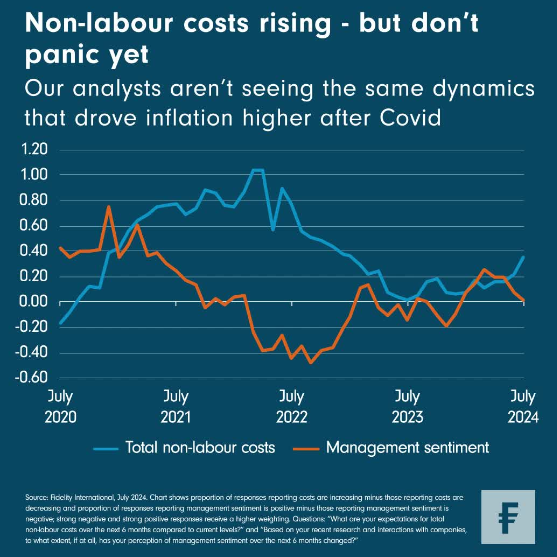

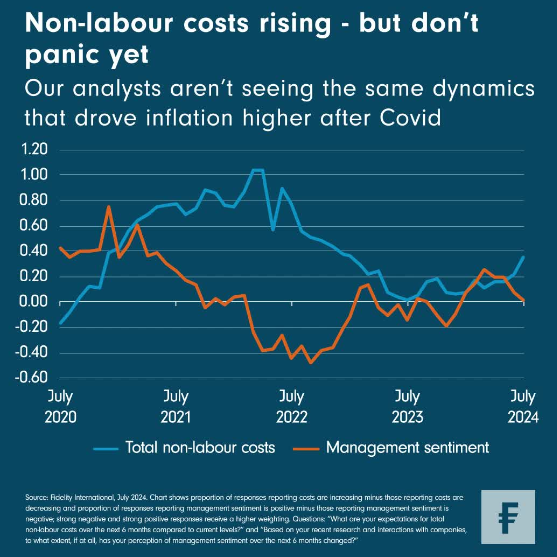

An early warning sign that foreshadowed rises in consumer price inflation post-Covid has resurfaced on our dashboard. But with a radically different economic backdrop, there’s not enough reason to worry just yet.

Our latest Chart Room returns to the knotty topic of non-labour costs, which our monthly Analyst Survey shows are on the rise again. One of the findings in our 2024 annual Analyst Survey was how the non-labour cost indicator could serve as an early warning sign for increases in consumer price inflation.

During the period starting in 2021, when countries started lifting Covid restrictions, our non-labour cost indicator ticked higher, followed with a lag by higher global consumer price inflation.

So, is it time for investors to brace for another round of post-pandemic inflation?

As ever, the analysis that drives the indicator holds more clues than the indicator’s value by itself. A bottom-up view suggests that this time is likely to be different. In the two sectors where non-labour costs have been rising most notably month-on-month - namely information technology and healthcare - there are signs that increases are down to one-off drivers, or pressures that are less likely to be passed on to the rest of the economy.

“In general, pharmaceutical companies will incur inflationary cost increases but can’t necessarily raise their prices at the same rate because of price setting rules,” says Emma Newey Clark, an analyst covering that sub-sector in North America. Restructuring and new launches are also piling on costs, and something similar is unfolding across the pond, says Matthew Cook, who covers European biopharmaceuticals. He cites research and development around LSD as another driver for costs.

Cost increases in tech likewise appear to be episodic, unlike in the months and quarters immediately after Covid. Jonathan Tseng, who covers semiconductors and hardware companies, attributes recent non-labour cost pressures to a big semiconductor supplier catching up in price hikes, having fallen behind lower-tier foundries. “That’s having a ripple effect down the supply chain. Other than that, there haven’t been any big step changes in tech non-labour costs.”

With our management sentiment reading also showing a dip in recent months, investors and policymakers fearing the return of sustained, broad-based price inflation can rest easy for now. But we’ll be keeping a close eye on our non-labour cost indicator, just in case.