AI: A multi-faceted story

In June, we completed our 11th Silicon Valley bus tour, where 11 Fidelity analysts and portfolio managers spent 5 days on the road, meeting 25 companies and organisations. There is no substitute for being on the ground meeting companies in their natural habitat, where we can observe operations first hand, engage with executives in their environment and experience the culture of organisations directly. It is an opportunity for Fidelity analysts and portfolio managers to be immersed in an industry, sharing notes, comparing companies, and robustly challenging the assumptions and opinions we each have.

It will be no surprise that artificial intelligence (AI) continues to dominate the Silicon Valley discourse. The feeling in Silicon Valley remains buoyant on AI, with companies investing heavily in the technology and working off optimistic projections. However, what struck me was the nuance and variety of approaches in AI that means both the uncritical proponents and gloomy naysayers on the technology seem to miss the finer details of the story. AI is a multi-faceted industry with a range of opportunities, requiring a discernible approach to investing in the technology.

Hardware in high demand, for now

AI hardware is in demand. The hardware provides the power for AI computation and any organisation that wants to use AI technology will have to invest in hardware such as processors, memory and storage, interconnects, and datacentres. Graphics processing unit (GPU)s dominate hardware sales given it is a critical technology building block in the AI datacentre.

With hardware in demand, software is facing some crowding out, but this is likely to be a temporary issue; while GPUs provide the compute power, AI users still need the rest of the information technology (IT) ecosystem to optimise AI solutions. That means we should expect more balanced spending between hardware and software as the wider IT infrastructure comes back into focus. In addition, even with hardware spending we may see more variety over time; currently GPU spending dwarfs everything else, but this could change as alternative technologies are developed.

There may also be a sense of ‘fear of missing out’ (FOMO) in the AI race, driving hardware investment. Companies don’t want to be left behind peers in leveraging AI, but that is unlikely to sustain investment unless businesses are able to monetise AI. Indeed, much of the demand for AI hardware has come from startups backed by venture capital firms. Many of these startups are unprofitable and if that remains the case, VC financing will slow, which will knock on to hardware demand.

Industry integration varies

There are some industries that have been able to purchase AI hardware and quickly find ways to integrate the solutions, adding tangible value to their operations. These companies are typically media-based with creative tasks central to their business models, for example content generation in music, video and gaming. There are also certain job functions that are readily able to exploit AI technology such as coding.

For other industries, the pathway to AI monetisation is less clear. Enterprise businesses such as financial services, healthcare, multi-nationals, conglomerates, and governments are large, operationally diverse organisations that are the biggest spenders on IT. Enterprise AI hasn’t made that much progress since last year’s trip. There is lot of testing and trialling taking place, but no material breakthroughs in finding a solid business case for AI use. Enterprise customers are still searching for ways to incorporate AI and it’s uncertain how long this ‘discovery’ phase will take.

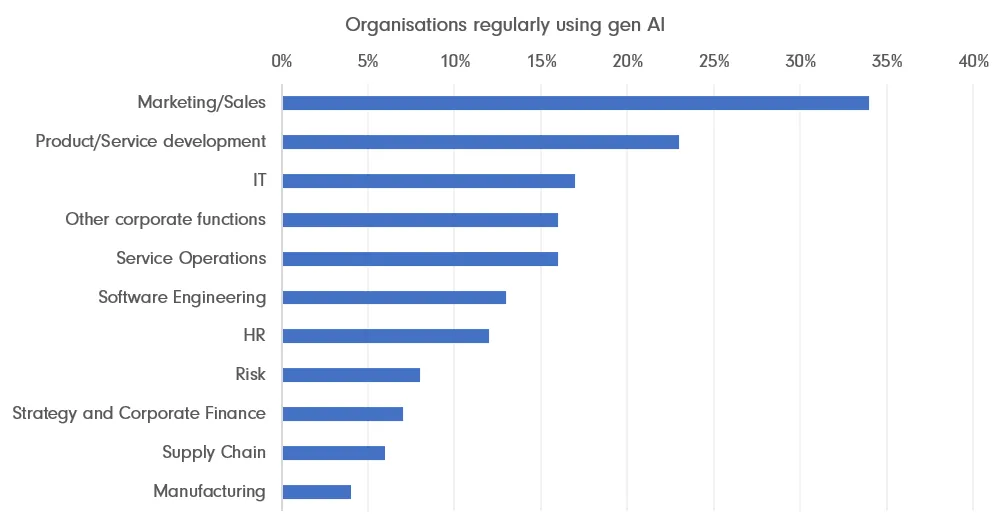

Wide dispersion in types of organisations using generative AI

Source: McKinsey, March 2024. Note: 1,363 survey participants.

That said, AI is making a difference in small ways, for example in coding. But AI technology is still not mature and the results from it are inconsistent. While this is not a problem for creative industries, it is a major obstacle for areas where accuracy is vital such as in healthcare, financials, some industrial companies, and government departments.

Some of these sectors are also highly regulated, which means the reliability of AI solutions must reach very high standards to meet requirements and convince regulators. If there are slight errors in results the consequences may be significant, and these companies could find themselves liable for regulatory action and face significant reputational risks. For these reasons, enterprise customers have been slower to adopt AI technologies.

Investing in AI

The market is currently fixated on immediate AI beneficiaries where directly related earnings are showing up in the financial statements. These companies, predominantly in the hardware and semiconductor space, have seen their share prices bid up. However, for the companies to maintain their earnings growth, their customers are going to have to commercialise AI, which could prove tricky in the short to medium term. It may be better for investors to look for companies where AI-related earnings are not yet manifesting in accounts but have the potential to do so over the longer term.

Data infrastructure and IT consulting companies sit at an important but underappreciated point in the AI value chain. Businesses must address data constraints in order to best utilise AI, which requires data solutions and domain expertise. Data experts can help these companies navigate these challenges including the evolving regulatory and legal landscape of AI. I’ve seen a lot of companies engage with data experts and this should gradually show up in company results.

In hardware, there are some manufacturers that provide ubiquitous components in AI systems, so are not dependent on particular AI technologies or providers. For example, TSMC’s semiconductor manufacturing business should benefit regardless of which AI silicon outperforms (GPU, central processing unit (CPU), or custom silicon), or which customers emerge as winners (Nvidia, AMD or hyperscale cloud companies).

Cloud service providers should benefit from AI penetration but are not completely reliant on it for growth. For example, Amazon’s cloud computing business will be a winner from companies adopting AI and having greater cloud computing needs. However, even in the absence of AI, cloud users must still modernise their IT stacks and increasingly use cloud services.

AI winners yet to emerge

AI is a multi-year, multi-speed story, where the winners will gradually emerge over time, in different parts of the economy. Companies are competing to determine how they can best exploit AI and there is consequently high demand for GPUs for example, to support this ‘discovery’ phase; however, tangible benefits have been generally elusive so far. Over time, different industries and companies will vary in their adoption and success of using AI. As a result, we should try to understand the impact, application, and commercialisation of AI on a case-by-case basis.

The race to monetise AI has meant that corporate budgets allocated to the innovation are crowding out broader IT spending. Again, over time, this is likely to change, and IT spending should become more balanced. We can be confident that overall technology spending will trend higher over time given that technology brings efficiencies, which are crucial for companies to compete.

Digitisation and automation are technological developments that are ongoing and being deployed by companies in a variety of ways. We can view AI in a similar light, where it is the latest efficiency introduced by technology but remains part of the evolution of technology.