The process of decarbonising whole business sectors is not linear. But what Fidelity’s research teams are observing time and again is there is one dominant driver now needed to push fundamental sectoral change: government policy.

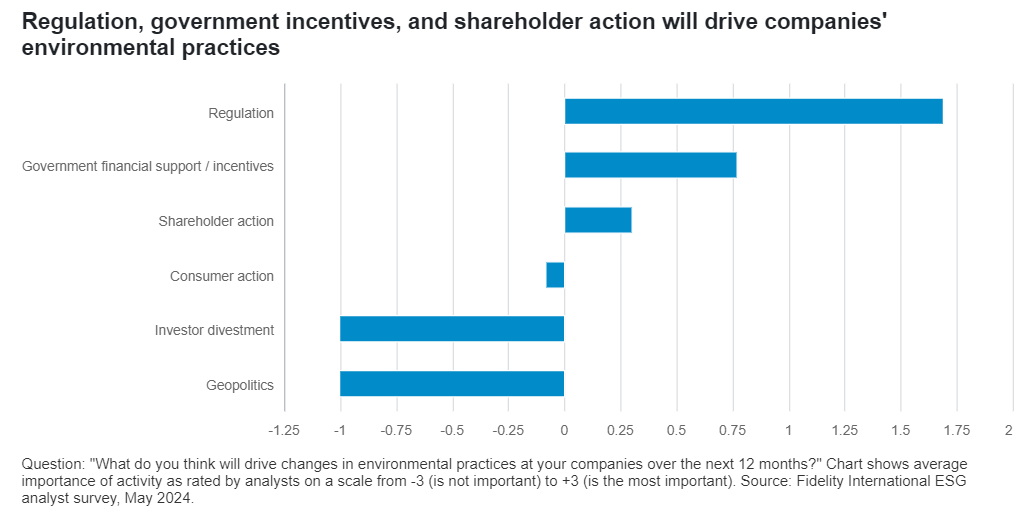

In our annual ESG survey earlier this year, 81 per cent and 63 per cent of our analysts respectively identified regulation and government support as one of the three most important tools to improve companies’ environmental practices.

But while broader policies such as the EU’s Sustainable Finance Disclosure Regulation (SFDR) and the Inflation Reduction Act (IRA) in the US have already had positive effects, regulatory support is not coming through quickly enough, particularly in the sectors where there are greater challenges to reaching net zero. Of the Fidelity analysts surveyed again in August, half of those covering hard-to-abate industries such as materials said not enough is being done by policymakers.

Now the research teams are calling for more specific regulatory changes. An equity analyst focused on Australian mining notes that a consistent approach is needed across subsidies and tariffs, while a fixed income analyst covering the European airlines industry calls for regulators to “subsidise or finance investment in sustainable aviation fuels (SAF) production”.

Alongside these requests for change within individual industries, our analysts are also keen to see stable policy frameworks that provide long-term visibility to help drive investment. The 2024 calendar is full of elections and potential policy changes, so we could see some shifts in approach before the end of the year. But stable, supportive regulation must underpin any changes in administration, with long-term developmental strategies such as investment in infrastructure and training for future skills.

More carrots, fewer sticks?

Policymakers have the option to use either the carrot (incentives through financial support, as demonstrated by the IRA) or the stick (such as the regulation in practice in Europe). Some analysts have noted that as we move closer to the target dates laid out under the 2016 Paris Agreement, it’s important that any sticks being wielded act as a true deterrent and are properly enforced.

“The difficulty is that at the moment regulators may struggle with enforcement,” says one fixed income analyst in Europe. “Companies just have to calculate and report on their own energy efficiency, and only after some years are remedial actions required for the most polluting offenders. By that time, we are already in the 2027 framework and it’s not clear what powers there will be to force firms to comply with targets.”

On a more positive note, analysts do report that incentivising regulations are already having an impact. A fixed income analyst focusing on consumer discretionary names in North America points out that policymakers are making a difference with basic self-help energy saving investments. And in the UK, the Future Homes Standard, which aims to decarbonise new-build properties by improving heating and hot water systems and reducing heat waste, is already stimulating activity for manufacturers of ventilation and heat pump systems.

Pay up

As a society, we’ve become very good at doing things in the cheapest way possible, but the energy transition is going to require more expensive solutions in many industries, and a lot of the decarbonised technologies we’re hoping to see in wider use are more commodity intensive. An electric vehicle uses six times more minerals than a combustion engine, while the build out of onshore wind turbines will increase the need for copper, manganese, chromium, nickel, molybdenum, and rare earths.1

The rising demand for these materials will drive scarcity, which will lead to higher prices and bottlenecks. Ultimately, it presents us with a question: are we as a society willing to pay the price of abatement?

Certainly, it seems that consumer preferences are shifting with the desire to see change. Customers are more sensitive to the environmental and human impact of the goods and services they procure. As consumers become more scrupulous about what they buy, how their products are made, and what energy is used in their home, this should force policymakers’ hand to regulate for real change.

We are still far off the target laid out in the 2016 Paris Agreement to limit warming to a 1.5 degree rise. Current expectations suggest that we’re on a trajectory for an increase of up to 2.9 degrees.2 For companies from all industries and across all regions, policymakers must step up to accelerate the process.

1 Overall mineral demand from wind in the base case by scenario, 2020-2040, IEA

2 Nations must go further than current Paris pledges or face global warming of 2.5-2.9 degrees, United Nationals Environment Programme