Updated May 2024

Staying the course for growth and diversification

In the current environment, investors may be considering the role of global equities in their portfolios. It is important to remember that investing globally continues to play an important role of diversification and can also provide meaningful growth opportunities, particularly around long-term structural themes.

But the investing playbook has changed, and companies that have succeeded over the past ten years may not be the winners of tomorrow. Stock selection is key and investors will need to be discerning.

“Asset allocation matters. In less volatile times, there’s less to be gained by picking your fights. Just taking part is all that matters. The last couple of years have shown the importance of being in the right place at the right time.” Tom Stevenson, Investment Director, Fidelity International

Capturing long-term growth trends across a bigger universe

Over the past two years, we’ve seen accelerated growth across themes such as digital transformation, online retail and cloud technology. And while more recently we’ve seen a revaluation of many companies within the technology sector, the underlying trend of digitisation is here to stay.

By investing internationally, investors can not only participate in the long-term success of established giants like Amazon and Microsoft, but also gain exposure to lesser-known but crucial suppliers (such as semiconductors and microchips) to these companies as they grow, such as Taiwan Semiconducting Manufacturing Company and SK Hynix.

There are also underlying structural growth themes globally, such as demographics and environmental, social and governance (ESG) obligations, underpinning the success of select companies and the countries and regions where they operate and supply markets.

The demographic factor

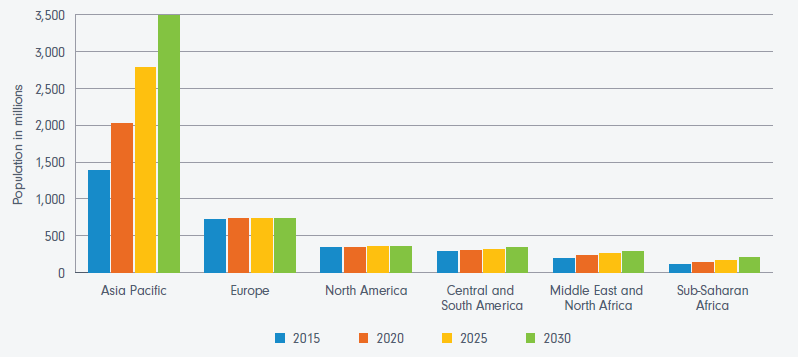

A macroeconomic growth factor that continues to unfold is the changing demographic profile of our world as a whole, and of regions within it. As Figure 1 shows, the middle class in Asia has been growing rapidly over the past seven years and is expected to grow to well over three times the size of any other region by 2030.

A skew towards ageing populations is expected to drive expansion of the healthcare sector in some countries, while rising demand for retail and leisure from a growing middle class and greater urbanisation can be expected in others. We believe that investment opportunities arising from these transitions can be captured in a portfolio targeting companies with products and services that address these shifts in income, labour markets, consumption and more.

Policies supporting sustainability

Another significant growth trend with a long tail, but a less predictable trajectory, is the transition to more sustainable and environmentally responsible economies and business models.

The outbreak of war in Ukraine has rapidly accelerated Europe’s transition to renewable energy, with the European Union vowing to end its dependence on fossil fuels from Russia well before 2030 and increasing its target for renewables to 45% from 40%.1

The US Inflation Reduction Act, President Biden’s flagship climate and tax bill, is expected to raise US$737 billion, of which US$369 billion will be spent over the next decade on climate and energy programmes. It will extend tax credits for wind and solar, and introduce new ones for nuclear power, energy storage and hydrogen. It also includes tax credits for buying electric vehicles.

All this is welcome for climate investors; the legislation is expected to increase demand for quality investments in wind turbines, solar panels, power transmission, batteries and carbon capture storage. The growth in these technologies will also help create a virtuous cycle where scale and research and development should rise, leading to even better and more competitive solutions, and encourage more demand.

Locally, the 2023–2024 budget sets out $4.6 billion in new climate-related spending commitments for climate action out to 30 June 2030, further to the $24.9 billion committed in the October 2022–23 budget. While many opportunities in sustainability will be found here in Australia over time, the opportunity set globally is vast and deep, particularly in the global small-to mid-cap sector – companies that are often at the leading edge of innovation and growth.

Demographics point to an age of prosperity for Asia

Figure 1. Middle-class population changes by region to 2030

Source: Statista, 2021 https://www.statista.com/statistics/255591/forecast-on-the-worldwide-middle-class-population-by-region/

Diversification is key

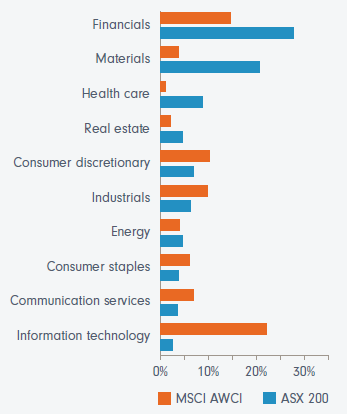

Global shares offer diversification across sectors and themes that would not be possible to achieve by investing in Australian equities alone.

The S&P/ASX 200 Index has been traditionally dominated by two industries for the last 20 years – financials and materials accounted for roughly half of the ASX by market capitalisation.

More recently, healthcare has had a larger presence in Australia, with the sector representing approximately 10% of the ASX 200, after strong growth in 2020 and 2021. While this relatively recent change in sector composition has helped to reduce concentration risk, as Figure 2 below shows, by only investing in Australian shares you will miss out on meaningful exposure to sectors such as information technology and consumer discretionary.

Figure 2. Top 10 sectors by Australian market capitalisation, as at 31 October 2022 S&P ASX 200 vs MSCI All World Index

Source: Fidelity International and S&P ASX 200 and MSCI All World Index as at 29 February 2024.

Staying domestic may also mean missing out on opportunities to be found among small- to mid-cap global companies. Focusing on bottom-up research to find companies in their earlier stages of their life cycle offers investors a way to gain exposure to this growth segment.

Investing globally may be easier than you think

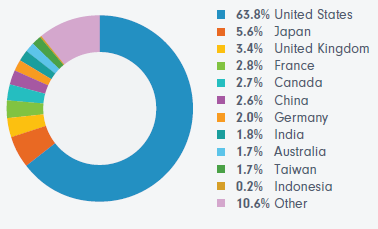

With more than 55,0003 listed companies on stock exchanges worldwide, investing globally can feel too overwhelming, or too risky and complicated. But it doesn’t have to be — access to international markets may be easier than you think.

Figure 3. Australia represents just 1.7% of the world’s listed companies

Source: Fidelity International and MSCI All World Index as at 29 February 2024.

An easy way to access global markets is through a diversified portfolio via actively managed funds or active exchange traded funds (ETFs). This is a simpler way of investing globally than investing directly, because you are investing in a fund that has a portfolio manager responsible for picking and choosing assets as well as the overall management of the fund.

Why active management is key

In uncertain markets, active investing provides the flexibility essential to navigate rapidly changing market conditions. We expect conditions to remain challenging, due primarily to inflation and geopolitical concerns.

However, market volatility may play to the advantage of active stock selectors as they can flexibly find and invest in quality and reasonably valued companies that are expected to withstand market tumult while offering growth potential. As trends shift, they may be able to manage portfolio exposures to cushion downside risks and participate in the rebound.

With a global team of over 400 investment professionals, Fidelity is well-positioned to provide a comprehensive view of global and domestic trends across industries and markets.

We apply a consistent, rigorous bottom-up process to select companies through different market cycles and create diversified portfolios designed to help Australian investors maximise the benefits of global equity opportunities.

Fidelity offers a range of international equity funds in Australia – all actively managed, providing greater flexibility to capture opportunities and manage risks through market cycles.

Sources:

1. https://worlddata.io/.

2. European Union, as at 18 May 2022, https://ec.europa.eu/info/strategy/priorities-2019-2024/european-green-deal/repowereu-affordable-secure-and-sustainable-energy-europe_en .

3. Number of Listed Companies | The World Federation of Exchanges (world-exchanges.org) as at December 2023.