The US GENIUS Act, which passed the Senate in June, created a federal regulatory framework for stablecoins, a type of cryptocurrency token pegged to the value of another asset, typically fiat currencies. Some investors are betting that the bill will help popularise stablecoins and win market share from more traditional solutions. For example, shares in Visa dipped on the news, losing nearly 10% or US$ 70 billion in the days around the announcement. However, I wouldn’t bet against the big payment incumbents. They have the scale, trust and ability to innovate that may help them rise to the challenge.

The stablecoin wave

As a global equity portfolio manager, I scour the investment universe looking for businesses that fit my criteria: strong and sustainable industry positioning, growth opportunities, high return potential, excellent management, and compelling valuations, enabling these companies to compound over years. Global payment incumbents, Visa and Mastercard, fulfil these criteria. However, there is an upcoming rival that’s threatening to eat their lunch – stablecoins.

The US Senate passed the GENIUS Act in June, which aims to regulate payment stablecoins, a type of cryptocurrency pegged to a stable asset like the US dollar. This is expected to bring regulatory clarity to the sector, paving the way for broader adoption. But it’s got some investors worried that stablecoins will start eroding the market share of traditional payment providers such as Visa and Mastercard.

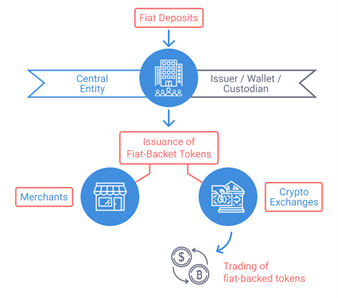

Stablecoins are digital assets able to maintain a stable value against a reference asset (usually US dollars). A company issues a stablecoin, and for each unit holds the equivalent value in currency. The stablecoin is then issued to the public through a ledger, which records transactions and the transfer of ownership. The owner can exchange their stablecoins for money in their existing bank account. Another company provides a digital wallet that can be used on a smartphone to store, send and receive coins.

Stablecoin issuance process

Source: EXMO Exchange, 2025. For illustration purposes only.

The payment infrastructure around stablecoins is still nascent, but proponents claim they can offer a cheaper and faster alternative, with lower transaction fees and around-the-clock settlement, especially useful for cross-border payments and in the countries with underdeveloped banking systems. Behemoths like Amazon and Walmart are exploring stablecoins (although it’s unclear if there is any disintermediation of providers like Visa and Mastercard). However, there are also potential drawbacks of stablecoins.

Drawbacks of stablecoins

Firstly, payment systems only work optimally when there is widespread usage. People do not tend to carry multiple methods of payment simultaneously and prefer to opt for the most accepted medium. While stablecoin use is growing, it has only niche usage in today’s payment systems for goods and services. Related to this point is the lack of last mile infrastructure - it’s difficult for users to buy stablecoins and move them in/out of their bank accounts. The cost of this can be high and banks seem unwilling to integrate many of these services. Until the infrastructure is built out further, this will likely be a drag on widespread adoption.

Secondly, security, whether real or perceived, makes a significant difference to consumers. Some say that centralised, as opposed to decentralised, stablecoins are less vulnerable to smart contract exploits and other security breaches because your identity is traceable, although the evidence on this is not yet clear. A more pressing challenge on consumer protections is dispute resolution and chargeback protections with clear rule setting/mediation. These systems are difficult and costly to build, and consumers also expect them. Banks often absorb these risks but it’s not clear which party would do that within the stablecoin infrastructure.

Finally, while the GENIUS Act made progress on the regulatory framework for stablecoins, there is still some way to go. For example, there are numerous different regulatory authorities stablecoin issuers can apply to, creating a messy and potentially gameable system. At the same time, certain regulations like capital requirements will be made jointly by regulators, slowing down the rulemaking process. These gaps will have to be plugged for stablecoins to work smoothly and be more widely adopted.

In summary, stablecoins suffer from a lack of acceptance and underdeveloped last mile infrastructure, weak consumer protections and an immature regulatory framework.

Visa and Mastercard leadership

Visa and Mastercard command significant market share in payment processing, with Visa holding approximately 50% and Mastercard 25% of global card transaction volume. In local markets there are regional challengers like India’s UPI (Unified Payments Interface) and China’s Alipay.

The argument against Visa and Mastercard is that they will no longer be necessary if alternative payment methods are created. Why would companies pay them billions of dollars in transaction fees if they can create their own payment system through stablecoins? But Visa and Mastercard do provide services in exchange for the fee they charge.

Visa and Mastercard offer robust, tested and trusted protection for consumers. The payment systems have a famous zero liability policy, where if you do not personally authorise payment you have no liability, for example if your card is cloned or stolen, or you are scammed. With stablecoins payment is irreversible. Stablecoins do not have the same anti-money laundering rules or consumer protection that Visa and Mastercard do. As a result, they do not have the trust that the incumbent payment systems have built up over decades.

This trust contributes to the formidable competitive moat that Visa and Mastercard have developed. The trust in the system led to widespread adoption, creating network effects comprising of millions of merchants and billions of cardholders in a self-reinforcing ecosystem. And when banks and merchants are embedded in the system, they face high costs to shift to alternative networks, acting as a further barrier to entry for competitors. For card users, rewards programmes, cashback and other perks encourage loyalty.

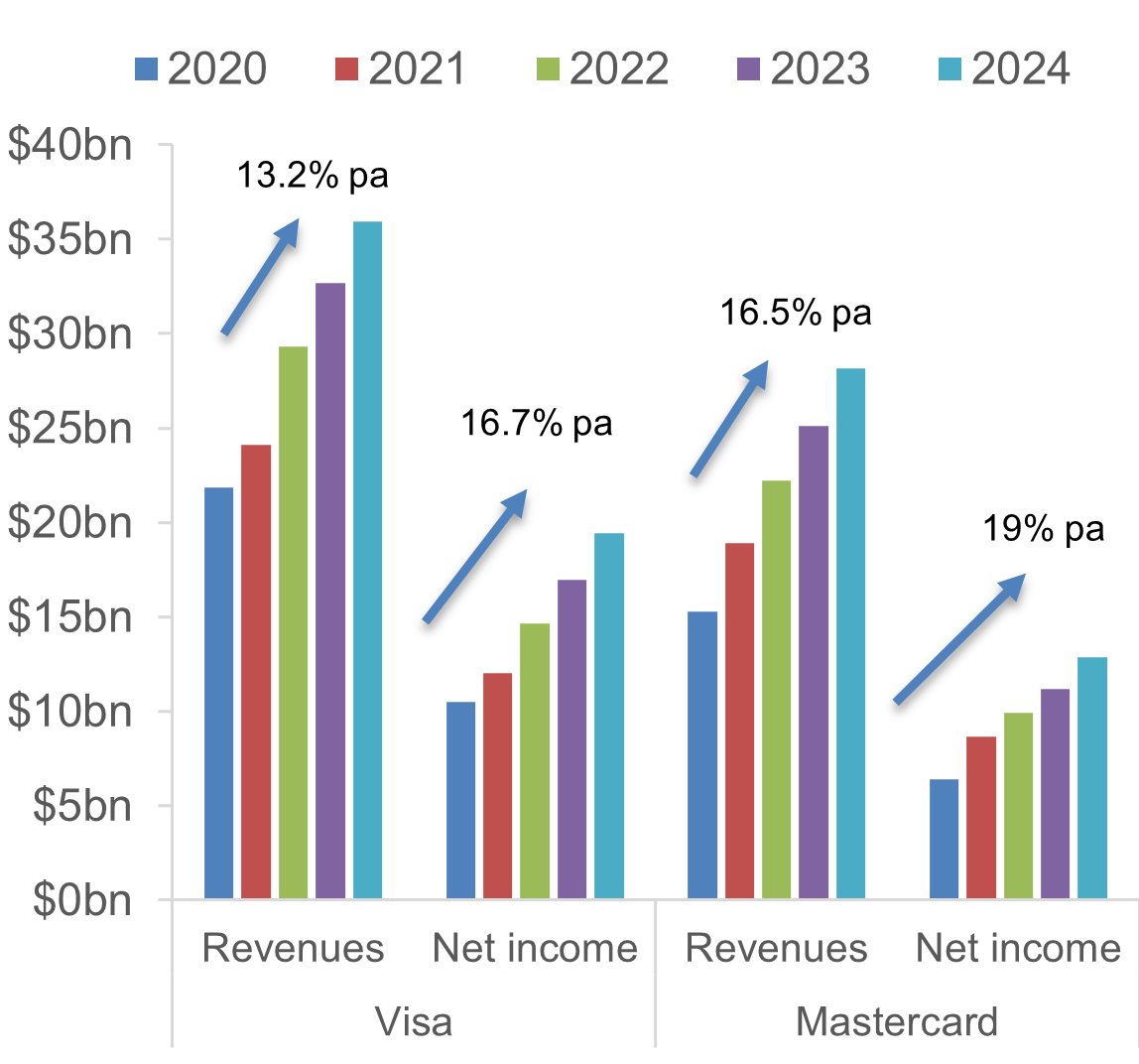

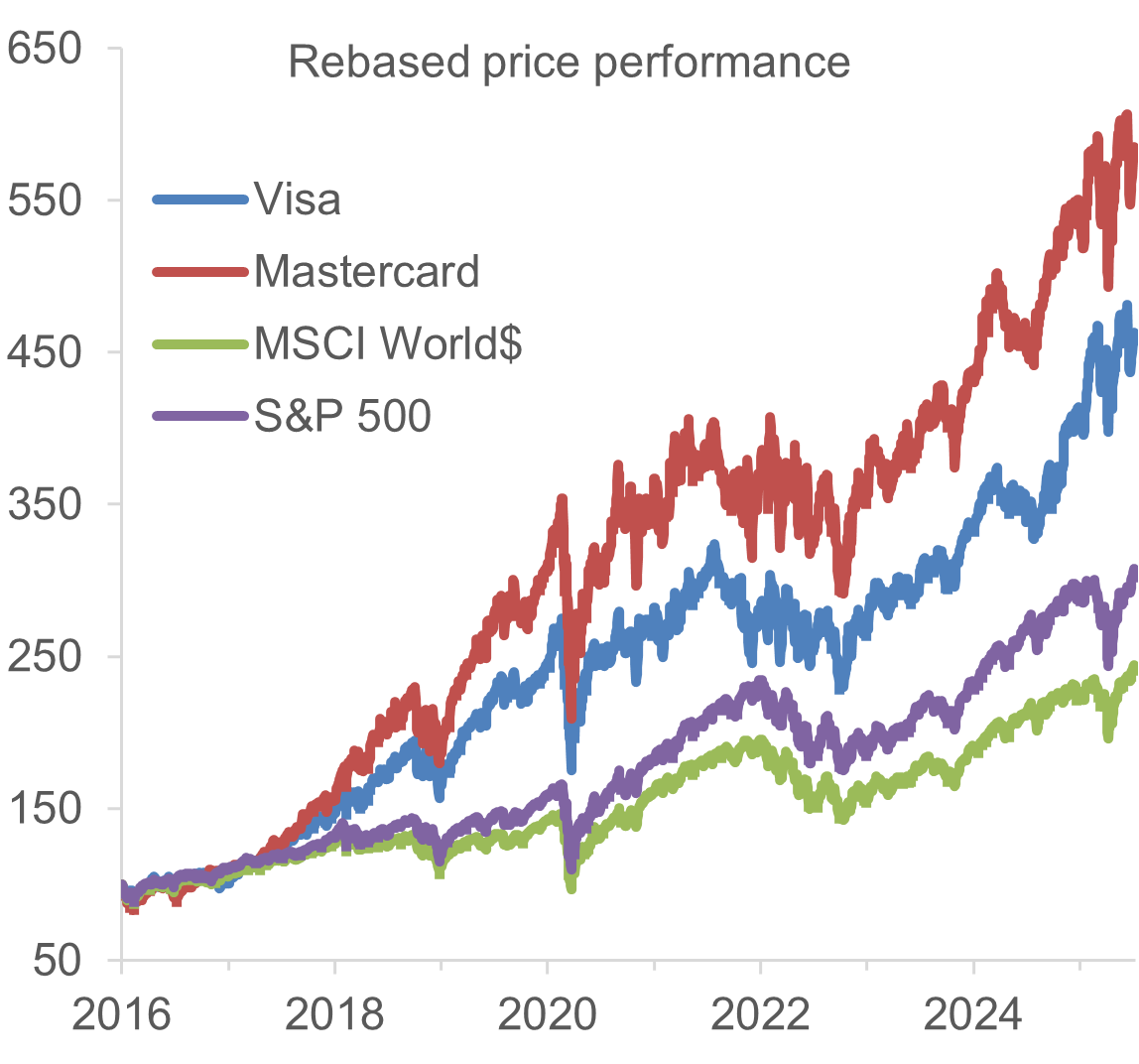

This commanding position in the industry has helped Visa and Mastercard grow their revenues and earnings at a double-digit compound annual growth rate over the past five years, generate net income margins of around 50% and hold little net debt on their balance sheets given their size. Both companies have nearly doubled their share prices over the period.

|

Double-digit compound growth in sales and income |

Strong outperformance of indices |

|

|

|

|

Source: LESG Workspace, July 2025. |

|

Why Visa and Mastercard can continue to dominate

I think these companies can continue to outperform even with the threat of stablecoins. While Visa and Mastercard’s competitive positioning protects them from rivals, they also have growth opportunities.

Visa, for example, has been investing and operating in digital assets for several years. It facilitates crypto transactions and is expanding applications for stablecoins with stablecoin-linked cards, settlement and programmable money. It’s teamed up with stablecoin infrastructure startup Bridge, which is owned by payments platform Stripe, to develop a new card product that allows fintech programmers to offer stablecoin-linked Visa cards through a single API integration. This will enable consumers to use the Visa ecosystem to pay in stablecoins and be protected.

Visa is also developing its Tokenised Asset Platform (VTAP), which supports banks in creating and managing their stablecoins. VTAP operates as an intermediary between banks and the blockchain in a complex process that few payment providers can replicate.

A key market for payment systems is capturing share in emerging markets, where there is a lack of banking infrastructure. The world is moving towards a cashless economy, posing a problem for emerging markets that do not have the platforms required. While stablecoins could potentially fill the gap, companies such as Visa may be even better placed to benefit if they partner with stablecoins to facilitate the growth in transactions.

Visa and Mastercard likely to shape future payments landscape

The GENIUS Act has opened the door for stablecoins to become a potential competitor for payment incumbents like Visa and Mastercard. However, while stablecoin transaction volumes reached a staggering US$26.1 trillion in 2024, 88% of this came from trading on the cryptocurrency market. Stablecoins are not yet widely used for everyday payments, and it will be some time before they are.

There are some important obstacles that stablecoins will need to address before they are considered a viable alternate for the mass consumer, such as security issues, a lack of widespread acceptance and an inefficient regulatory system.

While stablecoins are not an immediate risk to companies like Visa and Mastercard, they could pose a threat in the longer term. However, Visa and Mastercard are not static; their proactive engagement, strategic partnerships, and investments in integrating stablecoins into their existing networks demonstrate a strategy of adaptation and absorption. By positioning themselves as trusted bridges between traditional finance and new digital assets, they can extend their competitive moats. Their focus on modernising cross-border payments and enabling programmable money through stablecoins indicates a drive to capture new value streams and enhance their relevance in an evolving ecosystem.

Visa and Mastercard, as the architects of the modern digital economy, demonstrate robust business quality, characterised by asset-light models, high margins, and a powerful network effect. Their financial performance underscores their strength and ability to execute.

Ultimately, the future of payments will likely involve a hybrid landscape where traditional networks, digital wallets, and stablecoins coexist and increasingly interoperate. While stablecoins may reshape certain segments, particularly in B2B and cross-border transactions, the established advantages of Visa and Mastercard - scale, brand trust, deep financial institution partnerships, and regulatory expertise - provide resilience.

The payments industry is a compelling long-term investment with secular growth drivers and the strategic adaptability of its leading players. The impact of stablecoins will be a gradual evolution rather than a sudden revolution, requiring ongoing monitoring of technological advancements, regulatory developments, and shifts in consumer and merchant behaviour. That’s why I think the recent stock price sell offs on the news of the GENIUS Act were a knee-jerk reaction. Both companies have characteristics that I look for and I believe these quality businesses can compound gains over the coming years.