Japanese companies generally have lower sustainability scores than their European counterparts. From our analysis and engagement with companies, we believe this is not due to any fundamental differences in strategy, but more to do with cultural reasons around disclosure practices and language. As Japanese companies improve disclosure, ESG ratings should catch up and the market should adjust valuations accordingly. For investors, this creates an opportunity to benefit from the correction. Chemicals maker, NOF Corp, is a good example of how engaging with companies to improve disclosure can lead to rewards for investors.

The Japanese ESG discount

As investors become more aware of the benefits of sustainability, they are paying more attention to corporate ESG ratings. Third-party ESG ratings provide an independent assessment of a company’s sustainability profile that can help investors decide which companies to allocate to. However, there are gaps in the framework that investors can exploit. One of these is the relatively lower sustainability ratings in Japan, which is setting up an arbitrage opportunity.

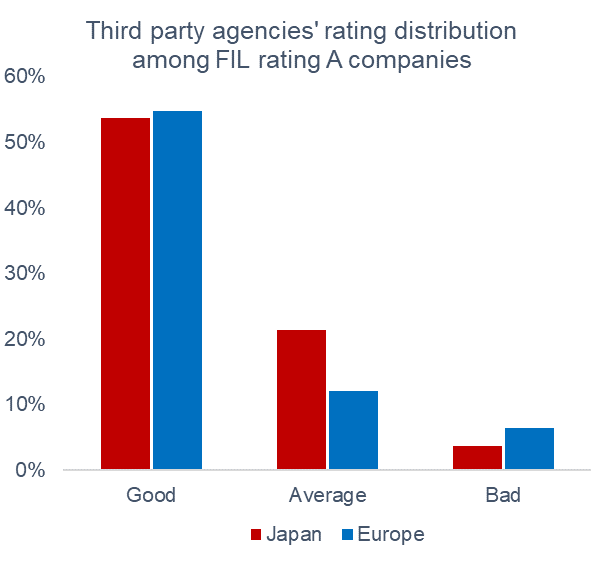

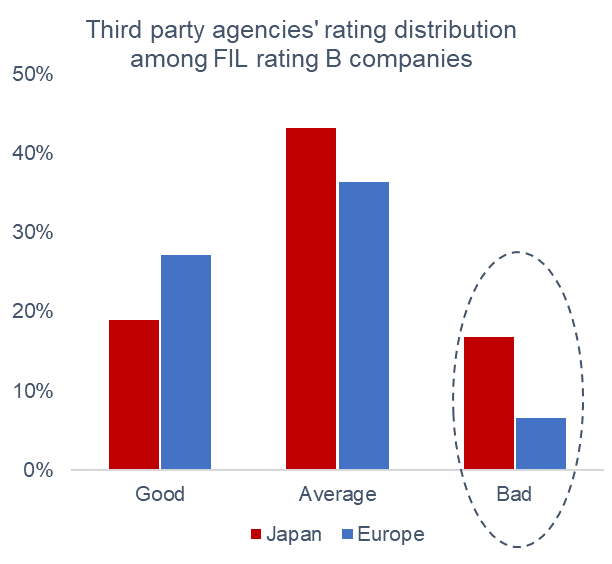

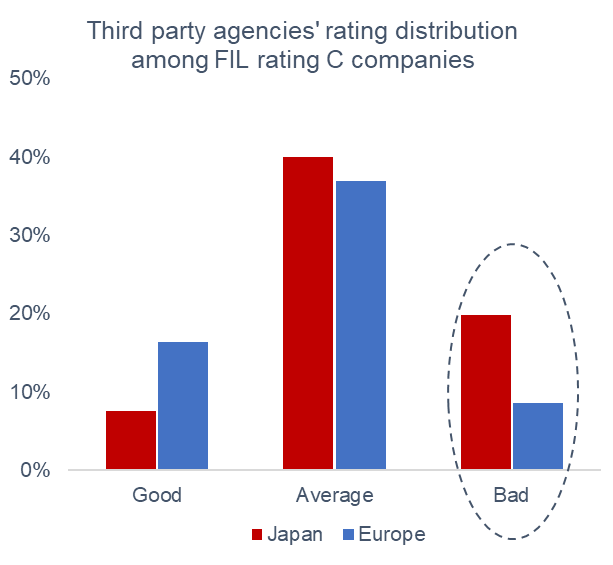

Japanese companies tend to be rated lower on sustainability than their European peers. We compared the sustainability ratings of a widely used third-party agency with our in-house ratings and found that there was a systematic under-rating of Japanese companies versus European ones. Comparing the third-party’s ratings to our own, corrects for any underlying fundamental differences in the companies, so the variation is down to non-fundamental factors.

Source: Fidelity International, Average rating of third party rating agencies, data as of 13/11/2020. Universe consists of companies covered by Fidelity analysts. For illustrative purposes only. Representative of typical ESG criteria but may change from time to time to ensure that desired investment characteristics are reflected. Fidelity Sustainability Ratings were launched in June 2019 and cover more than 4,600 equity and fixed issuers as of 31 December 2020.

Cultural reasons behind the discount

We think the difference in ratings are broadly due to cultural issues, but these should correct over time. Corporate culture in Japan has historically avoided conspicuously emphasising achievements, which is seen as not aligned with the more sober management style that is prevalent there. Japanese executives therefore tend to underplay their sustainability credentials compared to other regions and this can work against them with investors accustomed to a higher level of corporate promotion and disclosure.

The other issue is the language barrier. Japanese companies, particularly small caps, still do not widely publish reports in English; in Europe, most small companies produce statements in English. For third-party ESG ratings agencies, which tend not to have many on the ground analysts based in Japan, this makes covering Japanese companies harder. As a result, Japanese companies are often unintentionally penalised.

Our engagement with Japanese companies confirms these reasons. We find that they are taking sustainability seriously, making progress ESG issues and keeping up with their European counterparts. The problem is that they are not making this information as accessible. Japanese companies have the right corporate strategy and operations but are not fully appreciating the significance of sharing this information publicly to help investors value companies accurately. But this is changing.

More and more Japanese companies are realising that to continue attracting investors they need to evolve their disclosure policies and publish sustainability reports. In our conversations with corporate executives at these companies, we are finding a real openness to engage on this issue and a willingness to re-think their disclosure policies. Our relationship with NOF Corp, a diversified chemicals manufacturer with a US$ 4.5 billion market cap, is a good example of a company that has developed its disclosure on both financial targets and sustainability.

NOF Corp: Sustainability worth shouting about

NOF has strong positions in many niche markets, resulting in stable growth and high profitability. Its core businesses include surfactants (inputs for toiletries and cosmetics) and drug delivery system (DDS) products, which ensure a drug’s active ingredient is delivered and absorbed safely in the correct part of the body and used in mRNA medical technology.

A well-known ESG rating agency concluded that NOF Corp’s chemical safety management system lagged peers and it was behind on adopting policies and practices to mitigate the risk of toxic emissions. Our analysis suggested otherwise. We found that the company was in-line with industry standards and complied with the EU’s Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH) regulations.

It also had other initiatives to meet domestic and international requirements for controlling chemical substances, and complied with the Joint Article Management Promotion-consortium (JAMP) to facilitate the exchange of information on chemicals contained in products across the supply chain and the UN’s Globally Harmonized System of Classification and Labelling of Chemicals (GHS). NOF was a member of a council of industry players set up to address plastic waste in the oceans and was included in Japan’s Ministry of Economy, Trade and Industry (METI) ‘White 500’ list of outstanding organisations for health and productivity management. The problem for NOF was that it wasn’t receiving the publicity it deserved for its ESG policies.

Equity analysts, portfolio managers and sustainable investing analysts from Fidelity International held four meetings with NOF’s investor relations team and CEO between December 2019 and May 2020. During the course of the engagement, the company accepted that its financial and ESG disclosure was poor, and we specifically identified that the reluctance of top managers to be vocal about sustainability and a lack of publicly pronounced targets were the reasons for its low ESG score. We felt the company was committed to addressing these issues and that positive action would help to redress its valuation discount and low ESG rating.

In November 2020, NOF positively surprised the market by announcing its first constructive mid-term plan with a clear commitment to sustainability objectives. The following month, NOF published its first integrated report, which reflected all our sustainability recommendations including an ESG data book, English language materials, and, importantly, a Co2 emissions target. The company also committed to improving its governance standards and addressing its overly

conservative financial targets, as well as reducing cross shareholdings with other companies, which can limit the accountability of corporate executives to shareholders.

NOF is a company with good ESG and business credentials but was discounted by the market because it didn’t communicate its sustainability record effectively and, as a result, was downgraded on ESG. By releasing more information on its sustainability, explicitly stating emissions targets, and publishing more reasonable mid-term targets it addressed key risks for investors.

.png)

Source: Fidelity International, Refinitiv, April 2021.

Positioning portfolios to benefit from ESG upgrades

As companies disclose more information on sustainability, ESG ratings from third parties improve and the market incorporates a valuation premium. In Japan, there is some way to go before ESG ratings catch up to their European peers, but it’s a relatively easy fix; Japanese companies have the right sustainability strategies, they just need to recognise the significance of disclosing information around it.

Misumi Group, a factory automation supplier, is another company we think could potentially improve its ESG rating. It ranks low on ESG despite its business of delivering efficiency solutions. We are currently in discussions with the company and the management understands its ESG ratings gap comes from poor disclosure.

Over time, we think executives at Japanese companies will treat the disclosure of sustainability as important as financial data. Finding those companies that will disclose sooner and better, perhaps by engaging with them, will potentially create additional alpha opportunities.

For investors, blending a portfolio of top-ranking sustainable companies with those exposed to potential upgrades makes sense. These companies have the potential to consistently earn more than their cost of capital over the longer term because of their sustainable competitive advantage. As engaged investors, we are partnering with companies to see where we can advise them to improve practices and benefit from ESG ratings upgrades as they happen.