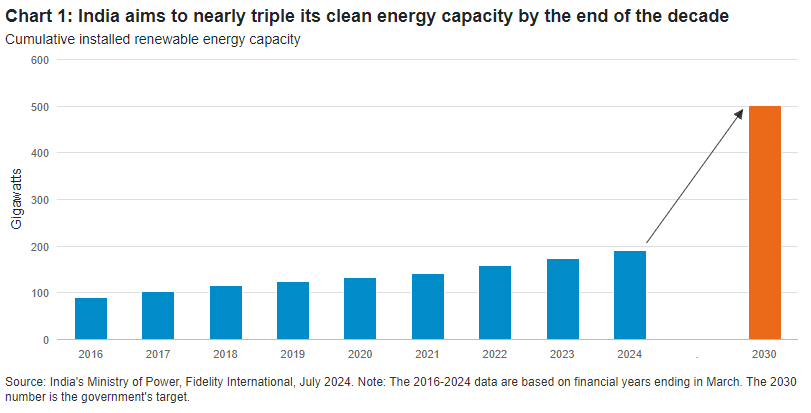

India’s transition to renewable energy still has a very long way to go. Cumulative installed capacity from renewables was only 191 gigawatts as of March of this year, less than two fifths of the country’s 2030 target.1 The government has made moves to encourage investment, including waiving interstate transmission charges for renewable generators. But spending will have to nearly triple by the end of this decade to put the country on track to meet the target of carbon neutrality by 2070.2

Much of that capital will come from corporate credit and bank loans, with Indian renewables companies’ offshore dollar bonds steadily becoming an important chunk of the high yield market in Asia. Their weight in the market has doubled over the past three years.3

These renewable power producers’ bonds offer a combination of relatively lower beta exposure and compelling yields. Most issuers are rated in the BB space, the highest rating band for high-yield bonds. The bonds’ average yield-to-worst (the lowest return that can be received without the issuer defaulting) is 7.4 per cent, higher than the 7 per cent for similar-rated peers in Asia (excluding China property bonds), and higher than the yield-to-worst of 6.5 per cent in the US and 5.1 per cent in Europe.4

India’s robust growth story enhances the bonds’ appeal. The South Asian economy is projected to grow 6.8 per cent this year, the fastest of the world’s major economies.5 S&P Global in May raised its outlook on India’s sovereign rating from stable to positive, citing its strong economic fundamentals.

No alternative

For the government, the stakes in the long run could not be higher.

India surpassed China to become the world’s most populous nation last year and Prime Minister Narendra Modi has focused for a decade on delivering the growth that would lift more of that population out of poverty. To do so, it must deliver radical increases in the power available for businesses and homes in cities where daily blackouts are a fact of life. The country’s peak energy demand, driven by heightened industrial activity, grew 12.7 per cent in 2023-24 from a year earlier, faster than the 8.2 per cent expansion in GDP.6

Straddling the equator, it is among the countries most exposed to global warming. A scorching heat wave in May took temperatures in New Delhi to almost 53°C (about 127°F).7 Meanwhile, India’s power generation is dominated by greenhouse gas-heavy coal. Only a fifth of all power generation was met by renewables.8 The pace of renewable addition will have to go up.

The government’s resulting commitment to change and the growing number of projects have kept issuers’ credit fundamentals relatively stable. The Ministry of Power’s late payment surcharges has caused a meaningful drop in overdue receivables owed by state-owned distributors (the primary buyers, or ‘off-takers’, for renewable energy). Companies have enjoyed cheaper funding from domestic lenders and we expect financial conditions to remain supportive as government-owned non-bank financial companies continue to step up funding for renewable projects. Access to capital and stable cash generation will help borrowers withstand a high interest rate environment.

Net challenges

The task ahead for India’s renewable sector is huge. On a macro level, the surprise election outcome last month does raise concerns about Mr Modi’s ability to make more coherent changes in the system. Similarly, on a micro level, the sheer amount of capex needed to upgrade energy infrastructure may strain issuers’ financial profiles in the near term.

But once the projects are launched, the capital spending should yield benefits in the years to come - both for investors in bonds, and for a world in which cleaner development in India is an environmental must.

1 According to India’s Ministry of Power.

2 International Energy Agency, World Energy Outlook 2023 – Analysis - IEA.

3 As of April 2024, Indian renewables companies’ bonds represented about 6 percent of the JP Morgan Asia Credit (JACI) Non-IG, more than double the 2.7 per cent three years ago.

4 As of June 2024. European BB-rated bonds are denominated in euro.

5 According to the International Monetary Fund.

6 According to India’s Ministry of Power.

7 India heatwave kills at least 33, including election officials | Reuters

8 According to India’s Ministry of Power.