Even the best-laid plans across the global manufacturing industry haven’t kept pace with a swiftly evolving siege of pressures on supply chains.

Companies battling a concussion of supply chain shocks from the pandemic and lockdowns, the war in Ukraine, and surging inflation have thrown the kitchen sink in response.

From Tesla to Texas Instruments to garment maker Shenzhou International, firms are scrambling to regroup. They have halted production and hiring - or kicked them into overdrive. To boost resilience and counter supplier delays and shortages, they have beefed up inventories or spent big on technology upgrades. Some offshored operations; others re-shored, or near-shored. It’s not simply deglobalisation. The range and scale of responses are redrawing supplier networks and behaviour to the extent that ‘re-globalisation’ might be a better term for the shifts we see playing out.

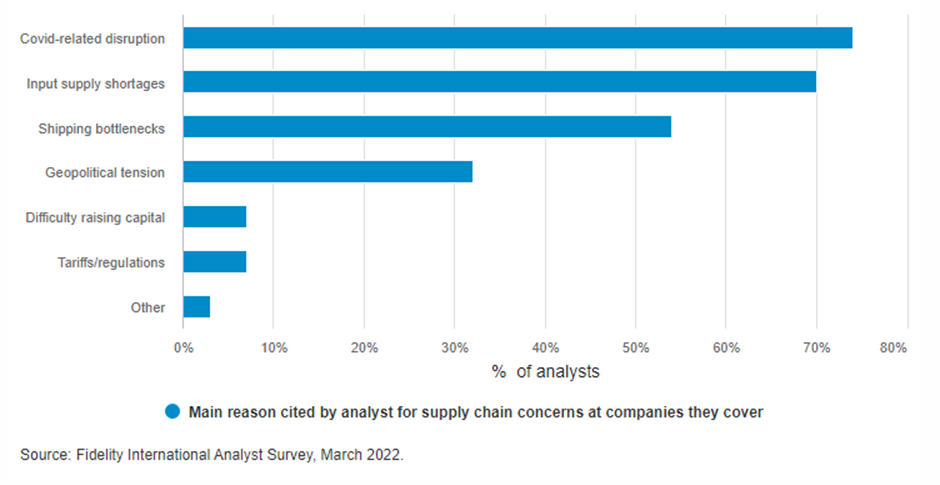

No market has been unaffected by the global dislocations: for instance, even Chinese companies have been reshaping supply chains to be less reliant on manufacturing in the mainland. In a survey in early March, 74% of Fidelity International analysts cited the pandemic and 70% cited input shortages as the major causes of supply chain disruptions at their companies. The escalation of Ukraine hostilities since then has only added to supply chain challenges globally.

Chart 1: Covid and input shortages lead supply chain woes

Which way forward?

Not for the first time, pundits are saying the current challenges mark the death of globalisation. We think this misses the mark. Based on what Fidelity’s global network of analysts are seeing on the ground - especially around the manufacturing hubs of Asia - globalisation is very much alive and well, if in a state of rapid change. While the near-term fallout is evident, we see companies emerging from the current crunch with revamped better-diversified supplier networks that, in the long run, will only make them more resilient to external shocks. This, in effect, is what we mean by re-globalising.

Here, we take a regional look at how companies in three key industries in Asia are evolving their supply chains: garment production, shipping, and semiconductor manufacturing.

Apparel and diversification

Shenzhou International Group, which makes clothing for Nike, Uniqlo, and Lululemon, in recent years diversified its client base and added plants abroad to shield its supply chain from a tumultuous global economy.

But that didn’t help the knitwear giant, which in March posted its worst year on record, including its first earnings decline since listing in 2005. Like many other China-based manufacturers had over the last decade, Shenzhou sought to diversify risk by moving some operations offshore. But as Covid continues to outflank state policies aimed at its eradication, companies are finding that the pandemic pays short shrift to geography.

Starting in April last year, Shenzhou’s plants in Cambodia and Vietnam were hit successively by Covid, halting work and deliveries. The company moved some operations to its Ningbo base in eastern China, where operating costs are higher, then got hit as the pandemic returned to the mainland and disrupted Shenzhou’s hiring. When work finally fully resumed at its Southeast Asia plants in the fourth quarter, cotton prices had risen some 40%, hitting Shenzhou’s input costs even harder as the company had to catch up in the fourth quarter on third-quarter orders already agreed upon.

Other garment companies buffeted by similar shocks despite offshoring include Hong Kong-based Cirtek, which has plants in Bangladesh and Vietnam. Cirtek has been hit by supply shocks from Covid to the Sino-US trade war and Brexit. In China, fabric makers from Hebei to Guangdong spent most of the first quarter in shutdown as demand shrivelled. Many among them, along with Chinese units of auto makers Hyundai Motor, tech giant Samsung, and hydropower engineer Power Construction Corp. of China, had expanded in recent years to neighbouring Southeast Asia and beyond for cheaper labour, sometimes looser regulation, and what they thought would be a stronger supply chain. Now, the fallout from pandemic disruptions is likely to trigger a retooling of these networks across a wide range of industries.

Shipping and logistics bottlenecks

Margin pressures in a globalised world used to call for a “just in time” outlook that kept inventories as slim as possible. The pandemic now is forcing operations to stock up on “just in case” orders. But inventories too are bulging due to a simple logistical issue: it’s been tough to find shipping vessels.

Three key chokepoints are setting up bottlenecks worldwide. US ports, especially on its West Coast, are congested due to legacy infrastructure and labour shortages. The Chinese seaboard is battling Covid. The Ukraine conflict is roiling the Mediterranean and Black Sea.

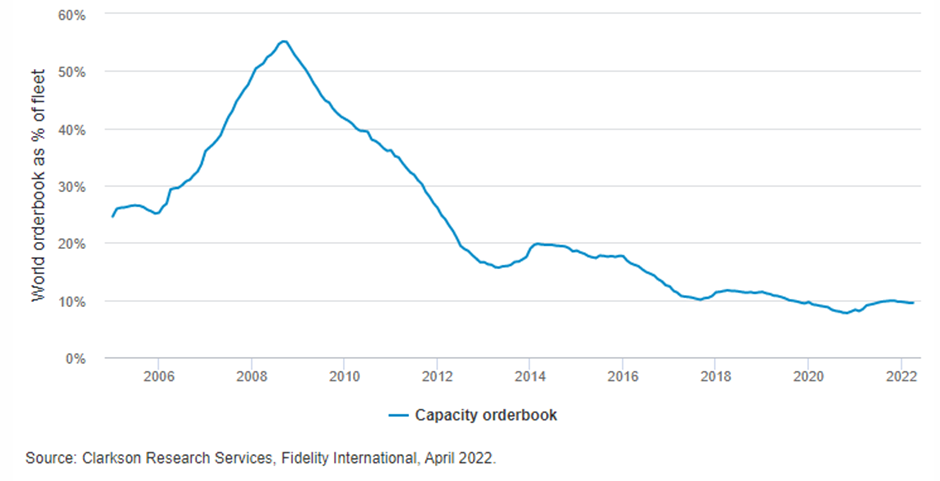

Container rates soared in the last two years as global consumer demand shifted from services to goods, driven by more people working at home. Supply of vessels couldn’t catch up, driving exceptionally high profits that continue to hang over the container industry. Even as shippers fell short of containers, ageing ports in the West were struggling with underinvestment in processing capacity. Covid restrictions in the last two years caused port operators to fall behind on capex commitment. Major ports such as Los Angeles and Long Beach haven’t upgraded their capacity sufficiently to keep up with demand surges. And container ships have become ever bigger; a case in point is the Ever Given, the 400-metre long leviathan that temporarily blocked the Suez Canal when it ran aground there last year.

Chart 2: New shipping capacity has fallen sharply relative to global fleet size

In Asia, China hasn’t been able to beat the coronavirus. That has snarled cargo clearance onto the mainland. Recent lockdowns in Shanghai have cut off supply chains for Apple and many other companies. Some shifted export operations to the mainland from bases such as Hong Kong earlier this year - when the former British colony struggled with its fifth Covid wave - but are now grappling with the mainland outbreak. As Covid and ensuing lockdowns spread to other major Chinese cities such as Zhengzhou and Xi’an, China’s central bank in April called for lending assistance to logistics firms to rescue battered supply chains.

Companies are not taking any chances with inventory levels. Analysts in our survey in March said only about 10% of the companies they cover reduced inventory in the preceding 12 months. Among the sectors most actively increasing inventory levels are materials, industrials, and information technology.

Auto inventories are an example of how managers failed to anticipate the inelasticity of key parts of their supply chains. When broad demand ground to a halt in early 2020 due to the pandemic, automakers cancelled chip orders. Cars use a lot of bulk semiconductors, which are lower-margin products for chip makers. When macro demand recovered months later, the auto industry found that chip makers had already redeployed to higher-end products and no longer were able to supply the lower-tech chips.

Now, in an attempt to upgrade their supply chains, manufacturers that used to rely on lower-tech eight-inch wafers - for which output capacity hasn’t increased in the last five years - are scrambling to pay chip makers a one-off fee of about US$2 million to migrate production of their chips to higher-cost 12-inch foundries.

Going local: chip makers

In response, Chinese chip makers have been trying to “localise” to get around global bottlenecks. Companies including Silergy Corp. and SG Micro Corp. have accelerated the trend in the last two years, trying to outflank rising geopolitical tensions between the US and China.

To create their own version of Taiwan Semiconductor Manufacturing Co., the world-class chip foundry known as TSMC, Chinese companies have tried everything from poaching engineers from TSMC and rival Samsung Semiconductor, to offering perks that mimic the culture of the foreign talent they hope to hire. So far these tactics generally haven’t significantly raised these companies’ relative competitiveness, analysts say, but the localisation push continues - and not just in China. US tech firms like Texas Instruments also are starting to turn to a similar model, producing more of their own chips in part to re-shore their supply chains.

Takeaways for investors

The success of these efforts depends on long-delayed upgrades to global infrastructure. In US ports, efforts are underway to expand container processing capacity, though in some cases this could take another three to five years and would depend on freight prices staying relatively high.

As China’s macroeconomic challenges multiply and inflation rises across the world, companies already grappling with supply chain shocks face an increasingly fraught capital-raising environment. Yet funding needs have become ever more compelling for companies to maintain a solid balance sheet amid turnover drag. Take Asian airlines, a sector that rarely comes to the market to issue. Some are now doing so - Singapore Airlines, among the better-capitalised of global carriers and unrated given its easy access to funding, has come twice to the market since the pandemic began.

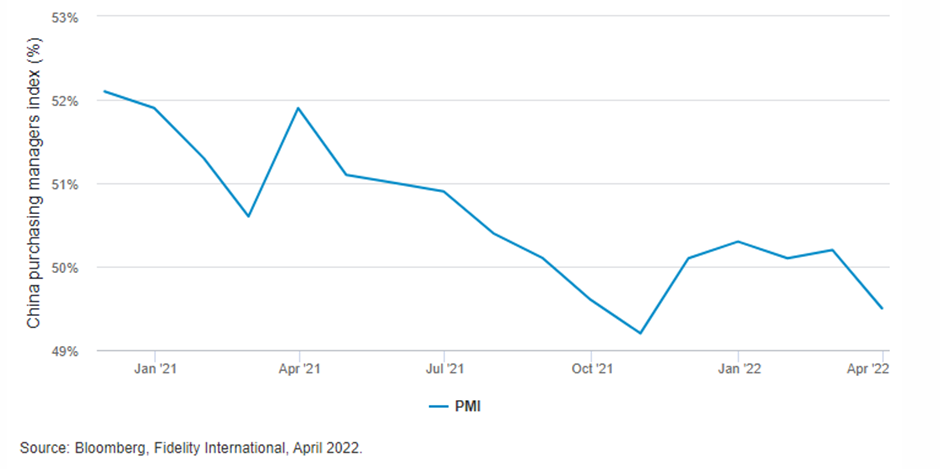

Chart 3: China purchasing managers index slips into recessionary conditions

On the demand side, investors are getting more selective. Companies in sectors such as engineering and agricultural sectors that should have been top picks given their ratings or scarcity value have failed to gain traction in some cases due to rising market sensitivity towards factors such as issuance size, valuations, and environmental and governance concerns.

For all of Covid’s ability to transcend borders, geographic diversification still is a trump card for businesses. All food and beverage companies are under pressure due to the lockdowns in China, but those with a broader footprint including a range of global locations, such as hotpot chain Haidilao Holding International, can eke out the most advantage over Asia’s uneven management of the pandemic.

In the longer term, new models of global supply chains are springing up around a reconfigured semiconductor industry. Just as the emergence some three decades ago of TSMC as a pure-play champion shook up the then-existing model of tech companies owning their foundries, the latest supply shocks are again redrawing the modern tech supply structure. Companies making products that run on the rising connectivity of tech devices, such as Tesla and consumer tech giant Midea Group, are using their clout to hire ever more engineers with domain knowledge and ties to TSMC, leveraging on the Taiwanese giant’s longstanding culture of close collaboration with clients, to increasingly produce their own chips.

It’s clear that for many best-in-class producers, the supply shocks haven’t meant the end of globalisation - but rather a doubling-down on its next iteration as supply lines are redrawn.