October 2016

Brazil – A perfect storm

Brazil in particular has had a torrid time over the last few years with the Ibovespa benchmark declining 63% in USD terms in the 36 months to January 2016. Since then it has staged an impressive 65% rally from the lows, though still -42% from the January 2013 reference point.

Reasons for this have been well documented: A fall in commodity prices saw terms of trade deteriorate resulting in a weaker currency; State owned Oil Company, Petrobras became embroiled in scandal spotlighting systematic political corruption which has nobbled the economy and crowded out productive private capital. This has culminated in a collapse in the value of the Brazilian real (BRL), a spike in domestic inflation, and a hike in domestic interest rates.

The outcome of this ‘perfect storm’ is an economy which by the end of 2016 would likely have declined by 8.5% peak to trough over a 3 year period and a political crisis which has led to the bitterly fought and highly contentious impeachment of President Dilma.

It isn’t all bad however, within the wreckage there are interesting opportunities for prudent investors focused on businesses with resilient cash flow streams capable of weathering the economic downturn and funding reinvestment opportunities. However, investors will need to be patient to benefit from the fruits of their reinvestment labour.

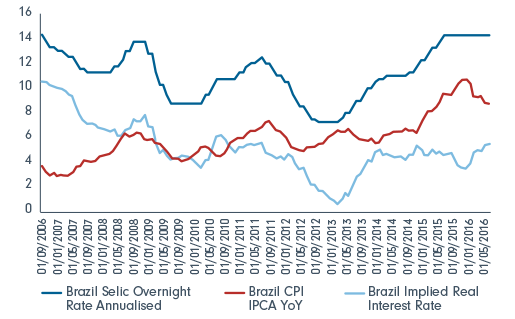

The macroeconomic backdrop is also ‘less bad’. Commodity prices appear to have found a floor which takes the terms of trade pressure off of the currency, inflation expectations are heading lower and domestic interest rates are at 14.25%. In a Negative Interest Rate Policy (NIRP) world, such high real interest rates will likely be enticing to fixed income mangers the world over. For equities these are tentative signs of stabilisation which should eventually lead to a base from which corporate earnings can start growing again. More importantly the retrenchment of government funded investment will lead to an increase in reinvestment returns for private businesses – accretive reinvestment is one of the most important drivers of long term compounding of equity returns.

Brazil Nominal and Real Interest Rates as at September 2016

(% per annum and % change year on year)

Source: Bloomberg

The starting point for equity investors, whilst not as attractive as earlier in the year, is still relatively healthy with many stocks implying structural costs of equity of >15%. As interest rates decline, the potential for multiple expansion on a 2-3 year time horizon is clearly attractive. In the interim there is much which can go wrong and my focus remains on being discerning with respect to stock selection. Certain privately managed financial companies will benefit once the economy starts growing again and public banks pull back from lending at negative economic profit yields. Certain industrial companies will likely benefit from divestitures of fundamentally sound yet poorly managed state owned assets. As a consequence, good businesses and most importantly attractive investment opportunities will arise from the economic ashes which we have been sifting through.

India – unlocking the potential

In recent years the political and capital market backdrop in India has created a far more favourable environment for equity investing. Opportunities presented by India’s large population and low levels of market penetration across multiple industries are well known. The challenge for companies and investors alike is how to unlock that potential in a profitable manner whilst navigating the maze like bureaucracy of the world’s most populous democracy. Rules and processes are often necessary to safeguard against exploitation of workers, abuse of minority shareholders and most importantly uphold trust and confidence in a system. However when taken to an extreme they can also lead to high friction costs which ultimately slows capital deployment and stymies economic development.

It is such issues which the Modi administration is seeking to address via a process of tentative political and economic reform, GST liberalisation being one such measure. 70% of the banking system is dominated by State owned banks whose balance sheets are currently hamstrung by unrecognised bad loans originated during the last cycle. This has served to dampen the rate of investment in the economy due to excess capacity in certain industrial pockets, an unwillingness by over leveraged corporates to take on more debt and the inability of banks to grant new loans before recognising the mistakes of the past. It does however create opportunities for those companies who aren’t burdened with the baggage of the last cycle.

As a consequence stocks such as HDFC Bank & Kotak Mahindra continue to make hay in the predominantly consumer lending market where they are serving retail customers through a deeply ingrained prudent approach to risk management with innovative banking products and attractive reinvestment returns.

Consumer stocks remain fantastic growth stories but, with most of the names trading north of 30x forward PE there is very little margin for error in this space. There are some tentative signs of an early cycle light project capital expenditure recovery taking hold although not necessarily broad based. However, should this continue it will lead to an overall increase in investment and job creation in an economy which badly needs both for it to realise its true potential.

In conclusion, it’s been an eventful few months. My outlook remains cautiously optimistic. The backdrop for EM assets from a FX perspective is healthier than it has been in recent years. There will always be reasons for caution, but equally there are a number of attractive opportunities across the investment universe for prudent, focused and patient investors.

References to specific securities should not be taken as recommendations and may not represent actual holdings in the portfolio. Investments in overseas markets can be affected by currency exchange and this may affect the value of your investment. Investments in small and emerging markets can be more volatile than developed markets.