Asia’s emergence over the last decade has clearly had a major impact on the global investment landscape. An interesting - but perhaps underappreciated - development has been the change in the investor base of Asian companies. Not only are a greater number of international investors now recognising the region’s favourable long-term prospects, but rising wealth levels across Asia means more individuals are also investing their own money in equity markets.

The net result of this has been a significant improvement in corporate governance standards as investors demand companies move to higher international standards, with greater transparency and better capital allocation. In short, we are seeing more emphasis on minority shareholders.

Paying a dividend is a prime example of this. Over the last 15 years, Asia has shown the strongest dividend growth globally and today offers very attractive headline dividend yields. In fact, the dividend yield for the overall market is higher than the US and only marginally below Europe.

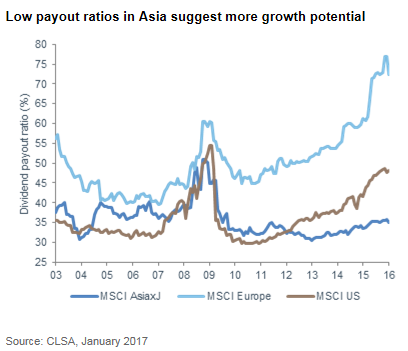

We would argue that the outlook for further dividend growth in Asia is equally positive. Corporate balance sheets are generally in good health after years of deleveraging and payout ratios are still low at around 35%. This is materially lower than the equivalent levels in the Europe, US and Japan and provides ample room to increase from here.

An example of a company improving shareholder returns through dividends is Taiwan Semiconductor Manufacturing Company (TSMC). The company is the largest semiconductor foundry business globally and has recently introduced a progressive dividend policy instead of a stable dividend in previous years.

In June, TSMC paid out over US$5bn to shareholders making it one of the largest dividend payers globally. It now pays out more than 50% of earnings to shareholders and provides an attractive headline yield with significant prospects to grow the dividend stream to investors.

Encouragingly we are also seeing governments across the region implement reforms to encourage companies to return more cash to shareholders via higher dividends, particularly among Chinese state-owned enterprises.

Elsewhere, we see positive signals around capital allocation in Korea, where the authorities have pushed through reforms to make it more tax efficient for companies to return cash to shareholders than to leave it sitting idle on balance sheets.

This is particularly evident in Samsung Electronics - one of the largest and highest profile companies in Korea - which earlier this year boosted total shareholder return through a combination of dividends and share buybacks. Over time, we expect more companies to follow this lead with dividends set to become an increasingly important driver of returns across regional equity markets.

Interested in investing in Asia? The Fidelity Asia Fund has a strong ten-year track record backed by more than 40 years’ experience investing in Asia. Click here to view fund page.