The amount of policy easing carried out so far has not been enough to jump start China’s economy, and now the engine of global growth is spluttering. Markets are now eagerly awaiting clues of what to expect from future policy at the 20th Party Congress beginning on 16 October.

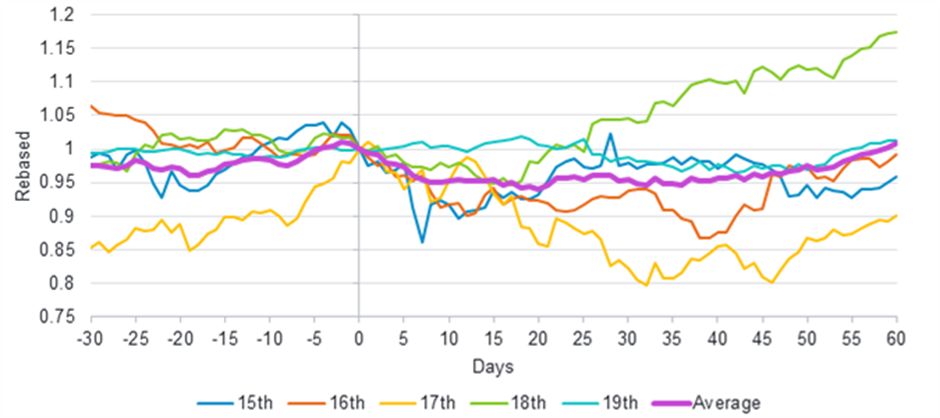

Shanghai Composite performance around Party Congress

Source: Bloomberg, Fidelity International, September 2022.

The 20th National Congress of the Chinese Communist Party is due to begin on 16 October. Much hangs in the balance. After strict Covid lockdowns derailed the economy earlier in the year, hopes were high that a loosening of restrictions, alongside some monetary and fiscal easing, would get the Chinese economy going again. But the property sector, the lynchpin of the Chinese economy for so long, is yet to recover from a series of reforms last year. And now Covid is flaring up again, precipitating further restrictions on movement, albeit less widespread than in March and April.

Policy has eased in recent months, including cuts to interest rates and the foreign exchange required reserve ratio designed to limit the currency’s devaluation against the dollar. Recent high frequency data has been mixed. Consumer confidence and export data is concerning. However, PMIs and earnings appear to be stabilising.

As the chart above shows, in the weeks leading up to party congresses, the Shanghai Composite tends to drift upwards as markets speculate on supportive policies. In the weeks following, equity performance is more varied, depending on policy guidance. However, the average of recent congresses indicates markets are often slightly underwhelmed. We will be watching for indications of the future path of policy in this challenging period for the Chinese economy. Possible actions that emerge from the congress could be central government bond issuance to fund infrastructure and more help for small businesses hurt by Covid lockdowns.

And although we judge it unlikely, any indication that the government is ready to tone down its strict zero-Covid policy would be positive for risk assets.