After a volatile start to 2025, Japanese equities have surged to record highs, with resilient corporate fundamentals offsetting external headwinds. Despite global uncertainties from trade frictions and a slowing world economy to persistent geopolitical tensions Japan’s underlying economic trends remain robust. The transition toward moderate inflation, sustained wage growth, and improving corporate governance continues to provide a durable foundation for medium-term equity performance. Meanwhile, the Tokyo Stock Exchange’s (TSE) reform agenda and the unwinding of cross-shareholdings are driving greater capital efficiency and higher shareholder returns.

From deflation to durable reflation

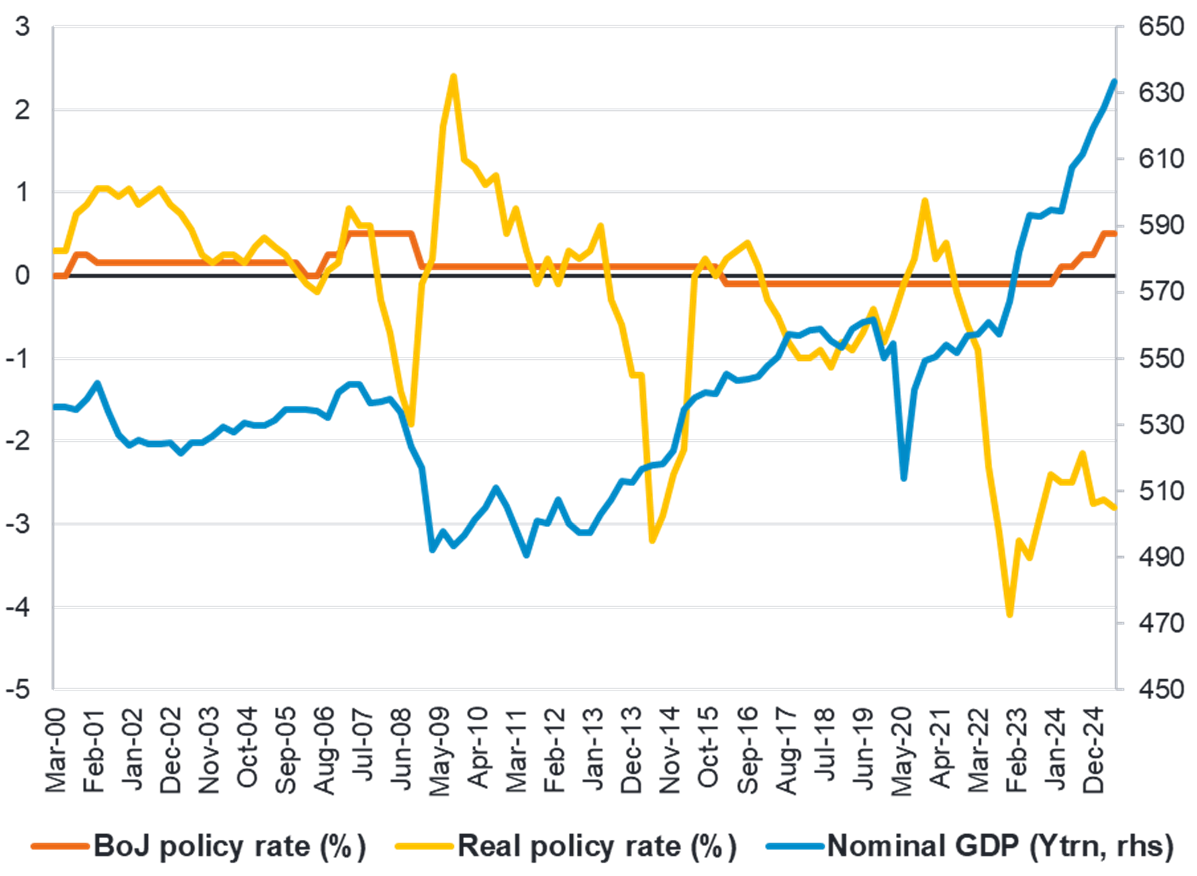

Japan’s pivot from deflation to mild inflation represents a defining structural shift. For decades, entrenched deflation suppressed nominal GDP, constrained household spending, and reinforced corporate conservatism. That era is ending. A combination of monetary, fiscal, and wage policies is fostering a reflationary environment that supports real income growth and private consumption. Core CPI, which averaged above 3% in early 2025, is projected to ease toward 2% by year-end, consistent with a sustainable inflation backdrop increasingly driven by wage dynamics and policy coordination rather than cost-push pressures alone.

The Bank of Japan (BoJ) has embarked on a cautious path of policy normalisation, gradually raising rates while retaining an overall accommodative stance. Policymakers remain focused on balancing inflation stability with growth support. This measured approach sustains favourable financial conditions, bolsters confidence, and helps embed inflation near long-term targets, all of which underpin a supportive environment for equities.

On the path to monetary policy normalisation

Source: Fidelity International, Cabinet Office, 30 June 2025.

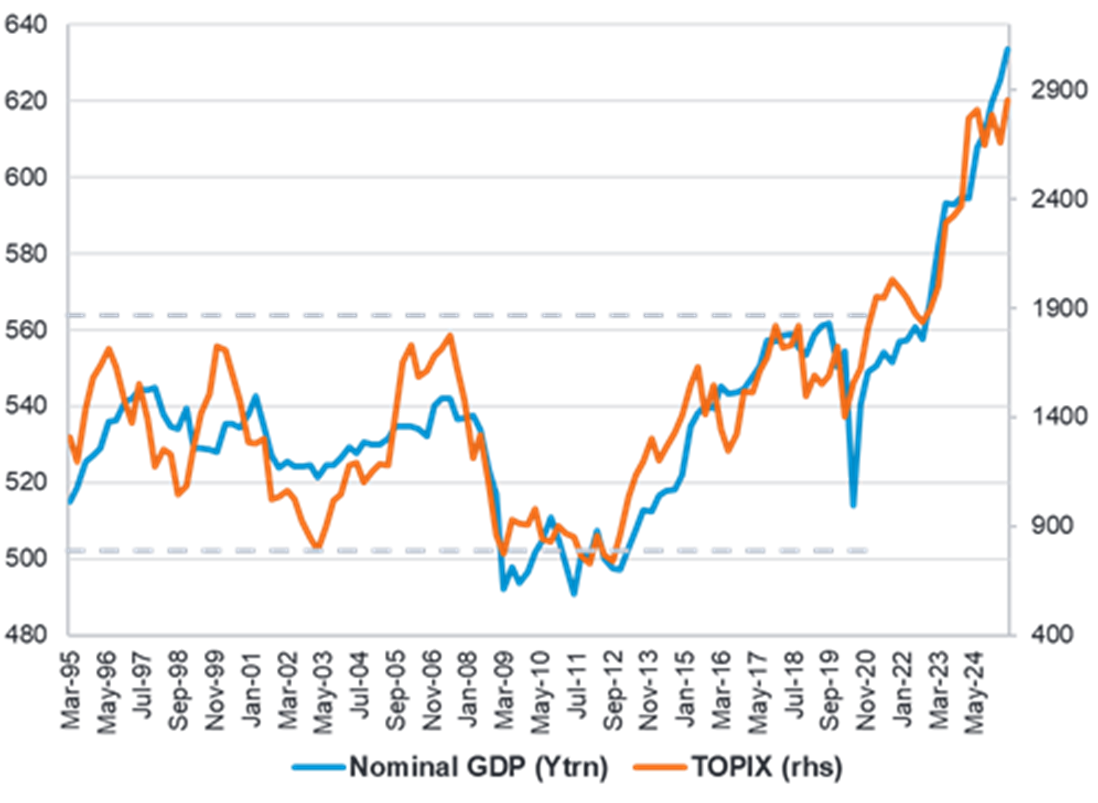

Stronger nominal growth key to the equity rally

Source: Fidelity International, TSE, 30 June 2025.

Shifting opportunities: new winners

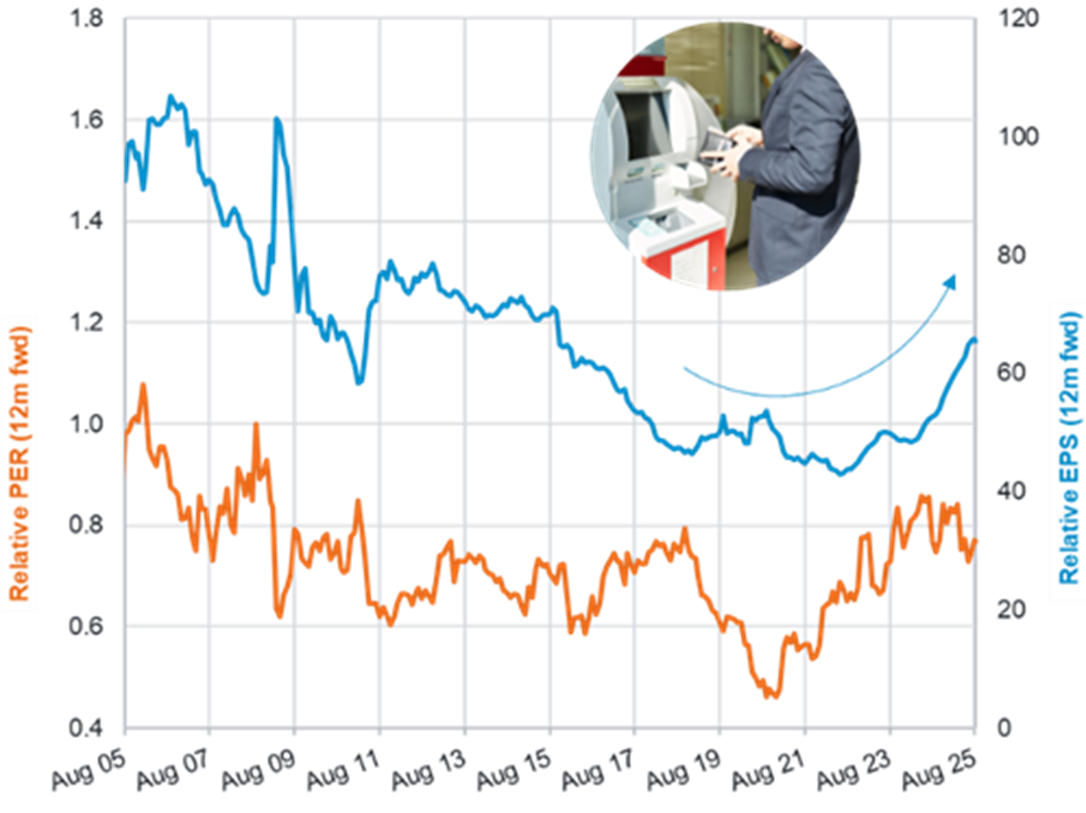

The banking sector is emerging as one of the clearest beneficiaries of Japan’s reflationary dynamics and governance reforms. Strong earnings momentum has been visible across the sector (from the mega banks to regional lenders), underpinned by resilient net interest margins, lower credit costs, and progress in cost controls. The improving return on equity outlook for Japanese banks has been accompanied by heightened expectations for shareholder returns. In addition to dividend growth, management teams are signalling more ambitious share buybacks, supported by the unwinding of cross-shareholdings and more disciplined balance sheet management. The combination of rising profitability, improved governance, and higher capital efficiency suggests that Japanese banks could deliver sustained rerating potential, especially as the BoJ gradually pursues policy normalisation.

The construction sector also presents a compelling outlook in this environment. Margins are expanding because contractors have regained pricing power. They are bidding selectively, focusing on large, high-productivity projects and pushing through price increases at the order stage. With labour capacity still tight and private capex rising, demand exceeds supply, so intake margins keep moving up. Reported results are catching the tailwind. Low-margin legacy jobs are rolling off, and revenue is increasingly recognised on newer, better-priced work. Q1 (Apr–Jun 2025) showed broad beats, with gross-margin gains at both general contractors and facility engineering (electrical/HVAC) sub-contractors. These trends are reinforced by the broader reform-driven backdrop: higher capital efficiency requirements and pressure to optimise asset portfolios are encouraging developers to recycle capital more actively, which in turn supports shareholder returns.

Banks: from megas to regionals

Source: Fidelity International, Bloomberg, 31 August 2025.

Construction: from general to sub-contactors

Source: Fidelity International, Bloomberg, 31 August 2025.

Governance reform: from mandate to momentum

Corporate governance reform has become a cornerstone of Japan’s equity story. The TSE’s directive urging companies trading below book value to address governance shortcomings has proven a powerful catalyst. Management teams are increasingly rationalising balance sheets, exiting low-return segments, and improving investor communication. Since 2023, this reform drive has gathered self-reinforcing momentum across sectors and market capitalisations.

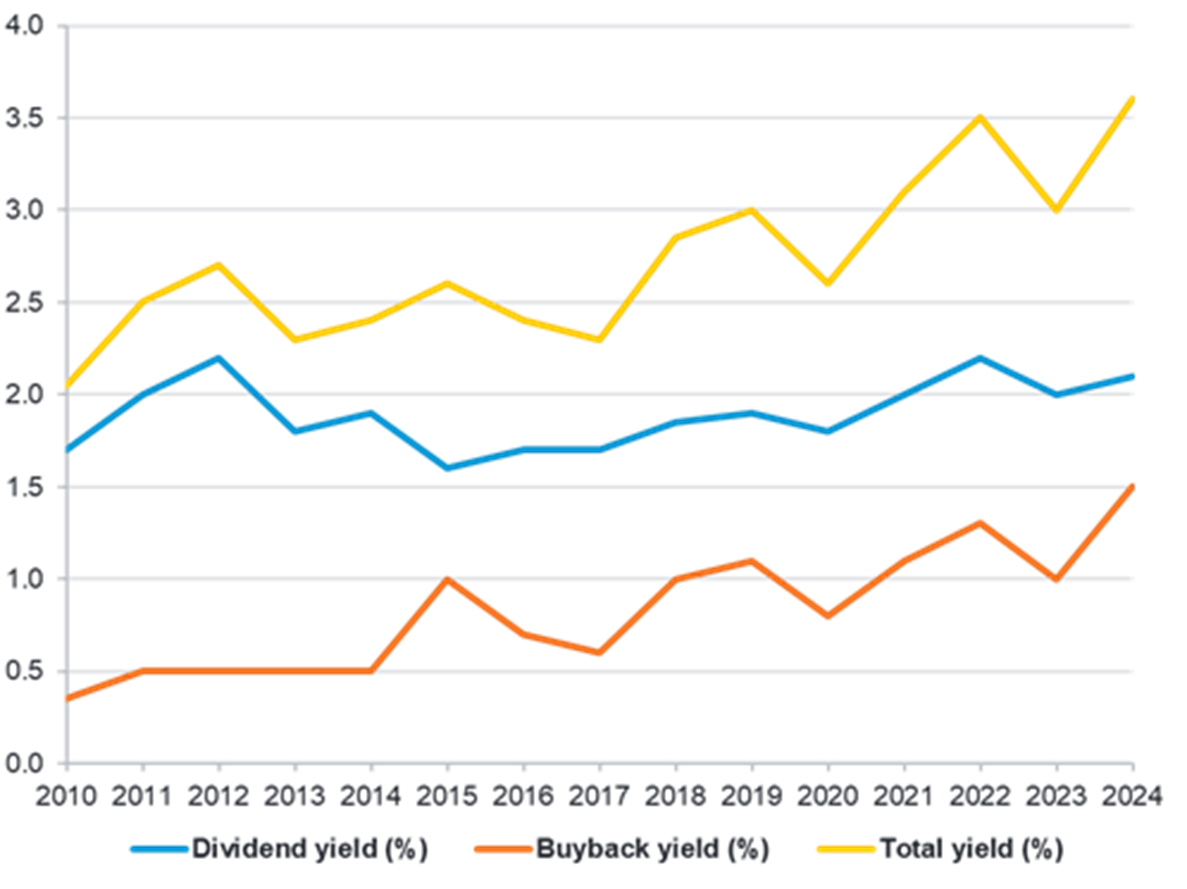

Shareholder distributions have risen sharply. Share buybacks grew nearly 90% year-on-year in FY2024 and have remained robust through 2025, even amid global volatility. Companies across multiple sectors, from electronics to financials, have embraced buybacks as a flexible tool to adjust balance sheets and enhance returns on equity (RoE). Dividend growth has also strengthened, with payout ratios now converging toward international norms. As a result, total shareholder returns yields in Japan are at record highs. This shift marks not just a cyclical recovery but a structural reorientation in corporate philosophy: from cash accumulation to disciplined, shareholder-oriented capital deployment.

Parent-subsidiary listings increasingly unwound

Source: Fidelity International, TSE as of 31 December 2024.

Total yield rising as buybacks accelerate

Source: Fidelity International, Bloomberg, 31 March 2025 (fiscal year basis).

The steady reduction in “parent–child” listings highlights the same drive toward efficiency. Historically, conglomerates maintained listed subsidiaries for financial flexibility and visibility. However, regulatory pressure (Tokyo Stock Exchange reforms, Corporate Governance Code, and Stewardship Code), combined with investor criticism of conflicts of interest and inefficiencies in capital allocation, has accelerated this unwinding. Rising activist involvement and demands for better governance have further forced conglomerates to rationalise structures, consolidate subsidiaries, or pursue buyouts. As a result, the prevalence of listed subsidiaries has fallen from nearly 10% of the market in 2014 to just over 6% today. The result is greater transparency, improved governance, and stronger shareholder alignment - key elements for sustained market performance.

As reforms deepen, Japan’s corporate sector is on track for structural profitability gains. After stagnating at 6–8% for much of the 2000s and 2010s, average RoE is forecast to reach 10% by FY2026 and 11% by FY2028. This sustained improvement should narrow Japan’s long-standing valuation discount versus global peers and reinforce the case for a long-term market re-rating.

Corporate fundamentals and valuations

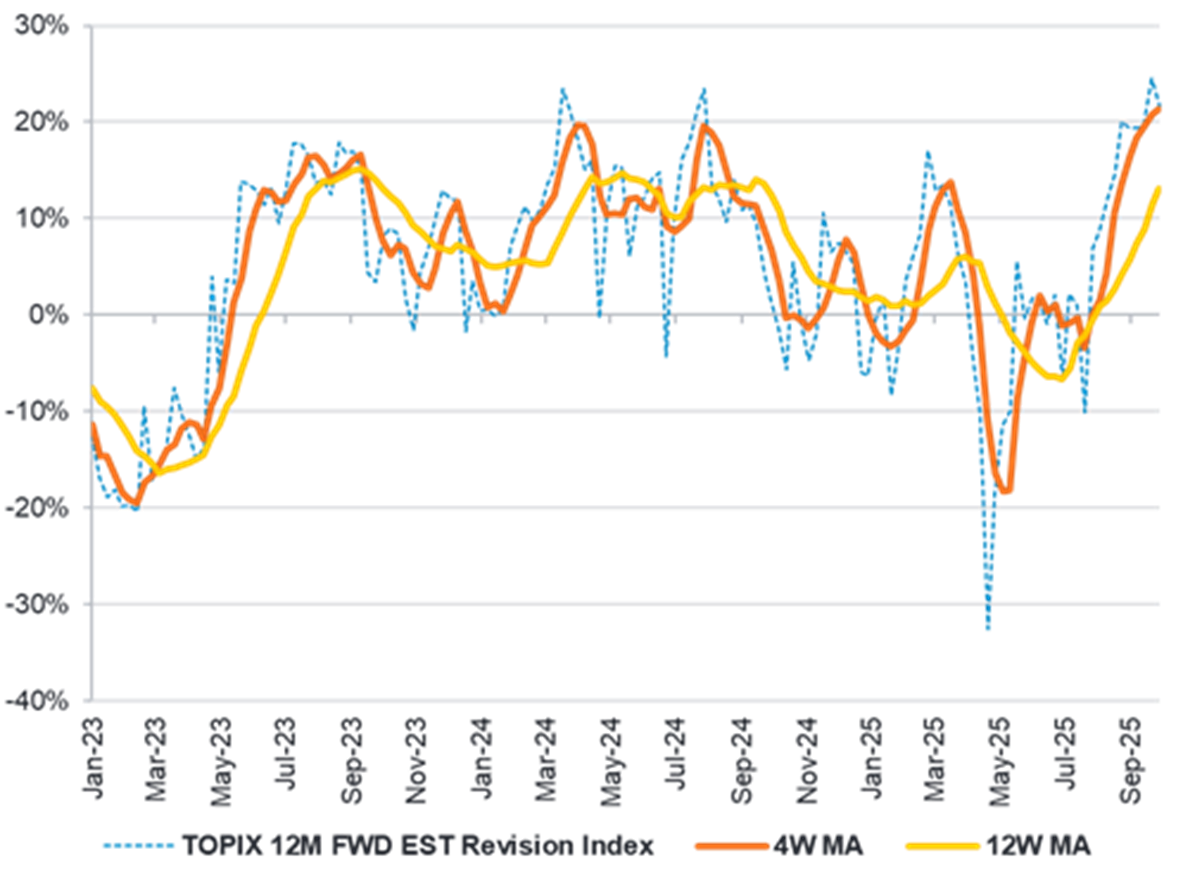

TOPIX-listed companies registered a sharp decline in earnings for the April-June quarter (FY25 Q1), led by tariff-exposed sectors. However, the aggregate results compared favourably versus both full-year guidance and consensus forecasts, especially for domestic-oriented firms. Since then, earnings revision momentum has turned decisively positive, aided in part by the US-Japan trade accord. Exporters are benefitting from cost pass-throughs and a softer yen, while domestic sectors, particularly banks, communications, and construction, continue to deliver steady profit growth. Against this backdrop, consensus earnings per share forecasts for FY2025 have been revised upwards and the market is starting to look towards a post-tariff normalisation of earnings from fiscal 2026.

Valuations, while no longer cheap, remain reasonable amid this improving environment. The TOPIX trades around 15–16x forward earnings, above the long-term median but below prior reform-cycle peaks. Structural tailwinds from corporate governance reforms and balance sheet optimisation underpin the case for a sustained rerating.

Earnings revisions on the up

Source: Fidelity International, Refinitiv, 3 October 2025.

Valuations have expanded but remain reasonable

Source: Fidelity International, Bloomberg, 30 September 2025.

Political realignment, policy stability

Japan’s political landscape has become more uncertain after Komeito ended its long alliance with the ruling Liberal Democratic Party (LDP), leaving new leader Sanae Takaichi heading a minority government. Opposition parties have gained influence but remain divided on key issues such as defence and energy. These underlying dynamics will make it harder to pass legislation but are unlikely to cause a major shift in direction. The next government is expected to shift from the Ishiba administration’s cautious fiscal stance towards targeted spending to boost growth and counter inflation pressures. Despite the political uncertainty, Japan’s stable institutions and experienced bureaucracy should help maintain policy continuity and economic stability.

Outlook: reform, resilience, and re-rating

Short-term volatility, particularly around US trade policy, global rate adjustments and shifting political winds, cannot be ruled out and the rapid pace of share price appreciation may presage a near-term pause or correction. Yet the medium-term drivers of the Japanese equity market remain intact: domestic reflation, stronger governance, expanding shareholder returns and rising RoE. In a global landscape marked by uncertainty and questions around US exceptionalism, Japan stands out for its improving fundamentals, credible policy coordination, and enduring reform momentum, offering investors both resilience and upside potential.