Updated May 2024

Download pdf

Take advantage of shifting global dynamics

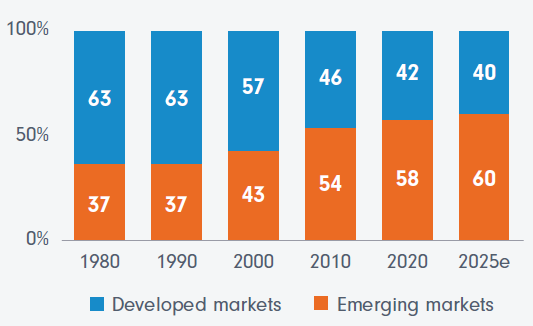

Emerging markets (EM) have been growing rapidly in recent years. In fact, emerging markets and developing economies now contribute over 50% of global growth and are expected to contribute over 60% by 2025.1 Having gone from a peripheral position in the world economy once dominated by agriculture and cheap manufacturing, emerging market countries are today home to some of the world’s fastest-growing economies and most innovative companies.

Despite this, they still account for just a fraction of most Australian investment portfolios and are under-represented in most global indices.

The opportunities, and risks, are as diverse and complex as the region itself, so investing with an active manager, with the resources to research and select quality stocks within this opportunity set, is paramount.

What are emerging markets?

An emerging market economy is simply one transitioning from low-to-middle income to high income. However, unlike a frontier economy, an emerging market economy already shares some of the characteristics of a developed market. This includes a functioning stock exchange where shares can be easily traded, access to debt and some form of predictable government regulation – all of which help smooth its path to development.

Emerging markets are home to geographies as diverse as a high-income Korea to a low-income Indonesia, from large domestic economies such as China, to an export-dependent Taiwan and from commodity exporters such as Saudi Arabia to importers such as India.

Amit Goel,

Portfolio Manager, Fidelity Global Emerging Markets Fund

Emerging markets are the growth powerhouse globally

Since 2010, emerging economies have had an output that is slightly larger than that of the developed world. In 2025, its estimated their contribution will grow to 60% (Figure 1).

Figure 1. EM is a significant contributor to global GDP, yet is under-represented in global indices.

Source: World Economic Outlook (April 2023) – GDP based on PPP, share of world (imf.org).

If you’re wondering why emerging markets are experiencing such solid growth, you need to look under the hood to the profound demographic shifts occurring in this region.

The world’s growing middle class

The middle class is already the largest spending group in the world, driving increased consumption of goods and growth. Fifty years ago, this group of global consumers lived almost exclusively in Western countries. Today, they are increasingly spread around the world, representing 45% of the global population.

Table 1. Future growth of the middle class

| Consumer group | No. of people 2020 | No. of people 2030 (projected) |

|---|---|---|

| Upper middle class | 0.6 billion | 1.0 billion |

| Lower middle class | 2.9 billion | 3.8 billion |

| Rest of world | 4.2 billion | 3.6 billion |

| Total | 7.7 billion | 8.4 billion |

Source: Visualizing the World’s Growing Middle Class (2020–2030) (visualcapitalist.com)

Since 2003, when the number of poor and vulnerable people in the world reached a historic peak of 4.4 billion, the middle class has been growing fast, especially in Asia. By 2030, another 700 million people are expected to join the global middle class, making it more than half of the world’s total population.

A younger population

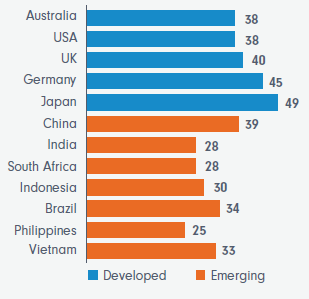

While much of the developed world struggles to come to terms with the cost of supporting an ageing population, developing economies typically don’t have this problem, as much of their population is still young.

For example, India’s population has a median age of 28 years, compared to Europe’s median of 43, which means there are still plenty of productive workers to keep the economy running, and fewer retirement-age workers to support.2

Figure 2. Median age

Source: Worldometers.info/world-population

As more of these young populations find meaningful work, they also tend to have more disposable income, thus perpetuating the growing middle class in emerging market economies.

A more broad-based index composition

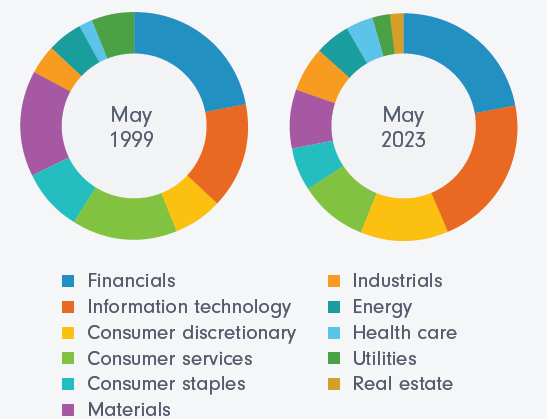

Today, encompassing 24 countries spanning five regions, the MSCI Emerging Markets universe captures more than 1,300 large- and mid-cap securities. The region has many exciting and innovative companies in which to invest.

Since 1999, we have seen a reduction in energy and materials in favour of financials, consumer discretionary and information technology names. This translates in a less cyclical earning stream and a more diversified investment universe.

Figure 3. MSCI Emerging Markets Index composition

Source: Fidelity International, Factset and MSCI Emerging Markets Index, as at May 2023

Why emerging markets; why now?

There are good reasons to be optimistic towards emerging markets. Emerging markets have consistently demonstrated higher gross domestic product (GDP) growth than developed countries through past market cycles.

The medium-to-long-term fundamentals in global emerging markets are very reasonable compared to those of the past. Unlike previous interest-rate hiking cycles, emerging market central banks were among the most proactive in the world when it came to raising rates early and bringing inflation under control. Brazil is the poster child of this trend, with inflation in the country falling back sharply. While interest rates have been cut a few times since middle of 2023, it still has positive real rates. We see a similar picture in other emerging economies. The strong fiscal position of emerging economies also stands the asset class in good stead, with lower levels of debt-to-GDP in many emerging market countries relative to developed economies, and particularly when compared to the US.

Valuations in most global emerging markets are much more reasonable, and the index is trading at a discount to the developed markets index, which is close to the highest level in 20 years. One exception is India. Valuations here are high, particularly in the small-to-mid-cap space, but areas such as banks and IT services firms still trade at reasonable multiples.

In addition, emerging markets remain resilient on the back of favourable demographic trends, shifting supply chains, a fast-evolving universe and improving ESG practices.

What sort of companies can you access?

The emerging markets universe is highly diversified. Investors can find global household names like Samsung in Korea, semiconductor giants like TSMC in Taiwan or banks with strong national franchises, as well as niche companies that have the leading edge in their respective markets or sectors. Let’s look at a stock example that is in the Fidelity Global Emerging Markets Fund:

Bank Central Asia: Invest in the bank that’s financing Indonesia’s growing middle class

Bank Central Asia (BCA) is Indonesia’s largest bank by market value, with a market capitalisation of approximately US$80 billion.* As South East Asia’s largest lender, it is set to benefit from increasing levels of credit penetration and expanding mortgage market in the region.

BCA has a long heritage. Founded in 1955, its real success came after the 1988 Asian financial crisis, when BCA re-invented itself with a change of ownership and a renewed focus on employee and customer engagement.

The bank has established itself at the forefront of Indonesia’s financial services market, servicing both individuals and businesses. With the same management team in place for almost two decades, it offers a diverse range of loan and deposit products in much the same way as Australia’s ‘big four’ banks. With the Indonesian economy expected to continue to expand over the coming years, BCA is expected to provide much of the private financing that will fuel the country’s development.

*Bloomberg, as at 21 March 2024.