The transition to net zero and renewable energy sources remains critical to our future, not only to reduce the chance of climate change on a catastrophic scale, but also, as Russia’s war in Ukraine indicates, the need to underpin future energy security. Private, as well as public, capital will need therefore to play an ever-greater role in funding the emerging technologies that will help the world reach carbon neutrality.

Huge potential for private markets to create a step-change

The potential importance of private markets to climate-related investment cannot be overstated. The overwhelming majority of global productive assets - particularly in the Asia-Pacific region - are in private rather than public hands.

Already, the total volume of global private capital has grown to US$8.9 trillion by the end of 2021 from around US$4.08 trillion at the end of 2015, and is projected to grow to around US$17.77 trillion by 2026 according to data from Preqin. But of this, only around 15 per cent is currently managed with the sort of sustainability criteria that have been implemented across public market-focused funds. This leaves plenty of room for a big increase in private market engagement that could represent a step-change in the journey towards net zero.

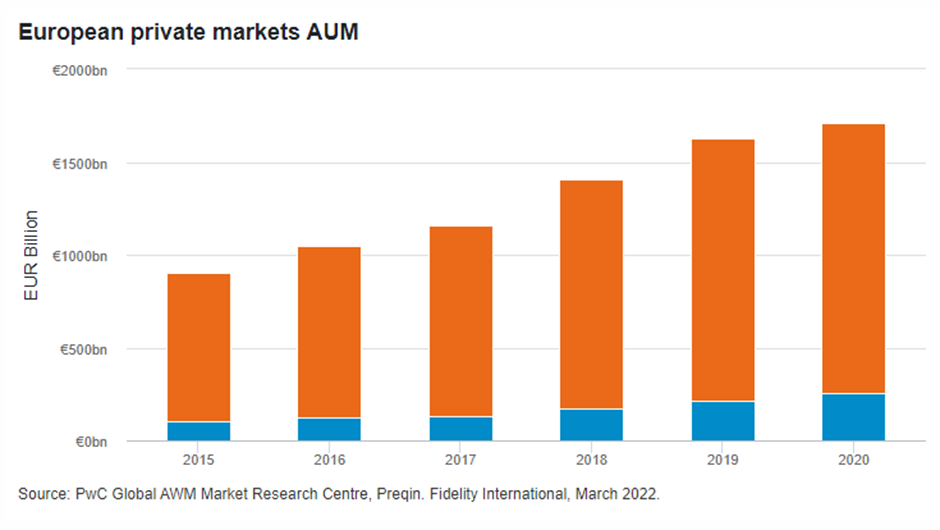

Chart 1: Private markets on the rise in Europe

Real estate is perhaps the sector in which private investors can have the most immediate impact on sustainability. Construction and operation of the built environment account for around 38 per cent of the world’s carbon emissions according to a 2020 report from the United Nations Environment Program. However, private lenders and private equity owners invested in other financial assets can also often exert greater influence over firms than their public counterparts.

For example, while investors in a publicly owned firm may rely on voting and shareholder activism to improve a company’s ESG trajectory, investors in privately backed companies will find their direct ownership or a larger stake in debt holdings can drive change much more quickly and effectively.

Investors and regulators encourage sustainability in private markets

Many private asset investors are now focusing on sustainability, influenced by their institutional buyer-base that is already well-versed in ESG engagement within public markets. Impact funds, in particular, are quantifying the non-financial advantages of sustainable investing, allowing investors to focus on funding assets that can make a measurable positive contribution to the transition.

Given the importance of private markets globally, if investors do not embrace sustainability goals, they may be imposed upon them by policymakers and regulators. Despite concerns that climate policy will temporarily take a backseat in the face of Russian aggression towards Ukraine and the cost-of-living crisis, the impetus to diversify the energy mix for security reasons has ratcheted up.

Fortunately, much of the groundwork for systematic ESG investing has now been laid, meaning private firms don’t need to reinvent the wheel - they can simply borrow public-market templates.

Challenges remain

This is not to say that private markets’ engagement with sustainability doesn’t face challenges. Issuers in the private debt space may be smaller firms than those in the public sphere. They may not have previously focused on ESG and may not have the capacity to run large teams dedicated to improving sustainability. Sustainability data is also more difficult to come by for small-cap or privately-owned firms and is less likely to be standardised or publicly rated.

However, private investors can adapt ESG frameworks used by larger firms to suit privately-owned companies. Asset allocation techniques can also create structural shifts across similar businesses, for example pivoting towards technologies that enable the energy transition or resource efficiency. In the future, emerging standards such as the IFRS green accounting standard and the TCFD framework are likely to be applied to smaller firms, improving data access.

Missing link comes into play

Private markets have the opportunity to close the ESG gap with public ones. Not only can private asset investors take advantage of existing transition projects that require private financing, these smaller-scale firms have also traditionally proven to be adept at creating innovative projects that drive seismic shifts in their industries.

With private market capital available to scale-up any viable innovations at speed, potential climate unicorns will be crucial to achieving global climate goals. Despite recent geopolitical events, projects with strong ESG characteristics are likely to continue attracting capital, as climate and security threats become ever more tangible and the possibility of stranded assets ever more real.