Fidelity’s third annual survey of our analysts on ESG issues delivers a home truth: there is a big gap between the action needed to deliver net zero and what the corporate world is currently doing.

The 2023 Fidelity International ESG Analyst Survey – our third - asks whether companies’ net zero plans are credible. The answer is: not yet. There are gaps in technology, a shortage of ambition, and the money currently allocated to reducing carbon emissions is well short of what’s required.

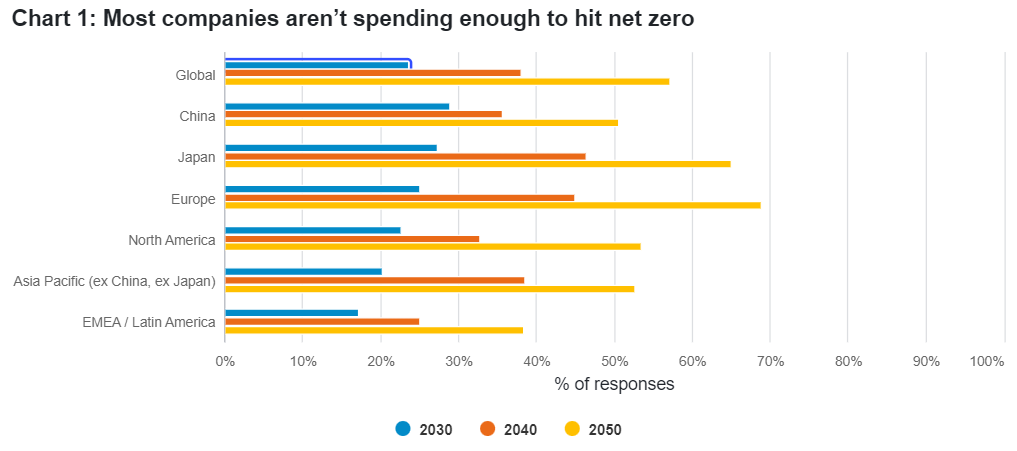

Currently, less than 60 per cent of companies are on track to cut their carbon emissions to net zero by the UN agreed target of 2050 , according to our analysts’ assessments of the companies they cover. And only one in four will do so by the more ambitious target of 2030.

That shouldn’t detract from the progress that has been made. The world’s big companies have, and are, listening, and the survey shows that most developed-world multinationals have committed to net zero targets, with 69 per cent of European companies allocating the funds needed to hit those targets by 2050.

But the survey tells us that the big multinationals that we invest in must up their game, and much of the impetus must come from governments.

“Although companies will get a return on their investment, they may not want to do the upfront spending,” says Velislava Dimitrova, a portfolio manager who focuses on climate. “If we want to get to 100 per cent within the timeframe scientists say we have, we will need a regulatory push.”

Question: “What proportion of your companies do you believe are allocating enough capex to achieve net zero by the following dates?” Source: Fidelity International ESG Analyst Survey 2023.

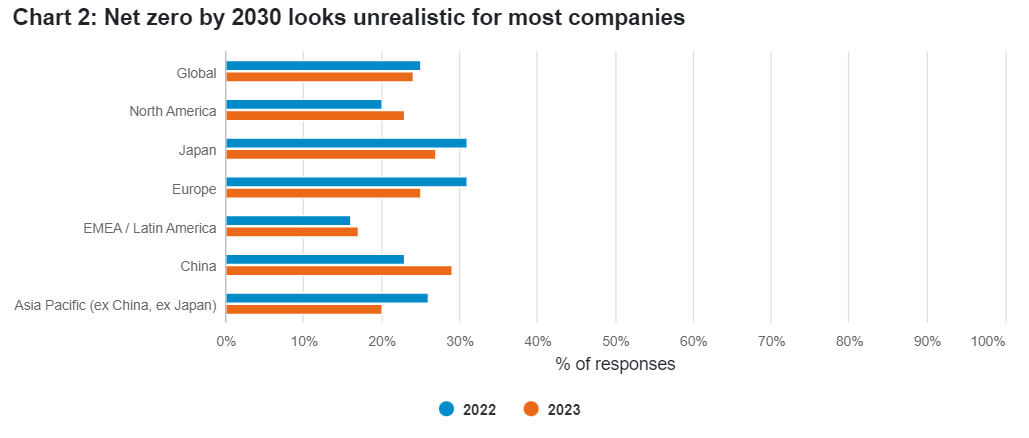

As Chart 2 shows, we are one year closer to 2030 and our analysts’ expectations for how many companies will hit net zero by that date has fallen slightly compared to last year on a global basis, although there appears to be more optimism around China.

Question: “What proportion of your companies do you believe are allocating enough capex to achieve net zero by 2030?” Source: Fidelity International ESG Analyst Survey 2023. [Please note, this chart corrects previously published numbers. In our 2022 survey, a data error led to an exaggeration of the results, for example the global figure was put at 35%, this has now been corrected to 25%]

Behind the headline numbers, as ever, is a complex mix of business- and policy-driven choices that vary widely across sectors and regions.

“In many cases the technology is not yet there,” says Laura Stafford, an equity analyst who covers Latin America and Eastern Europe, Middle East and Africa (LatAm/EMEA) mining and commodities companies. “For those targeting net zero by 2050 they still don’t have a clear roadmap of how to get there so it’s impossible to say how much capital will even be needed.”

Utilities stands out as a success story, with the opportunities in renewable power drawing huge investment. Our analysts judge that almost four out of five companies will reach the net zero target by 2050. In the energy sector, there is a clear split between European companies, which are pivoting towards renewables, and those covering North American energy firms.

“Our sector is at the heart of the problem,” says Randy Cutler, a credit analyst focused on the US energy industry. “Some will transform. But others either can’t get there or have decided they never will.”

Recession threats are a distraction

In the immediate future, the stresses caused by the world’s current weak economic situation will not help. As business conditions become tougher, managers will be under pressure to focus on immediate results over longer term sustainability.

“Most of my companies are either in default or deeply stressed. ESG has been low on their priorities and will very likely remain so in the next 12 months,” says Ming Gong, an analyst who covers China’s traumatised property sector.

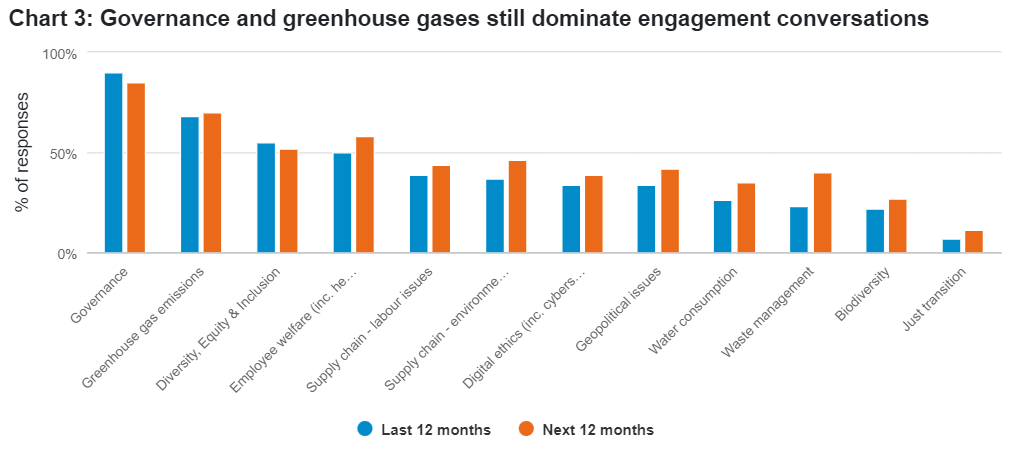

The survey data suggest that companies are gravitating towards areas where action is possible or easier. They are still discussing thornier, harder to measure issues like biodiversity or the need for a just transition, but far less than, for example, corporate governance.

Question: “What ESG issues have you engaged with companies on over the last 12 months?” and “What ESG issues do you expect to engage on over the next 12 months?” Source: Fidelity International ESG Analyst Survey 2023.

ESG now embedded in some sectors

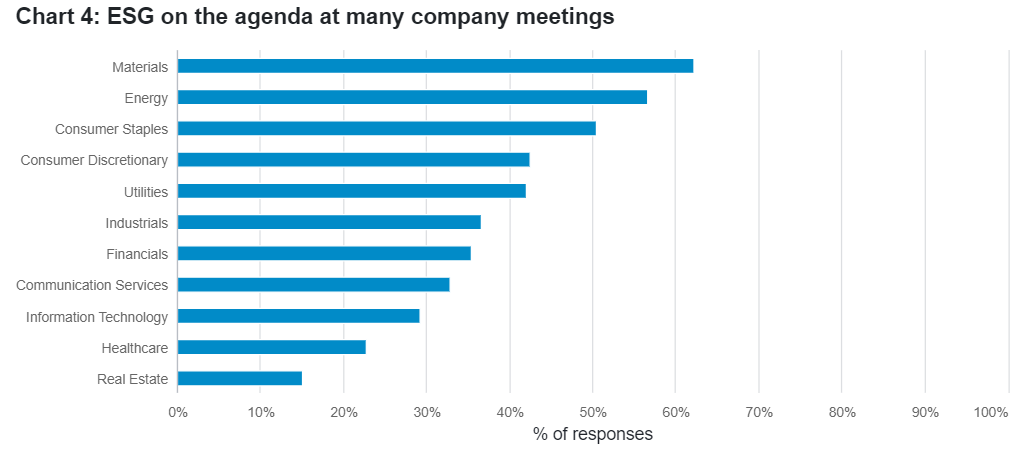

Opportunities created by the energy transition continue to outnumber the threats to corporate businesses, however, and in a number of sectors ESG issues have become an unavoidable factor in day-to-day operations and business strategy.

“In areas like building materials distribution, smaller players can’t invest in their ESG credentials, which are becoming increasingly more important in tender processes,” says Serhat Birbilen, who covers European consumer discretionary firms. “Big companies like Travis Perkins, which can afford ESG investments, have already started taking share from those smaller players. So ESG might already be consolidating some markets.”

Question: “What percentage of your company meetings have included engagement on an ESG topic in the last 12 months?” Source: Fidelity International ESG Analyst Survey 2023.

Analysts are also realistic about where they are having an impact, with investor engagement ranked as the top factor influencing changes to governance, but further down the list on social and environmental issues. Regulation and government policy are seen as the main factors driving change as we head deeper into the transition. Government incentives are almost as important but free markets and consumers themselves are not providing the necessary impetus. This is writ large in China, where the government’s pledge to make the country carbon neutral by 2060 is driving a sea change in company commitments.

Overpolished credentials

The proportion of meetings with c-suite executives has dipped slightly for the third year running as companies build out sustainability teams. But 73 per cent of analysts say companies are responsive on ESG issues, a figure that has been steadily climbing since we started this survey two years ago. More than half of respondents say management remuneration is now linked to emission targets and the survey suggests that more than 60 per cent of companies now have board level oversight of sustainability.

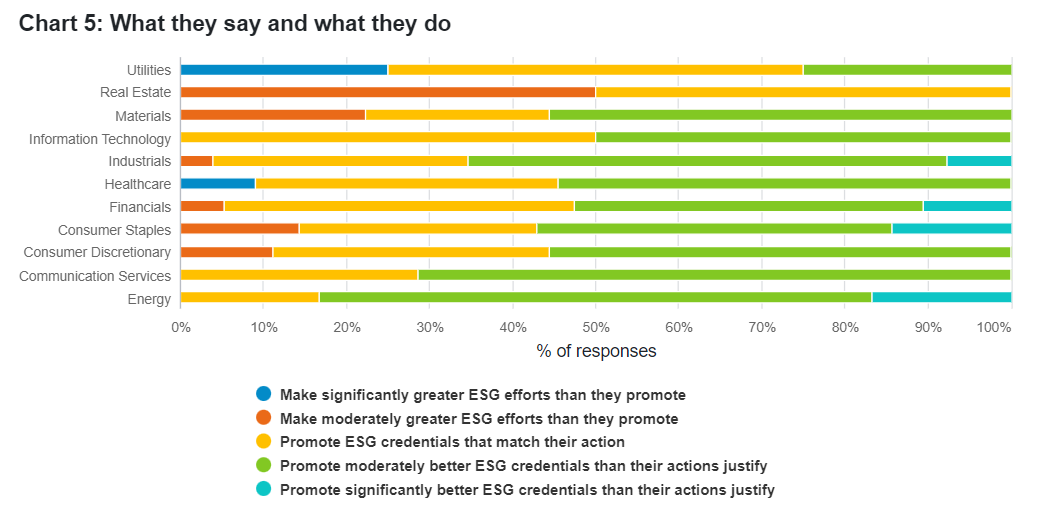

At the same time, however, there is some cynical behaviour: almost 60 per cent of our analysts estimate that their companies promote ESG credentials not backed up by their actions. Last year, around half of our analysts made the same assessment, suggesting that overpromotion of ESG credentials may be growing more common.

“Usually, the mismatch is in promoting or emphasising only the clean aspect of a company’s business, when most of what they do remains in non-sustainable categories,” says Paul Milon, a sustainable investing analyst who covers Asia Pacific (ex China, ex Japan, ex Australia). “There's a mismatch due to selective communication.”

Question: “Thinking about your companies’ efforts to promote their ESG credentials, which of the following would you say companies typically do? Chart shows percentage of analysts. Source: Fidelity International ESG Analyst Survey 2023.

Typically, it is the sectors where companies are performing poorly where this is more visible. In the energy sector, 83 per cent of analysts say their companies moderately or significantly overstate their credentials.

Trade-offs abound

The transition to a better social and environmental state is complicated and often involves trade-offs. Solar panels are better than energy from fossil fuels but some panels are made with forced labour; banks in the developed world boast they are offering easier access to finance - but vulnerable customers are often being overcharged.

These problems and contradictions are emerging with time and resolving them is part of the maturing of the transition. But it is maturing. When companies first started making pledges, they were just that: vague promises that we had no way of testing. We have some data now and the discussion is becoming more concrete. The devil will be in the detail. What is crystal clear, as our survey shows, is that much more needs to be done than is currently the case.