It's easy to get sucked into the lure of the biggest companies - they're the most powerful; they're unstoppable. But history suggests that's not how these things work.

The companies many investors have relied on for their returns in the last few years are the Magnificent 7 (Mag 7). Today, what kind of shape are they in? Do they justify the faith that investors have placed in them? And crucially, is it too late to buy them as investments?

Just how big and important are the Mag 7 for investors?

In a nutshell, the Mag 7 are massive. Whenever we're talking about the Mag 7, we feel a need to triple check the numbers because they seem implausible. If you look across the world stage - the global market - these seven stocks represent a fifth of the market by value. So, if you buy a global tracker fund, you might think you're investing across the world and can gain exposure to over a thousand stocks, but in fact, a fifth of that portfolio will be in just seven stocks.

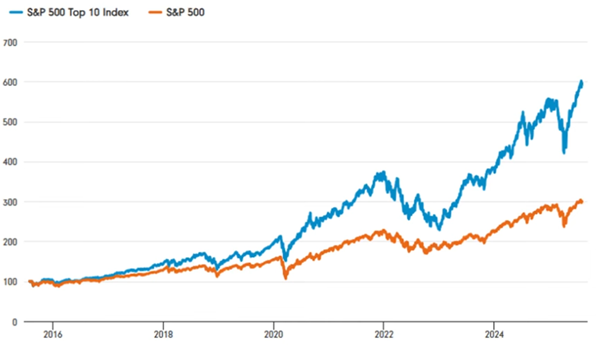

In Chart 1, you can see the performance of the S&P 500 over the past 10 years alongside the performance of the 10 biggest companies from within this index, of which, the Mag 7 make up a significant part of.

Chart 1: America’s biggest companies have outstripped smaller players

Price performance (rebased to 100)

Source: S&P Global, 05 August 2025.

Had you invested $100 in that main market back in 2015, you would have $300 now. Not bad. But had you invested in just the top 10, you would have had $600, largely driven by the mega-caps.

It hasn’t been steady growth for these stocks either, there have been periods in the last 10 years with bursts of outperformance by the Top 10 stocks. For example, many stocks took a performance hit during Covid, but thanks to their resilience to withstand the impacts of the pandemic, the Top 10 continued to soar. We saw this too around November 2022 when ChatGPT first launched. The artificial intelligence (AI) boom really helped to propel stocks like Nvidia, which up until that point, was largely unknown.

What about the near future for the Mag 7?

We're just coming out of the half-year results season for many of the Mag 7 names. It’s an important time for investors in terms of overall sentiment. In the past, we’ve seen instances of companies having watershed moments when their earnings are announced but it seems from what we’ve seen, particularly with Nvidia, that the market is relieved to see it can deliver on its potential.

Generally, other than Tesla, we've seen double-digit profit growth and double-digit revenue growth.

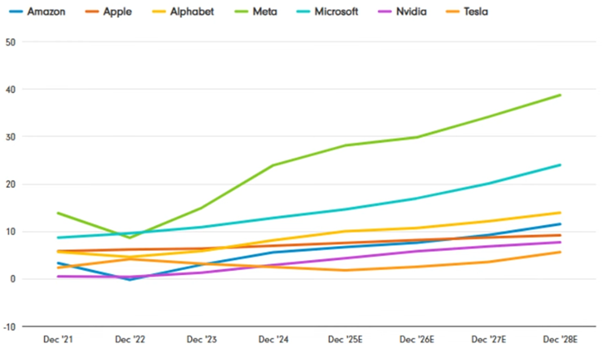

Chart 2: Where next for company profits?

Earnings per share (EPS) for each calendar year ($USD)

Source: FactSet, 08 August 2025. Figures from 2025 are consensus estimates.

EPS indicates how a company is performing and the money it’s making. So, in short, we can see the Mag 7 are performing well and the trend indicates they are getting more profitable as the years go on. There's some noise around a stock like Tesla which has had a bit of a dip, but as Chart 2 shows, the direction for the stock indicates an upwards trajectory based on earnings forecast.

Of course, it’s impossible to know for sure what the future for the big tech industry will hold. There is still uncertainty around the possibility of AI and what that could look like heading into the future. But in the short term, forecasts like this which are based on earnings suggest that they will continue to grow their earnings in the near future.

It's important to remember that the Mag 7 are classified as growth companies, which means they are particularly susceptible to certain economic factors. In 2022, these companies experienced a significant downturn, more so than the broader market, primarily due to rising inflation and interest rates. These factors erode the value of their future earnings, and because so much of those future earnings are factored into their current stock prices, it creates an outsized impact. This is a vulnerability inherent to growth companies. As we approach September, there is considerable interest in the direction of US interest rates. Currently, there is widespread confidence that rates will be cut, reducing borrowing costs, which would be beneficial for business. However, if these cuts do not materialise, the market may not respond favourably, potentially impacting these growth companies adversely.

Breaking up one big happy family?

The Mag 7 is not a homogeneous group. They're all in the business of technology but at the end of the day, Nvidia is making AI chips, Apple is making phones, and Tesla is making cars.

It’s the element of their technological innovation, how advanced they are, how big they are, their ability to buy up rivals that makes them part of one group, making it very difficult for anyone to compete with them.

However, this does get tested from time to time on individual members of the group. Take the ‘problem child’ this year, Tesla. Shares haven't performed well largely due to demand issues and there's been a lot of competition coming in from China. It's also quite an interesting point for the company because it seems to be trying to transition out of being just a car maker into more of a tech giant. With this uncertain phase brings bumpiness. Could Telsa fall out of the Mag 7 family?

There's another company out there which no one really is talking about yet, Broadcom. Broadcom creates chips which must exist for AI to happen. Nvidia designs chips largely that are almost a bit off the shelf that lots of companies can use whereas Broadcom is more specialist. The company is creating things for bespoke solutions that companies need specifically, but not all companies will need.

Think about the FAANGs which you may recall included a lot of the Mag 7 names but famously, Netflix, which has now fallen out of the group due to its size. It just goes to show that nothing is written in stone to say that one company will continue to be the biggest in the world. It’s what is the biggest right now. It's easy to think that these companies are unstoppable. But history suggests it won’t always be the same.

Eyes on valuations

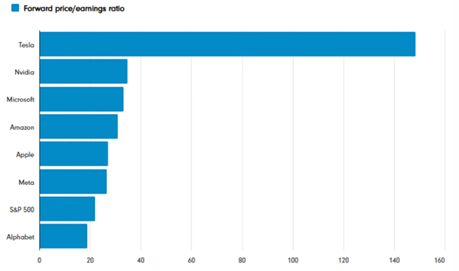

Chart 3: The Mag 7 stocks are a pricey bunch

Source: FactSet, 07 August 2025

When considering valuations, we often use the price-to-earnings (P/E) ratio for comparison purposes. However, the P/E ratio doesn't provide significant insight on its own; it's most useful when comparing it to other companies or the market as a whole.

As you can see in Chart 3, Tesla has a huge valuation of 140 times its earnings where the other six stocks tend to sit in a range between about 25-35 times their earnings. The S&P 500 currently has a valuation of approximately 22 times earnings, which suggests that the Mag 7 stocks are somewhat expensive. The S&P 500 figure is somewhat distorted by the presence of the Mag 7, which skews the overall valuation.

If we were to focus solely on smaller companies, the gap between these segments would be more pronounced. For instance, Nvidia is valued at around 35 times earnings, which is quite high. Although earnings are being realised, this valuation appears lofty. This raises an element of risk when investing in the Mag 7 as these companies must continue to deliver strong earnings to justify such high valuations.

What’s next for the Mag 7?

People are always cautious about any bumps in the road. Things like higher inflation and higher interest have always posed a threat to the Mag 7.

More recently, AI is in the forefront of the conversation. We often expect companies to invest heavily into AI to boost productivity, but what if the economic data starts looking a bit dodgy? Who really knows how that might shake up their spending plans. It's tricky to predict how that will impact the big names relying on AI.

Reflecting on past events, such as the dot-com bubble in 2000, can offer perspective. During that time, there was immense enthusiasm about the internet's potential, which was ultimately justified as it transformed our lives. However, the anticipated quick returns did not materialise, leading to short-term setbacks in the market. Some companies expected to thrive ended up struggling, highlighting the uncertainty of predicting which businesses will succeed over time.

We know the Mag 7 have captivated investors with their impressive power and perceived invincibility, but history reminds us that such dominance is not guaranteed.