Updated October 2025

India has a unique combination of structural, macroeconomic, and market-specific factors that set it apart as an investment destination worth considering for long-term investors. While short-term market movements can be volatile, we believe India’s fundamentals offer patient investors meaningful opportunity over time.

"With over two decades of investment experience, Fidelity leverages a substantial team of local research analysts in India. This burgeoning market is a stock picker’s paradise, offering extensive opportunities to generate alpha through strategic stock selection.”

Strong economic fundamentals and growth prospects

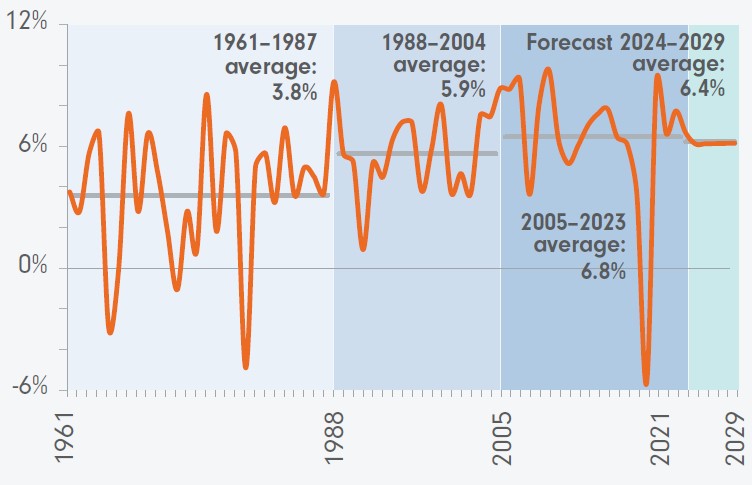

India is one of the fastest-growing major economies, with GDP expected to expand at 6–8% annually, driven by domestic consumption, a young population, and ongoing structural reforms. The country is benefiting from a demographic dividend: it has the world’s largest young consumer market of 1.4 billion people, a median age of 29 years,1 and a rapidly urbanising population.

Figure 1. As the fastest-growing economy, India’s global share is rising: GDP growth has sustained at 6% to 7% levels

Source: IMF World Economic Outlook Database, October 2024.

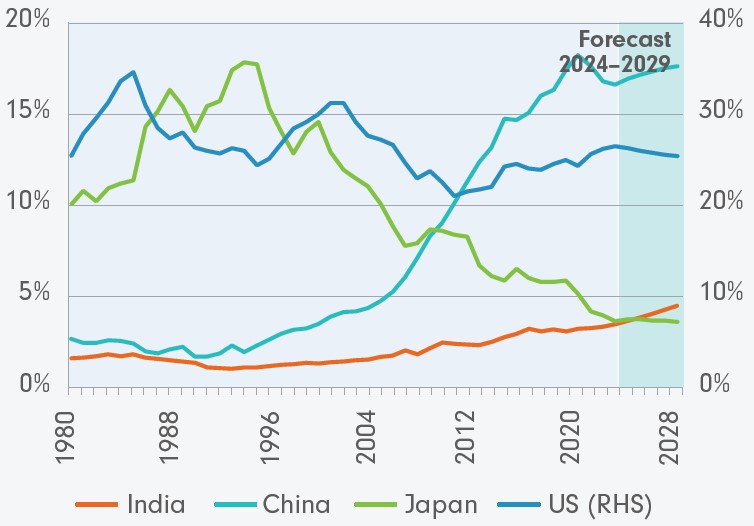

India’s robust demographics remains the most important factor underpinning the country’s consistently high GDP growth. While India still lags several emerging economies in terms of development, the nation’s economic trajectory is remarkable: since 1980, India’s per capita GDP has increased tenfold, now reaching around US$2,5002 — on par with China’s level in 2006 – 2007.

Figure 2. India’s share in world GDP is growing from a low base.

Source: IMF World Economic Outlook Database, October 2024.

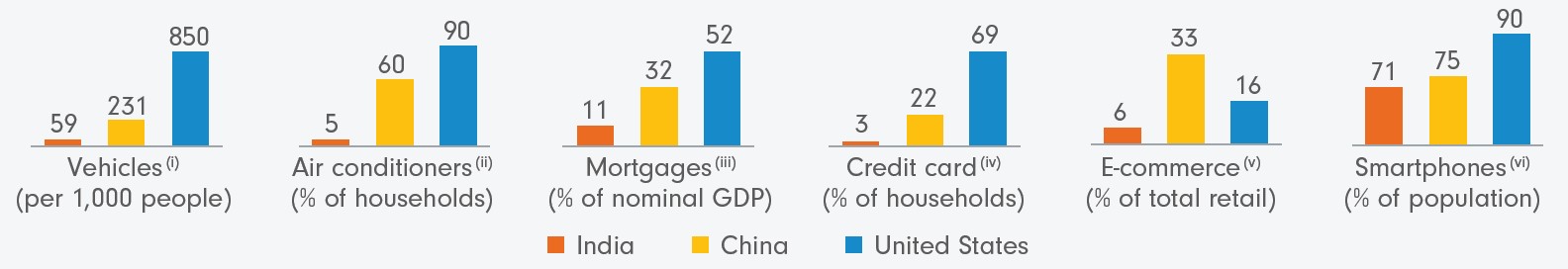

Despite this growth, ownership of basic products and services—including automobiles, consumer electronics, mortgages, and credit cards—remains considerably lower in India than in comparable emerging markets such as Brazil, China, Malaysia and Thailand. This under-penetration presents a unique investment advantage: as incomes continue to rise, the adoption of these goods and services is set to accelerate.

Looking ahead, the anticipated surge in the number of middle-income households from approximately 176 million in 2022 to 288 million in 2030 (Figure 3) is poised to drive a structural increase in the consumption of these goods and services. This fundamental shift unlocks significant growth opportunities for successful companies operating in these industries, positioning India as one of the most compelling investment destinations globally for long-term equity investors.

A well-diversified equity market

India stands out as one of Asia’s most established equity markets, with a rich history rooted in the founding of the Bombay Stock Exchange in 1875. Today, India boasts more than 5,000 listed companies, reflecting depth and breadth of its equity universe.

Decades of rapid economic growth and free-market reforms since the early 1990s have transformed the Indian equity market, nurturing the emergence of a diverse ecosystem of private companies across a wide range of sectors. The market is exceptionally well-diversified by industry, with growing representation in technology, internet, and other new-economy sectors—areas that are now commanding increasing investor interest and gaining critical mass on stock market listings.

With market capitalisation recently surpassing that of Hong Kong, India’s National Stock Exchange (NSE) is now the fifth-largest exchange worldwide by market cap. For investors, this means the Indian equity market offers not just scale and liquidity, but diversification and a wide array of investment opportunities across established and emerging industries3.

Figure 3. Rising income levels should lead to structural increase in goods and services penetration over next few years:

(a) Evolution of household income profile in India

(b) Penetration of products and services

Sources: 3(a): Morgan Stanley BluePaper: Why this is India’s decade, 31 October 2022. In 2021, Number of Households was 295mn and GDP per capita was US$2,278. In 2031, Number of Households estimated to be 361mn and GDP per capita estimated to be US$5,242. 3(b): (i) Vehicles excluding 2-wheelers. CEIC, China Ministry of Public Security, Hedges & Company. Data for 2022. (ii) International Energy Agency. Data for 2018. (iii) EMF, Hofinet, HDFC estimates, Wind, China NBS, 2022. (iv), (v), (vi) Payments & ecommerce report, PPRO Financial, 2022.

| Rank | Stock exchange | Country/region | Market capitalisation (US$ millions) |

| 1 | New York Stock Exchange (NYSE) | USA | $31,576,034 |

| 2 | NASDAQ | USA | $30,609,651 |

| 3 | Shanghai Stock Exchange (SSE) | China | $7,186,253 |

| 4 | Japan Exchange Group (Tokyo Stock Exchange) | Japan | $6,556,650 |

| 5 | National Stock Exchange of India (NSE) | India | $5,696,539 |

| 6 | Euronext | Pan-European | $5,441,764 |

| 7 | Hong Kong Exchanges and Clearing (HKEX) | Hong Kong | $4,549,721 |

| 8 | Shenzhen Stock Exchange (SZSE) | China | $4,528,667 |

| 9 | TMX Group (Toronto Stock Exchange) | Canada | $3,550,655 |

| 10 | Saudi Exchange (Tadawul) | Saudi Arabia | $2,664,791 |

Source: The World Federation of Exchanges (WFE), December 2024.

Despite India’s rapid economic transformation and strong market growth, equities penetration in India remains low with only about 6% of the population investing in the stocks.4 Liquidity and trading volume are a concern as we go down the market cap spectrum. This means short-term trading can be challenging.

We believe the full benefits of India’s evolving equity market are best realised by investors adopting a multi-year, disciplined approach.

Supportive policy and political stability

India is the world’s largest democracy where transfer of power after elections has always been smooth. The country has avoided the kind of policy shocks or capital controls that have hurt investors in other emerging markets, making it relatively attractive for foreign capital.

Government initiatives have helped democratise financial services. Most Indians have bank accounts they can access through their cheap mobiles, which are�used too for digital payments. This presents a significant opportunity for private banks as well as non-banking microfinance companies to expand their customer base and loan books.

Structural tailwinds: digitalisation and infrastructure

The government is also rapidly expanding its digital infrastructure, supporting innovation and productivity gains. From street vendors to high-end shopping malls, Indians are scanning QR codes to conduct payments, making the country one of the global leaders in this space. Growing digitisation has enabled new business models in sectors like e-commerce, insurance, food and grocery delivery, and ride hailing to gain critical mass and become publicly listed.

India’s digitalisation is also supporting thriving financial and technology sectors. It boasts private banks such as Axis, HDFC and ICICI Banks, which we believe are arguably among the best in the emerging-market universe in terms of long-term return and growth prospects.

Massive investments in physical infrastructure, such as roads, logistics and energy, are improving connectivity and competitiveness, further boosting economic growth. A growing manufacturing sector has the potential to create millions of jobs, reducing India’s dependence on imports and attract foreign investment.

India’s digital payments boomIndia is a global leader in digital payments and is rapidly expanding its digital infrastructure. The high penetration of digital payments is due to what’s called the unified payments interface or UPI, India’s popular mobile-based, real-time payment system that was introduced in 2016. Unlike traditional methods, UPI simplifies transfers using the recipient’s UPI ID, be it a mobile number, QR code or virtual payment address, thus eliminating account numbers. UPI operates as a digital public infrastructure, allowing seamless interactions for all without transaction costs. This technology is a push to increase bank account ownership and the government’s focus on building digital infrastructure, which are why mobile payments took off in the world’s most populous country. |

|

Case study

Fortis Healthcare is the third-largest hospital chain in India, with 31% owned by IHH Healthcare of Malaysia. Its focus is on higher-end tertiary and quaternary care, and it also has presence in the Indian diagnostics industry. Although India is a young country with a median age of 29 years, its 60+ population is growing fast and is expected to reach 13% by 2026, compared with 9% in 2016. This, together with the shortage of good quality hospital beds (given a weak government healthcare system), should support demand for private hospitals over the long term. We like Fortis Healthcare due to its strong growth through brownfield expansions. Its focus on bed expansion in existing facilities with healthy occupancy metrics aims to increase growth in the hospital space due to lower capital expenditure, faster ramp-up, and a better margin potential. |

Are investors missing out?

Despite their promise, Indian companies are under-represented in global equity indices. Those who invest in India via an index fund might miss out on tomorrow’s corporate stars because much of the index is laden with state-owned and ‘old-economy’ companies.

Active managers with deep coverage of Indian stocks and not beholden to a benchmark, have greater scope to outperform because the country’s stock market is less efficient than developed markets. This gives a well-informed active manager, focused on company fundamentals, a wider array of companies to select from when constructing portfolios.

Expert access to India’s potential

Experience matters in India. Fidelity has been investing in India for over 20 years with research analysts on the ground backed by an extensive global research platform.

Amit Goel, the portfolio manager of the Fund, favours high-quality companies with scalable business models and strong management track records available at reasonable valuations. Much of the focus is on fundamental research and continuous engagement to understand sustainability of a company’s quality and growth characteristics.

In addition, the team use extensive research to deeply understand the companies they invest in and implement a risk management framework when constructing the portfolio.

Sources:

1. World Population Prospects, 2024.

2. World Economic Outlook Database Apr 2025.

3. ‘India tops Hong Kong as world’s fourth-largest stock market.’ 23 January 2024, bloomberg.com/news/articles/2024-01-23/india-overtakes-hong-kong-as-world-s-fourth-largest-stock-market .

4. Ranked: Top Countries by Stock Market Ownership