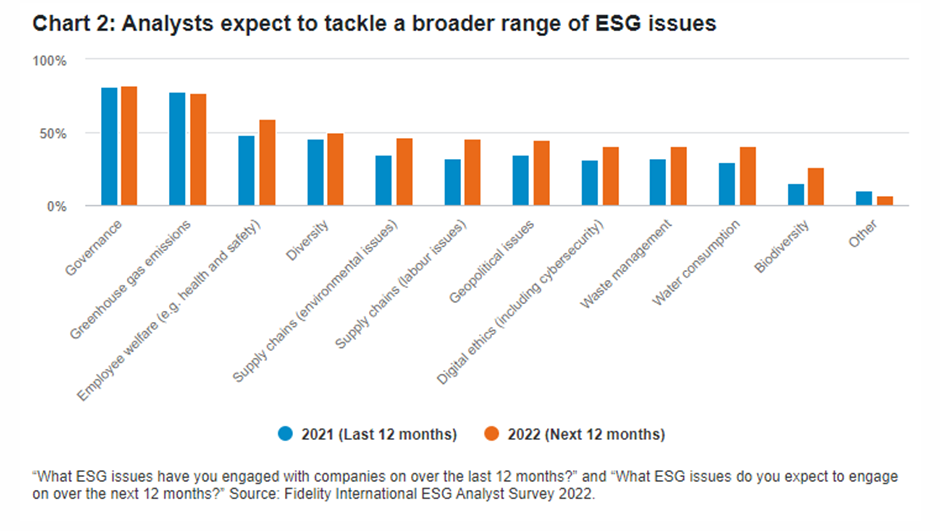

Our analysts report that - after governance - greenhouse gas emissions continue to dominate discussions in their meetings with boards and management teams, while there is a marked increase in interactions across the board on social topics like employee welfare and diversity. After the disruptions of the past year, supply chains are in focus, especially labour concerns, which show the largest increase in mentions by the analysts. But the natural world is a key concern too and, from a low base, biodiversity features in 26 per cent of analysts' conversations, with our team expecting that to rise in the year ahead.

These issues are still low on the agenda for telecoms, industrials and banks, but consumer staples producers for example are digging in, investing in programmes to cut consumption of new plastics, source more sustainably and reduce their impact on the oceans.

“Companies are more aware of their environmental footprint and are starting to take action and participate, primarily as financial sponsors, in projects to offset the negative impact,” says a consumer discretionary analyst. “In my area, for example, cruise operators are contributing to projects that either clean the ocean or protect certain endangered ocean species.”

Top drawer

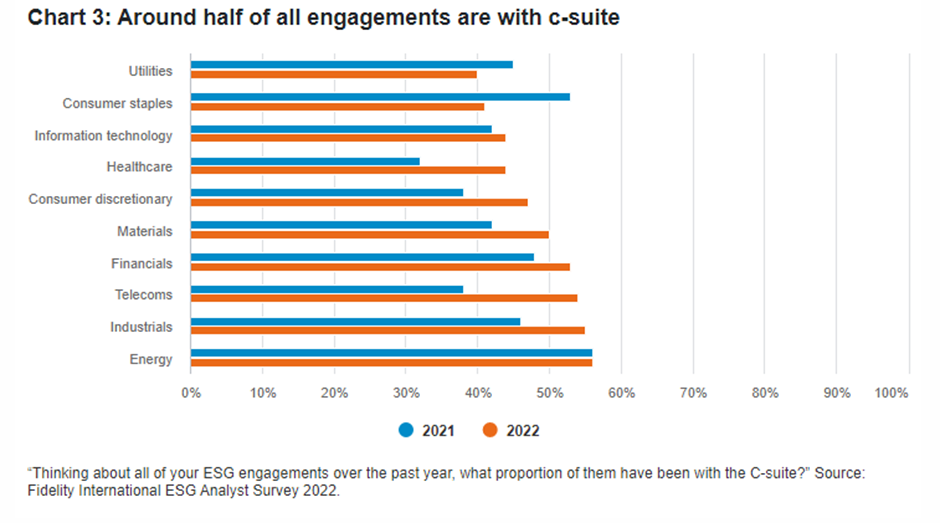

These discussions aren’t just handled by Investor Relations teams. We record higher engagement with sustainability issues by chief executives. Already high in 2021, it rose again over the course of this year . In Europe, which is leading on the energy transition, some 60 per cent of engagements have been with the C-suite.

This is a global phenomenon, as corporate leaders engage more in almost every market and sector.

“The companies ‘get it’ and the aim is to help them by increments rather than by delivering a transformational moment,” says one analyst who covers commodities producers and other materials companies, many of them in emerging markets. “Companies are embracing ESG and change in general, but we have to remember that the majority are state-owned enterprises. They cannot be patronised.”

Engagement with the C-suite has not risen across the board, however. In the utilities and consumer staples sectors, for example, the share of meetings with company leaders have fallen off slightly from last year.

“In some areas there are signs that CEOs and CFOs are engaging less,” says another analyst. “Sometimes that may reflect companies finally getting serious, in others there is less engagement at that level now, possibly because the agenda has been set.”

Making a difference

Dotted among the survey responses are examples of the small but necessary changes being made by companies with which we and other asset managers have engaged. In one example, China Power International announced a detailed green energy transition plan with a clear 2025 target for the percentage of capacity and revenue it would generate from renewables. This was largely driven by top-down changes announced at a government level but the company’s management were also keen to respond to the needs of international investors such as Fidelity and we had specifically raised the need for a revenue-based target in our meetings with the company.

In another example, we used the intelligence gathered from engagements with senior management at UK banks to steer our voting decisions on shareholder resolutions. We believe this helped us to support banks and senior managers who were genuinely moving forward on climate policy, and to oppose those guilty of greenwashing.

Nevertheless, it is often impossible to point to the exact moment when engagement made a difference and prompted real change. “At large cap level, it is a fallacy that we turn up to a meeting, talk about ESG and the company goes ‘oh wow’ and it’s transformative,” says the same materials analyst quoted above. “It’s about multiple discussions and inching out gains over time.”

Harder choices ahead

Banks, which can afford to employ departments to do the work, are pressing ahead with better environmental disclosure, laying the foundation for more difficult decisions ahead.

“Disclosure is easy, and managers don’t mind committing to it,” says an analyst who covers European banks. “You make the commitment, appoint some people to do it and it gets done. The bigger problem is what comes after: banks can’t finance a green economy if the economy itself isn’t moving in the right direction.”

Standardisation of disclosures may help other companies, but some are also having to make tough choices such as what to fund and when, given capital pressures and the absence in many sectors of the technologies required to complete the transition. Our air industry analysts, for example, say Boeing, Airbus and a raft of engine producers are diving into the process of delivering lower carbon planes.

“They all know there is a huge competitive advantage for whoever gets there first,” says one. “However, the tech is still in university labs. Electric is not really viable. The density of batteries needs to be much, much higher. In 10 years, it may be a very different story, but you cannot solve that problem just by throwing money at it.”

Collaboration can be effective

In several cases, we have engaged with companies alongside other asset managers advocating for similar agendas. More than a third of European analysts, and over 40 per cent of those covering China, say doing so can carry more weight than engagement on our own.

Our small group interaction with Bank of China last year, for example, gave the company clear recommendations on green finance and target-setting, much of which its management then delivered in a detailed action plan to reduce its carbon footprint that included environmental stress tests.

The sectoral expertise of financial analysts has often proved important. They have long-standing relationships with companies and appreciate the challenges they face.

“These are companies invariably we have been covering as financial investments for some time: we understand their businesses,” says one banking analyst. "So we are able to be honest with management in ways that others cannot be.”

Police the detail

We are not an activist investor. Even in groups with other shareholders and asset managers, we won’t always achieve things we want to. But we are active stewards of our client’s capital and by engaging continually with companies we know well, and sharing what works, we can help to bring about lasting change.

“There has been some push back. You will hear people in the US ask: ‘who made asset managers God’?” says another analyst who covers US and European airlines and aerospace firms. “Our job is to do the detail. To make sure that climate targets are finding their way into the long-term incentive plans, that they are being measured correctly. And that there are reasonable goalposts along the way. That will be our role.”

[1] Some responded more than once depending on their sector coverage.