“How’s it going?” is the often the first question I’m asked by my colleagues and clients alike. A question to which there are actually two answers. As an investor in the Fund the most important answer is my instinctive response, which as I type is -“Great!” Performance is 26.7% in USD terms year to date, a whopping 50% annualised, far in excess of what I target for the portfolio. The Aussie dollar year to date figure is more conservative standing at 14.4% due to currency movements.*

However, the question I’m actually being asked is “How’s it going versus the index?” The answer to which depends upon two quite broad parameters: the absolute performance of the 38 stocks held within the fund and the performance of the many hundred stocks held by the index. Whilst I manage the portfolio in a completely benchmark agnostic fashion, I do also pay close attention to what is happening more broadly in financial markets.

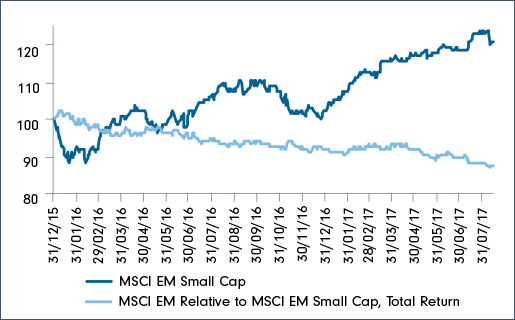

Over the past 18 months equity markets have been characterised by a major decline in what technical analyst’s term ‘market breadth’. In plain English this means that the overall market is being driven higher by a small number of individual stocks, with an increasing divergence in performance between a small number of winners and the broader market. Chart 1 below helps to illustrate this phenomenon.

Chart 1

Source: Thomson Reuters

The dark blue line shows the absolute performance of the MSCI Emerging Markets Small Cap index since 1 January 2016 which has delivered a respectable 23% in USD terms. Yet how does that performance compare alongside the absolute performance of large cap stocks?

Horrendously, is the simple answer. The red line in the chart above shows that over the same timeframe, small caps have underperformed their larger peers by a staggering 13% on a relative returns basis (this is actually ~19% on an absolute excess returns basis). So much for the supposed premium investors are expected to earn for embracing the additional risk of investing in smaller companies. Now one explanation for this could be that small caps are simply coming off of the back of a period of stunning and excessive outperformance versus large caps…

Chart 2

Source: Thomson Reuters

Perhaps, but in the five years ending 31 December 2015, small caps had outperformed large caps by only 8% or 1.5% (on a relative returns basis) per annum, hardly excessive considering the risk factors typically associated with small caps not to mention the additional transaction costs of dealing in less easily tradable stocks. Indeed if we refer to Chart 3, over the full time period from 1 January 2011 until today, small caps have underperformed large caps by 6.3%.

Chart 3

Source: Thomson Reuters

The recent underperformance of small caps is even more startling when you consider that the divergence is the greatest that we have witnessed over the period.

Are we in the era of the new ‘Nifty Fifty’ where we only need concern ourselves with a handful of globally dominant companies and to hell with all the rest? In fact, fifty is being generous - in reality the collapse in breadth has led to a mere handful of names driving markets higher. While there is some fundamental rationale for the performance of these names, I personally believe there are also a number of technical factors which are intensifying the outperformance of these names, not least the impact of benchmarking and the flow of passive money into the Emerging Market (EM) equity space since the beginning of 2016.

EM equities have seen significant inflows over the last 18 months, a significant proportion of which has been allocated to passive investment strategies. Passive flows by definition invest in the index and those stocks which hold the largest weight in the index - take the lion’s share of inflows. As these large cap stocks are bid up by passive inflows, benchmark aware ‘active’ investors often allocate more of their portfolios towards these stocks for fear of underperforming their benchmark. We can therefore quickly find ourselves in a self-fulfilling virtuous or vicious (depending upon which side of the trade you are on!) cycle where large stocks are bid up further due to their size in the index enabling them to attract an ever larger proportion of flows.

Many of these large companies are very good businesses with strong economic moats defending their cash flow. Ultimately however, the current market behavior is leading to an extension of valuation multiples where in some instances stocks at the head of the current rally have re-rated to an eye watering 12-13 times their annual sales revenues despite delivering relatively little or no net cash flow to shareholders. It’s nearly impossible to identify exactly which straw will break a camel’s back, but with these kinds of forward estimates, such businesses will need to deliver revenue growth rates above 20% and show positive operating leverage for a number of years to avoid disappointing shareholders. There is a clear risk that such stocks may face a period of stagnation whilst their earnings grow into the lofty multiples, at worst they may be treated with little respect by the passive investors for whom the only reason to own them in first place was because they were going up. The reverse may well apply should their stock prices start to decline and the passive money exits.

How can we attempt to navigate such an environment? As ever, there are a multitude of strategies which can be employed. Personally I believe that it is advisable to keep ones options open, to only invest in business which you truly understand and in fact be more active in portfolio construction, not less - the very opposite of the markets current herd behaviour.

A recent trip to visit companies in Hungary brought home to me the importance of casting the net wide in search of investment ideas. Hungary along with Central and Eastern Europe (CEE) more generally have received limited attention within the broader Emerging Markets space over the last 10 years. A challenging economic environment in greater Europe coupled with foreign exchange mismatches in the domestic mortgage market have lead many investors to look elsewhere for stock ideas within the emerging market space. Yet over the last 24 months there has been something of an economic renaissance in many CEE countries. The foreign currency mortgage issues have been largely overcome, corporate balance sheets have recovered and sovereign trade accounts have improved. The region’s biggest trading partner, Western Europe, while still facing multiple challenges appears to be tentatively rousing itself from economic slumber. During this time many businesses have cut costs to remain competitive and improve returns and management teams have taken hard strategic decisions to improve the fortunes of their companies.

Owning good businesses and continuing to allocate capital in a prudent manner by focusing on long term factors such as robust corporate governance, solid balance sheets, resilient return profiles and reinvestment opportunities at a valuation which provides a margin of safety will help to insulate investors from the inevitable market drawdowns whilst still participating in the upside.