Updated March 2024

Blessed with resilience and resources

The Australian economy has proven more resilient than most in times of major economic challenges. It held up well in the face of the calamitous 1997 Asian financial crisis1. It emerged relatively unscathed from the 2008–09 global financial crisis, thanks to its robust banking system and strong demand for resources from fast-growing countries like China2. It dipped only briefly during the COVID-19 pandemic and experienced an earlier recovery than most OECD countries.3

This resilience is underpinned by the unique composition of its underlying economy,4 which is also reflected in its equity market — making local shares an attractive investment opportunity. The outlook for Australia’s resources and energy exports remains positive despite softening commodity prices. Strong investment in Australia’s major resource and energy projects is expected to see continued growth in the sector in the next few years.

The country’s leading financial institutions are also highly competitive within the Asia-Pacific region, with its fund management sector particularly recognised for innovation and sophistication.5

“Over the longer term, Australia has been one of the best-performing equity markets in the world. These long-term structural drivers, such as population growth and a large, low-cost natural resource base, are still very much in place and should reassert themselves in 2024 as conditions continue to stabilise.”

Paul Taylor, Portfolio Manager

Fidelity Australian Equities Fund

Australia, where to from here?

While we believe that economic growth will continue to slow, for at least the first half of 2024, in Australia and in large parts of the world, we don’t think that Australia will move into a recession. Unemployment continues to be low, and the resumption of strong immigration and population growth will likely underpin the economy. Sectors like insurance, building and construction, communications, healthcare, diversified financials, and some consumer staples should remain strong or improve through 2024.

Over the longer term, Australia has been one of the best-performing equity markets in the world – driven by structural growth issues like population growth, corporate governance, a large and low-cost natural resource base, high dividend yield (driven by franking credits) and high real dividend growth (helped by capital discipline). These long-term structural drivers are still very much in place and should reassert themselves in 2024 as conditions continue to stabilise. This should bode well for Australia’s equities market – with over 2,000 listed companies, the domestic market is the world’s ninth largest and has consistently been among its best performers.

The largest 200 listed companies represent over 80% of the market’s total capitalisation, with the largest index constituents — such as BHP Group, Commonwealth Bank of Australia and CSL Limited — valued at over A$500 billion.6

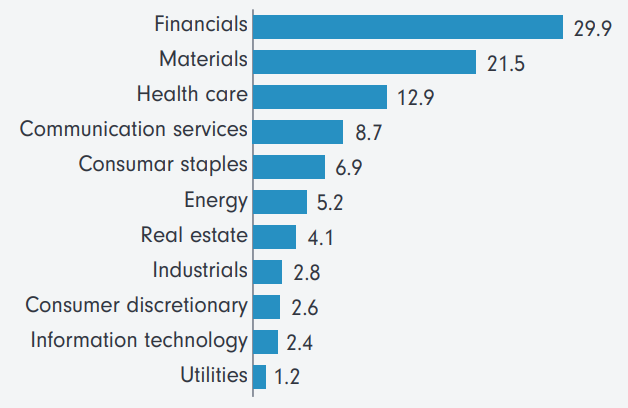

The S&P/ASX 200 sector/industry exposure in Figure 1 highlights that financial and materials make up just over 50% of the total index. Whilst the strong performance of the resources and financial services industry has contributed to the market’s consistent returns, the benchmark index doesn’t fully reflect the relatively stronger growth seen in sectors such as technology and health care in 2022 and 2023.

Figure 1. S&P/ASX 200 sector/industry exposure

Source: S&P/ASX 200 as at 30 April 2023

Don’t forget the smaller end of town

And investors should remember that the Australian market is not just limited to the large end of town. In fact, the Australian small- and mid-cap segment has been home to several future leaders, which have generated value for investors as they’ve graduated to the large-cap arena.

One such prominent recent example is Pilbara Minerals, an independent hard-rock lithium operation founded in 2005, which graduated into the S&P/ASX 50 Index in December 2022, and now has a market capitalisation of A$10.5 billion.

Pilbara Minerals holds one of the world’s largest lithium deposits after upgrading estimates for its drilling program for its Western Australian mines. The upgrade comes as global demand for lithium – a key component of the batteries in electric cars – continues to rise.

In Australia, we’ve witnessed other mid-cap and small-cap businesses evolve from an idea to established international businesses, including now well-known names such as Domino’s and CSL.

A greater focus on dividends

Another attractive feature of the Australian equity market is its well-established culture of dividend discipline, which includes tax-effective components such as franking credits.

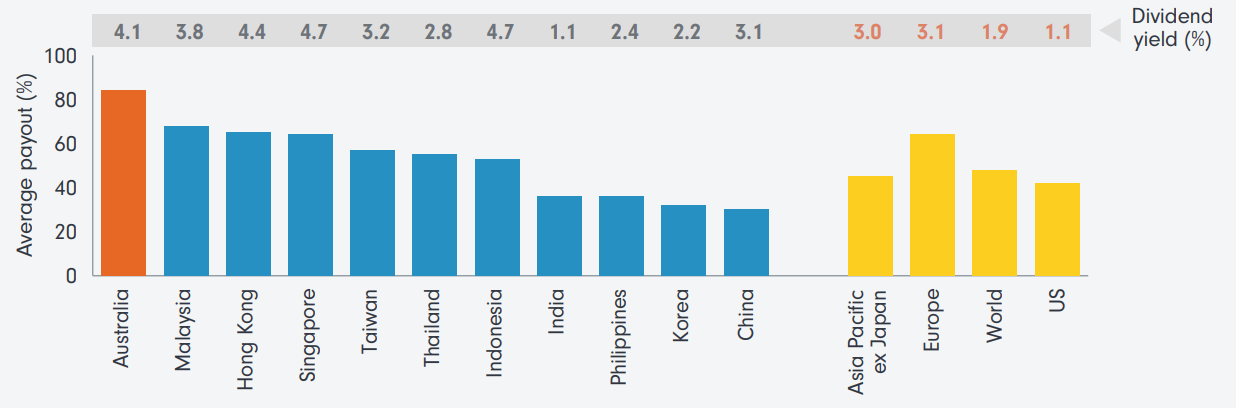

Over the last five years, Australian companies, on average, distributed more of their net income to shareholders (84%) than companies in the US (42%), Europe (64%) and Asia ex-Japan (45%) (Figure 2), offering an additional source of income for investors.

Figure 2. Average payout over the last 5 years (%)

Source: Bloomberg, Refinitiv DataStream, MSCI, as at 31 January 2024. Data for MSCI Indices. Past performance is not a reliable indicator of future results.

Returns may increase or decrease as a result of market fluctuations.

Stock story - The Fidelity Australian Equities Fund

BHP

BHP is the largest mining company in the world and the largest Australian company by market capitalisation. The ‘Big Australian’, as it is colloquially known, has been a mainstay of Australian equities since it began life as Broken Hill Proprietary in 1885, merging with UK-listed Billiton in 2001.

BHP offers exposure to a diversified portfolio of commodities and long-life, high-quality assets, but its Pilbara iron ore operations currently drive the majority of earnings. Steel is critical to infrastructure and the energy transition, as is copper for the electricity grid build-out and nickel for use in EV batteries. Potash, used in fertiliser, will also be critical to feed a growing population and BHP is increasingly focused on these ‘future-facing commodities’, divesting petroleum and acquiring more copper through the recent OZ Minerals transaction.

Commodities are cyclical by nature, but BHP’s scale, diversification, strong balance sheet and future-facing outlook has allowed it to consistently invest and grow through multiple cycles. This resilience through the cycle is why BHP is a long-term holding in the Australian Equities portfolio.

Stock story – The Fidelity Future Leaders Fund

HUB24

HUB24 Limited is an Australian fintech services company that transformed from an obscure micro-cap to one of the Australian share market darlings. HUB24 is an independent technology platform that sits between a financial adviser and their clients. The platform is considered a next-generation service with state-of-the-art portfolio management, transaction, and reporting solutions for licensees, financial advisers, accountants, stockbrokers and institutions. Its solutions include the HUB24 platform, leading SMSF software Class and myprosperity’s client portal technology designed to make it easier for accountants and advisers to collaborate with clients across all aspects of their financial lives.

A technology leader taking share in a structurally growing market, we see continual revenue growth an operational leverage. HUB24 is considered a market leader with strong pricing power in Australia. The business continues to innovate at an impressive rate, increasing its differentiation and competitive advantages along with rankings that support this across industry.

Stock story – The Fidelity Australian High Conviction Fund

CAR Group

Car Group (CAR) is the online automotive, motorcycle and marine classifieds business in Australia. Together with its subsidiaries employing over 600 people in Australia, developing world technology and advertising solutions that drive its business. The CAR network has operations across the Asia Pacific region and has interests in leading automotive classified businesses in Brazil, South Korea, Mexico, Chile, Argentina and the United States.

CAR is a dominant market leader with strong pricing power in Australia and multiple avenues to raise prices. The business is scaleable offshore. CAR have a strong track record in overseas expansion with additional upside in newer markets like the United States and Brazil. Although not immune from a macro slowdown, used car transactions are relatively resilient even in recessionary environments.

Fidelity – 20 years of Australian investing expertise

Fidelity has one of Australia’s largest and most experienced teams of Australian investors. With more than twenty years’ experience, we offer a range of actively managed Australian share funds, offering investors the exposure that suits their investment goals.

The Fidelity Australian Equities Fund, launched in 2003 and benchmarked to the S&P/ASX 200 Accumulation Index, invests in a diversified selection of 30 to 50 companies. Designed as a long-term core holding, it aims to outperform the benchmark over the medium to long term.

The Fidelity Australian High Conviction Fund, launched in 2012, is also benchmarked to the S&P/ASX 200 Accumulation Index, and offers a more concentrated portfolio of 20 to 40 high-quality Australian companies, with an emphasis on a company’s risk/return profile.

The Fidelity Future Leaders Fund invests in typically 40 to 70 mid- and small-cap Australian companies which favour attractive valuations, strong competitive positioning and sound company management.

Our Australian funds are carefully weighted for diversification across sectors and companies with the aim to manage risk in the portfolio and deliver sustained returns over time.

Why active management is key

In uncertain markets, active investing provides the flexibility essential to navigate rapidly changing market conditions. We expect conditions to remain challenging, due primarily to inflation and geopolitical concerns.

However, market volatility may play to the advantage of active stock selectors as they can flexibly find and invest in quality and reasonably valued companies that are expected to withstand market tumult while offering growth potential. As trends shift, they may be able to manage portfolio exposures to cushion downside risks and participate in the rebound.

With a global team of over 400 investment professionals, Fidelity is well-positioned to provide a comprehensive view of global and domestic trends across industries and markets. We apply a consistent, rigorous bottom-up process to select companies through different market cycles and create diversified portfolios designed to help Australian investors maximise the benefits of resilient homegrown opportunities.

Sources

1. Ron Duncan and Yongzheng Yang, ‘The impact of the Asian Crisis on Australia’s primary exports: why it has not been so bad’, Asia Pacific Press at the Australian National University, 2000-1: https://crawford.anu.edu.au/pdf/wp00/di00-1.pdf.

2. Credit Suisse Global Investment Returns Yearbook 2021.

3. ‘International economic comparisons after a year of the pandemic’, Australia Bureau of Statistics, 2 June 2021: https://www.abs.gov.au/articles/international-economic-comparisons-after-year�pandemic.

4. Austrade: https://www.austrade.gov.au/benchmark-report/resilient-economy.

5. Australian Trade and Investment Commission: https://www.austrade.gov.au/ international/buy/australian-industry-capabilities/financial-services.

6. As at September 2022, Market Index: https://www.marketindex.com.au/asx200.