Nafeesa Zaman, content producer at Fidelity, shares her lessons around her goals for long-term saving.

The allure of instant gratification is hard to ignore. Living my best ‘Instagrammable’ life - whether it’s a new outfit with next day delivery, taking a holiday in Fiji or ordering Uber Eats - life can get expensive.

So, when I hit 25, I decided it was finally time to stop being reckless with my money. I value my financial independence, so it makes sense to make strides towards it. Here are three habits I'm practicing to build long-term wealth.

1. Let go of a get-rich-quick mentality

When I scroll through my Instagram feed, I see a lot of twenty-somethings that have ‘made it’. Some live in fancy high-rise apartments, others wear the latest designer brands. It’s a luxurious world but it’s a far cry from the reality many young people live.

Step out of the social media bubble and young people are having to battle with a cost-of-living crisis, high inflation, rising interest rates and six figure house prices. It’s no surprise then that the get-rich-quick mentality is appealing to people of my generation.

I think this is the wrong approach. At 25, my greatest asset is time. That’s because the longer you invest for, the more opportunity there is to benefit from the stock market’s long-term growth. Of course, this is not guaranteed.

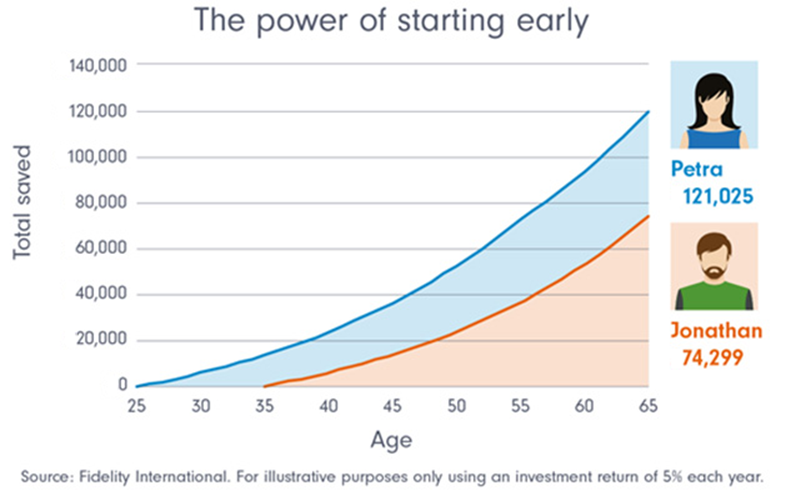

Take the example below - which is for illustrative purposes only - as investment values can fall as well as rise, rather than give a steady return. Charges would also apply and reduce any returns.

Petra starts investing $1,000 a year at 25 years old, while Jonathan investments the same amount from the age of 35. By the time they both reach 65, not only does Petra have significantly more money, she also stopped paying in at the age of 55. This is the power that starting investing early versus late can have.

That’s why I’m opting for a get rich slow mentality. That means regularly saving to look after some of my medium-term goals and for my future retirement.

2. Create good financial habits in my twenties

Like Meg Jay, author of The Defining Decade: Why Your Twenties Matter, said: “Feeling better doesn’t come from avoiding adulthood, it comes from investing in adulthood.”

This is something that really rings true with me. Before I turned 25, I avoided my finances like the plague.

I didn’t check my bank statements. I didn’t budget. And I didn’t save as regularly as I would’ve liked. Even checking my bank account made my heart skip a beat.

Now - despite the discomfort - I check in with my finances regularly. I review my monthly spending. I allocate a budget for my day-to-day costs like food, travel and socialising. I ensure I have enough cash for my bills and most importantly I use my hard-earned salary to save for the future.

I also put away a regular sum in an easy-access savings account in case of any emergencies. Before I knew it, these good habits had become second nature to me.

3. Focus my attention on my retirement

I’m glad I regularly contributed to my retirement since I started working, even if that meant less cash in my pocket.

Like most young people, my first experience with superannuation was through my workplace, where I was auto enrolled. Each month, I contributed a small sum, as did my employer.

Even though I’m in a better place with my superannuation contribution than many people of my age, I still try and add a little extra now and then - especially as the superannuation gap is real issue for women.

According to Industry Super Funds, Australia’s gender pay gap has been stuck between 13% and 19% for two decades with women still paid less than men in many industries, despite more modern laws and changing attitudes.

The pay gap translates into a much bigger superannuation gap of around 30% when women retire. This lack of retirement savings is largely the result of smaller pay packets compounded by broken work patterns when women take time out to care for others, especially children. This results, on average, with women currently retiring with $67,000 less than men.

While I don’t know what the future holds, I’m conscious of doing what I can, when I can, to help close this gap. I’ve been known to contribute birthday money and bonuses, as well as one-off contributions occasionally too. I know it all adds up.

Turning 25 has certainly been eye opening in all sorts of ways. Practicing better financial habits makes me feel good. Rest assured, I’m still living my best Instagrammable life. It’s just on a budget.