Stock markets house a dizzying array of companies. Right now, however, investors are hungry for one thing: Big Tech.

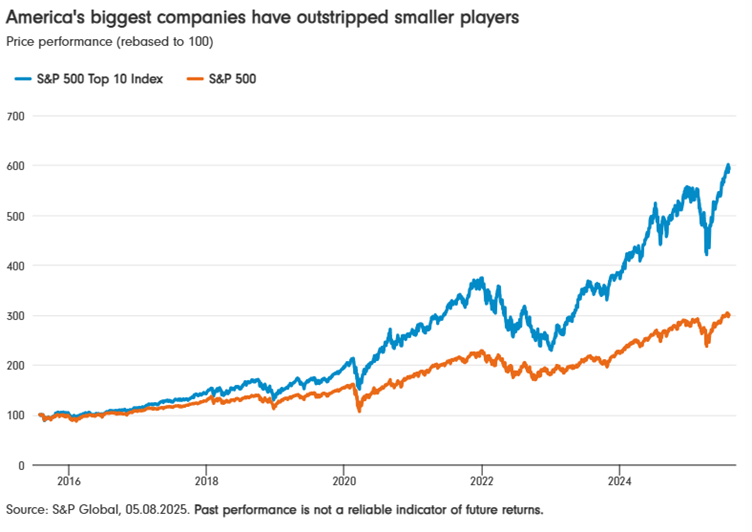

It is easy to see why. Over the past decade, these mega-caps have outstripped their peer group. Had you invested $100 in the S&P/ASX 100 in 2015, you would now have around $230, ignoring dividends. If you had invested $100 in America’s 10 biggest companies, however, you’d be sitting on around $525. Please remember past performance is not a reliable indicator of future returns.

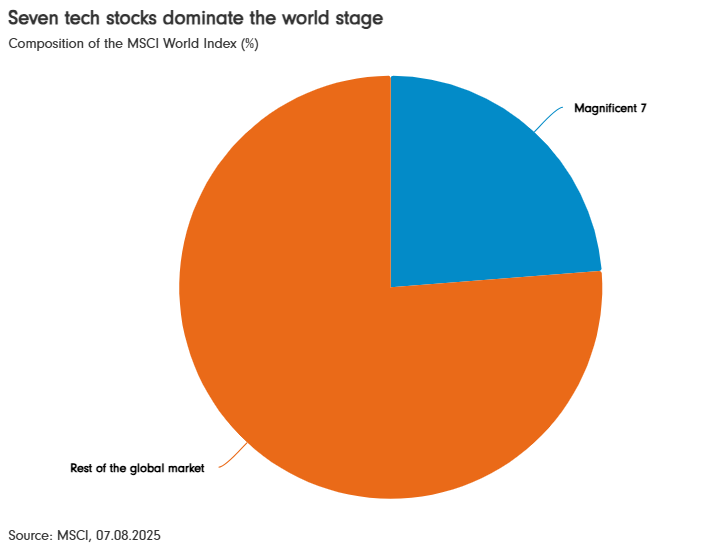

The phenomenal success of Big Tech has reshaped the market. When you buy a global tracker fund, you gain exposure to over 1,300 stocks - but a fifth of the portfolio is invested in just seven: Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla. According to Morgan Stanley, the market hasn’t been this concentrated since the 1960s.1

This means the performance of Big Tech is not an esoteric issue. It affects almost everybody’s finances. And one question is front of mind: can these mega-caps keep delivering?

Recent results

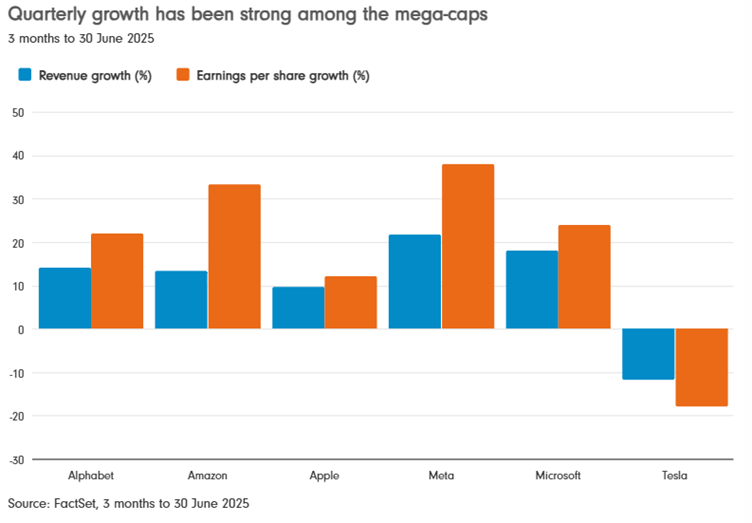

US stocks are pleasantly surprising the market this results season. Based on what we know so far, they boosted their earnings by an average of 10% in the second quarter of 2025 - twice as much as analysts expected.2

The Magnificent Seven are pulling their weight. Alphabet, Amazon, Apple, Meta and Microsoft all posted double-digit growth in the past few weeks, and great things are expected of Nvidia later this month. Only Tesla disappointed with a drop in sales and profits.

Let’s dig into what is driving this growth. Earlier this year, investors were fretting about the sector’s plans to plough money into artificial intelligence (AI), given the uncertain benefits. There are early signs, however, that these projects are paying off.

Take Alphabet, the owner of Google. Many feared that AI search overviews would cannibalise its business model, which relies on people clicking on links. However, it grew search revenue by 12% in the three months to June to a whopping US$54.2bn.3

Meanwhile, the Google Cloud business - which has been investing heavily in AI infrastructure - grew revenue by almost a third to US$13.6bn.4

Microsoft posted similarly bullish figures, saying AI strength had fuelled its latest results. Its Azure business - which offers a range of AI tools - grew sales by 34% to US$75bn.5

Profit predictions

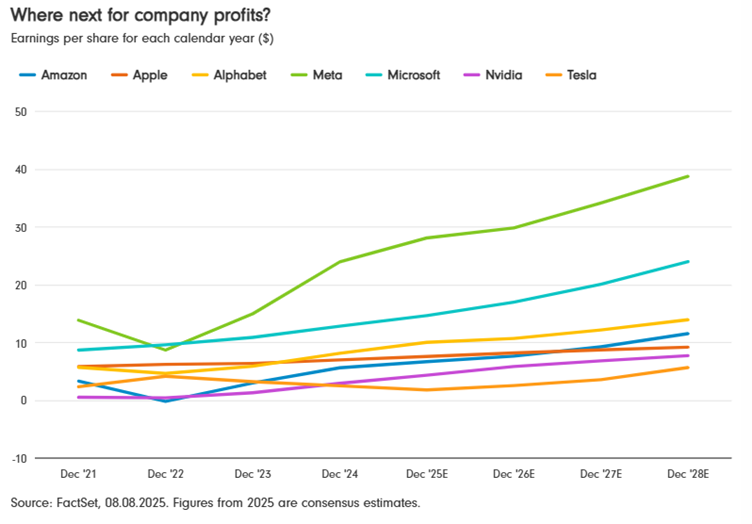

Ultimately, however, stock markets are forward looking. What comes next is more important than what has just been.

This is a problem, as nobody knows exactly where technology is heading, or what the next big breakthrough will be. Humanoid robots, augmented reality spectacles, mass redundancies - who knows? This means that profit forecasts in the sector are notoriously unreliable.

History does suggest, however, that it is very difficult to sustain stellar growth. David Kostin, chief US equity strategist at Goldman Sachs, found that just 3% of S&P 500 companies were able to generate revenue growth of 20% or more for 10 consecutive years.6

‘History suggests that the earnings performance of these companies will likely disappoint current euphoric market expectations over the longer run,’ he concluded in 2024.

Ultimately, the outlook is still very hazy and the debate among experts is fierce. There are some clear headwinds on the horizon, however. US President Donald Trump’s 50% tariff on India is a big concern for Apple, for example, as it produces a lot of its iPhones in the country, having pivoted away from China several years ago.

Meanwhile, Alphabet is facing a major regulatory threat, as the US Department of Justice considers whether to break up its core search business.

Valuations

You can’t think about the profit outlook in isolation, however. Company valuations are also crucial.

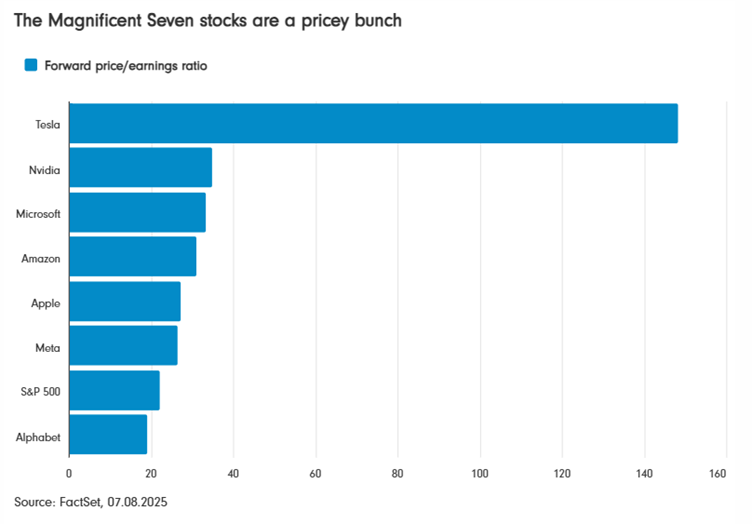

There are lots of ways to value companies, but a popular yardstick is the price/earnings ratio. This simply involves taking a company’s share price and dividing it by its earnings per share (EPS).

In simple terms, the higher the price/earnings ratio, the more expensive the company. Comparison is key here. Is one business more expensive than another? And has a stock become pricier over time?

Valuations vary significantly among the Magnificent 7. As a group, however, they are more expensive than the S&P 500 - as the graph below shows. This reflects the market’s high growth expectations.

Lessons from history

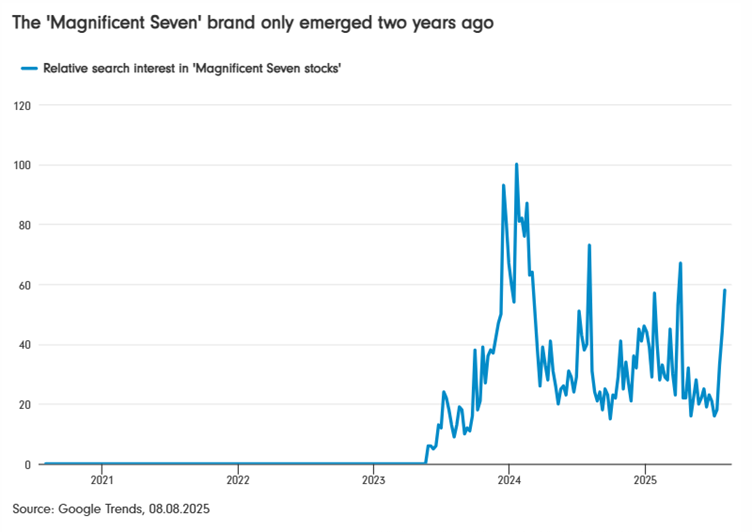

It is hard to remember a time when the Magnificent Seven didn’t dominate the world stage. A trip down memory lane can be productive, however.

Until 2023, however, nobody was talking about the ‘Magnificent Seven’. Instead, it was all about the ‘FAANGs’: Facebook, Amazon, Apple, Netflix and Google.

Journey further back in time, and the leaderboard is unrecognisable. Other than Microsoft, none of the top 10 tech leaders from 2000 are still leading the pack today.

The leaderboard has shifted in the past 25 years

| Magnificent Seven in 2025 | Tech leaders in 2000 |

|---|---|

| Nvidia | Microsoft |

| Microsoft | Cisco Systems |

| Apple | Intel |

| Amazon | Oracle |

| Alphabet | IBM |

| Meta | Lucent |

| Tesla | Nortel Networks |

Source: Goldman Sachs

‘Technological disruption is unforgiving, and amid intense innovation and competition, industry leaders can be quickly dethroned,’ concluded Rob Arnott, founder of asset management firm Research Affiliates.7

A different approach

At the end of the day, predicting the future is impossible. It is possible, however, to scrutinise your portfolio and manage concentration risk.

Sources:

1 Morgan Stanley, 4 June 2024

2 Factset earnings insight, 1 August 2025

3,4 Alphabet Q2 2025 Results, 23 July 2025

5 Microsoft, 30 July 2025

6 Goldman Sachs, 26 November 2024

7 Research Affiliates, The AI Boom vs the Dot-Com Bubble: Have we seen this movie before? March 2025