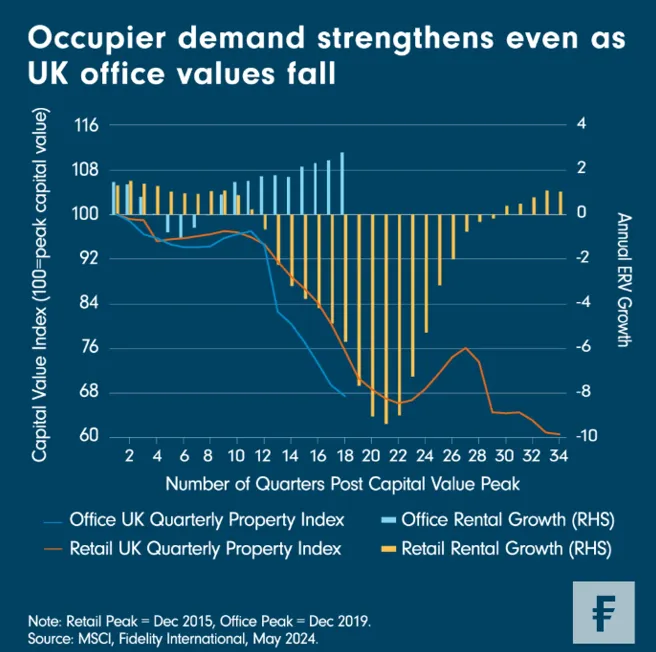

The value of offices in the UK market has been falling steadily since the beginning of 2020, even as rental demand for the most attractive, greenest buildings has been growing. There is now a curious disagreement between the market’s main two metrics that suggests certain assets are undervalued.

It is no surprise that valuations across the UK office market have plummeted since the market peak in 2019. Against a backdrop of headlines highlighting ‘the end of the office’ and the rise in hybrid working, investors are so wary of the sector that deal flows have now fallen to a lower level than in the wake of the Global Financial Crisis in 2009.1

But as this week’s Chart Room shows, the fall in valuations belies continuing demand from office occupiers, with year-on-year rental growth now well into positive territory and gathering pace. And this metric is tracking all of the office market – new and newly renovated assets with strong ESG credentials are able to demand a large green premium on rental prices compared to older and browner buildings.

In this, the UK office market is behaving very differently through the cycle to its retail counterpart. The peak of this sector came in December 2015, and since then it has faced a double dip repricing as the UK high-street was hit first by the rise of ecommerce, then the challenges of the pandemic, and since December 2022 by the rising interest rate environment. Here, rental growth has fallen alongside valuations in a more expected, natural way – at the point of the cycle 18 quarters after the market’s peak, retail assets’ rents had shrunk by 5.7 per cent year-on-year. In the offices sector at the same point rental growth is around 2.8 per cent year on year.

Investors are demonstrating a bearishness towards the entire asset class that does not give credit to the pockets of the office market that are seeing strengthening demand from occupiers.

While there are signs of price stabilisation over recent quarters across UK real estate in general, we cannot rule out the likelihood of some further price corrections to come for offices given investors’ reluctance towards the sector. However, investors cannot continue to ignore the strengthening supply/demand dynamics for the right assets in the right locations forever. This is a market that has not faced the same rate of tenant bankruptcies as retail, and while office vacancy rates are not as low as they were back at the height of the market before the pandemic, there has been a strong recovery in demand from occupiers in many areas of the sector. Investors should note the opportunity gap offered by the dislocation between these two metrics, and the potential for real valuation growth for sustainable UK offices.

Source: 1. MSCI RCA, June 2024