Amid heightened global market volatility triggered by President Trump’s trade policies, our local investment team outline the attractive opportunities in Japan’s stock market. While Japanese equities have been a relative laggard compared to global indices in recent months, a combination of structural factors, including domestic reflation, governance reforms and attractive valuations, is creating a positive outlook over the mid-to-long-term.

Key points

- An increasingly positive backdrop is creating a compelling investment case for Japan’s equity markets.

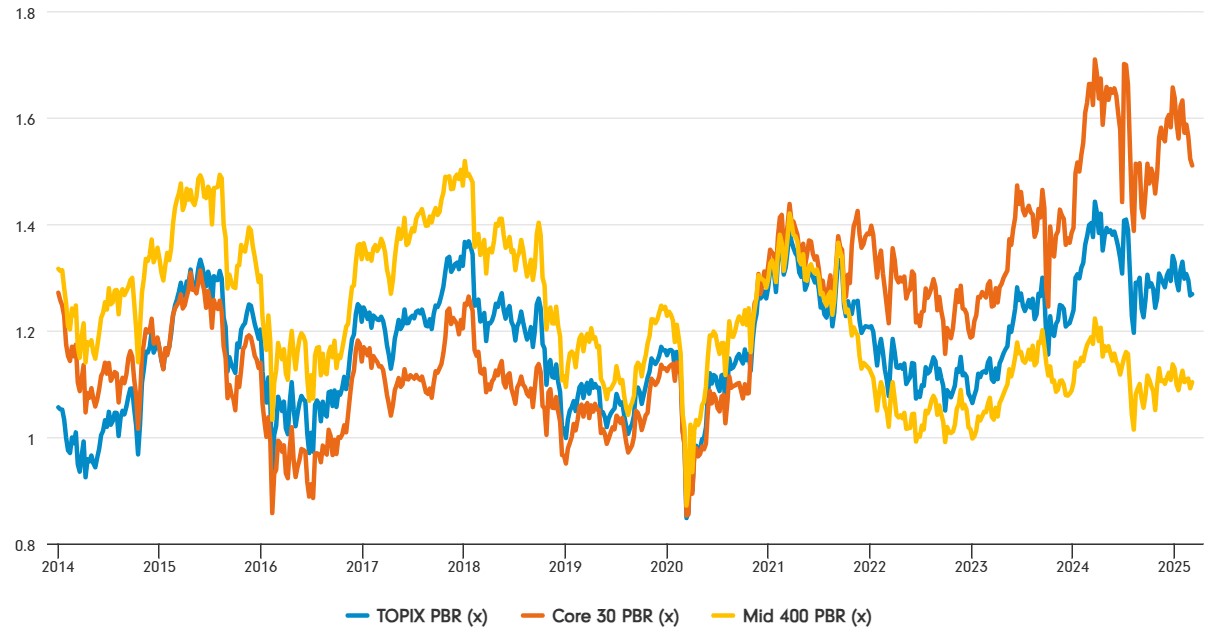

- From a valuation perspective, Japanese mid/small-caps are trading at a steep price-to-book discount to the larger cap indices and as we have seen in the past, when the valuation cycle widens to such an extreme level, it tends to snap back.

- With many of these companies still under-researched and mispriced, active managers with on-the-ground presence are well-positioned to identify the most promising opportunities in an evolving market.

Domestic reflation

In early March, the Japanese Trade Union Confederation (known as Rengo) announced that in the 2025 spring labour negotiations it will push for a 6.09% wage increase for fiscal year 2025, up from 5.85% in 2024. It marks the first time since 1993 that initial pay demands have exceeded 6%. A separate survey by Teikoku Databank, operator of Japan’s largest corporate databank, showed that more than 60% of firms, a record high, intend to raise wages this year.

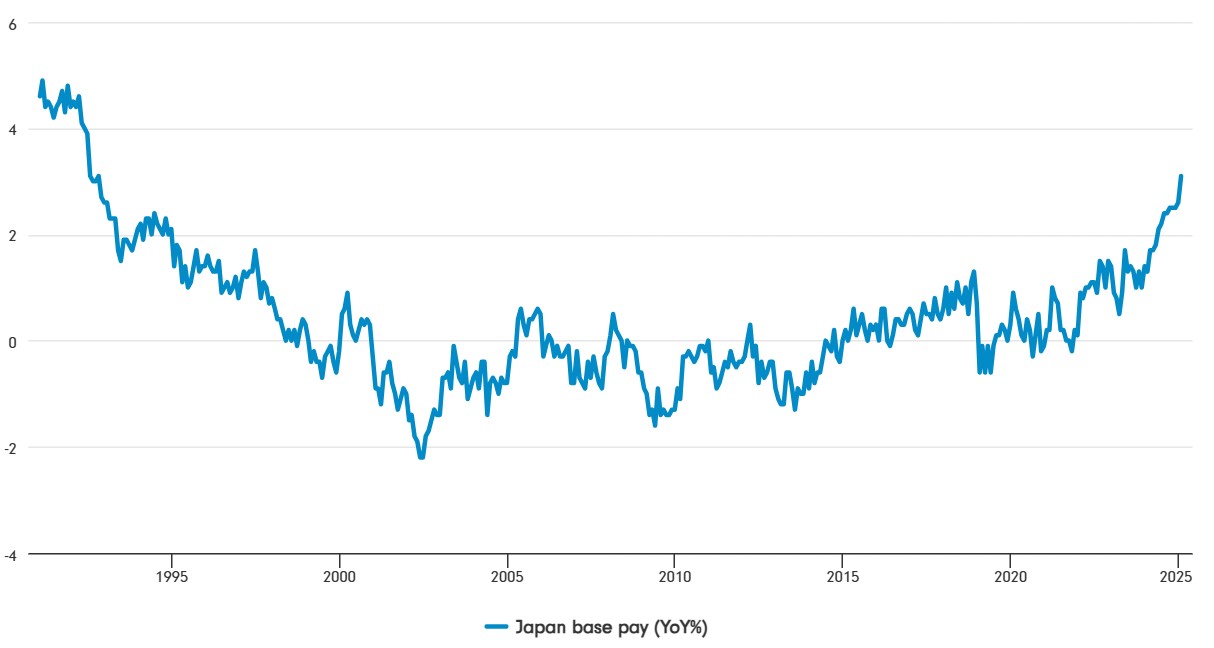

Given the recent reacceleration in domestic inflation (the headline CPI rose to 4% in January) and the need for companies to pay higher salaries to retain and attract talent, Japanese workers are seeking higher compensation. Data from the Ministry of Health, Labour & Welfare, showed that base pay increased by 3.1% in January, the fastest pace in 32 years, suggesting that underlying wage momentum is building amid increasingly tight labour markets. As highlighted by the Bank of Japan (BoJ), sustained pay growth is a key factor in achieving a virtuous cycle of rising wages, prices and demand-led growth.

Source: MHLW as of 31 January 2025.

After raising the policy rate to 0.5% in January, BoJ Governor Ueda noted that real interest rates remain deeply negative and that monetary conditions remain accommodative. The consensus view is that the next rate hike will come in July, though instability stemming from the trade policies of the Trump administration and the timing of an Upper House election may complicate matters.

Broadening of governance reforms

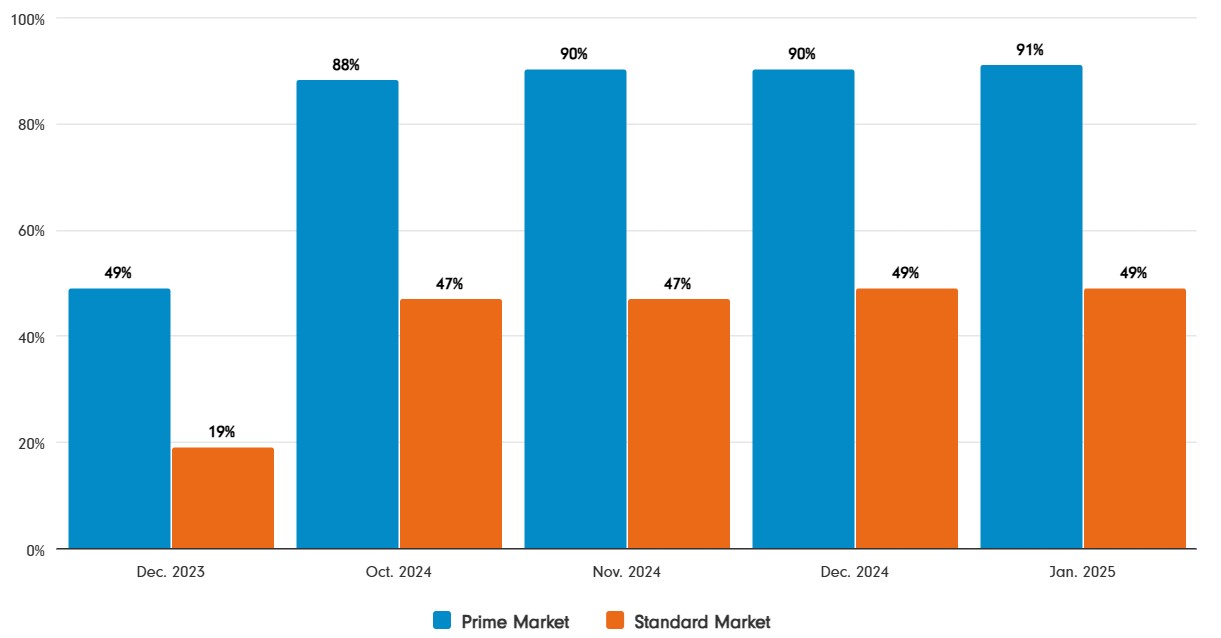

Based on the Tokyo Stock Exchange’s (TSE) “Action to Implement Management that is Conscious of Cost of Capital and Stock Price”, at the end of January 91% of Prime Market listed companies and 49% of Standard market listed companies had made some form of disclosure.

Meanwhile, the TSE has released a report summarising its focus areas for 2025. Looking forward, key governance-related developments are expected to include amendments to the Companies Act, revisions to Japan’s Stewardship Code, and the enhancement of disclosures related to cross-shareholdings.

Source: Tokyo Stock Exchane (TSE) as at 31 January 2025. Note: total of 1,636 Prime companies and 1,583 Standard companies.

So far, the highest disclosure rates have been concentrated in large-cap, low price-to-book companies in sectors including banks, shipping, utilities and commodities. However, the TSE-led reforms are broadening out across the market.

Through our engagements, we are seeing growth in small and mid-cap companies becoming more active in their shareholder returns. Given that mid/small caps have a large presence both in absolute numbers and the proportion that trade below book value, there are grounds for optimism.

Many mid/small-cap companies have solid balance sheets with high net cash-to-market- capitalisation ratios, which means that they can easily conduct share buybacks to improve their returns on equity. As we have already seen among larger companies, higher rates of disclosure translate into better share price performance, and in 2025 mid/small-caps are likely to emulate these trends.

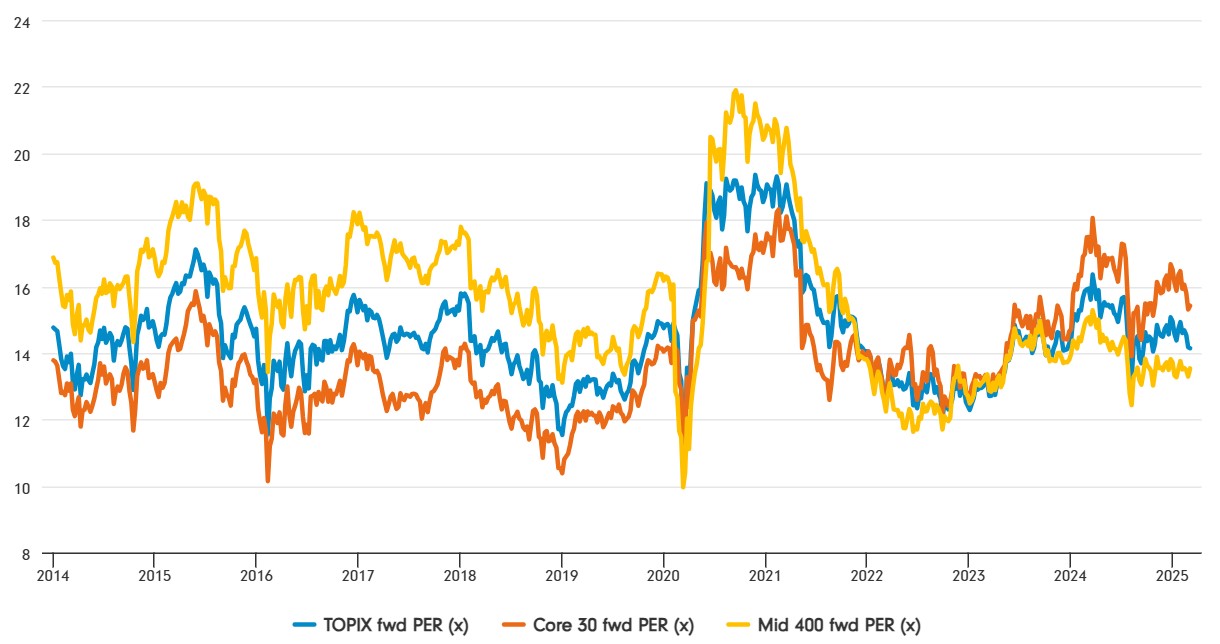

From a valuation perspective, Japanese mid/small-caps are trading at a steep price-to-book discount to the larger cap indices and have lost the price-earnings premium that was a constant feature of the past decade or so. As we have seen in the past, when the valuation cycle widens to such an extreme level, it tends to snap back and compliance with the TSE reforms can prompt this.

Source: Fidelity International, Bloomberg as of 7 March 2025.

In addition to a surge in shareholder returns, we are seeing a clear increase in corporate activity through management buyouts, takeover bids and mergers and acquisitions more broadly. As noted by KKR founder Henry Kravis, Japan has more than 3x the number of listed subsidiaries than the US and more than half of listed companies trade below book.

There is also an increased focus on the need to accelerate the unwinding of cross-shareholdings. In an historically overcapitalised market where there is a clear drive to improve capital efficiency and restructure balance sheets, this trend of de-equitisation is positive for the mid-to-long term outlook.

Fundamentals provide a tailwind

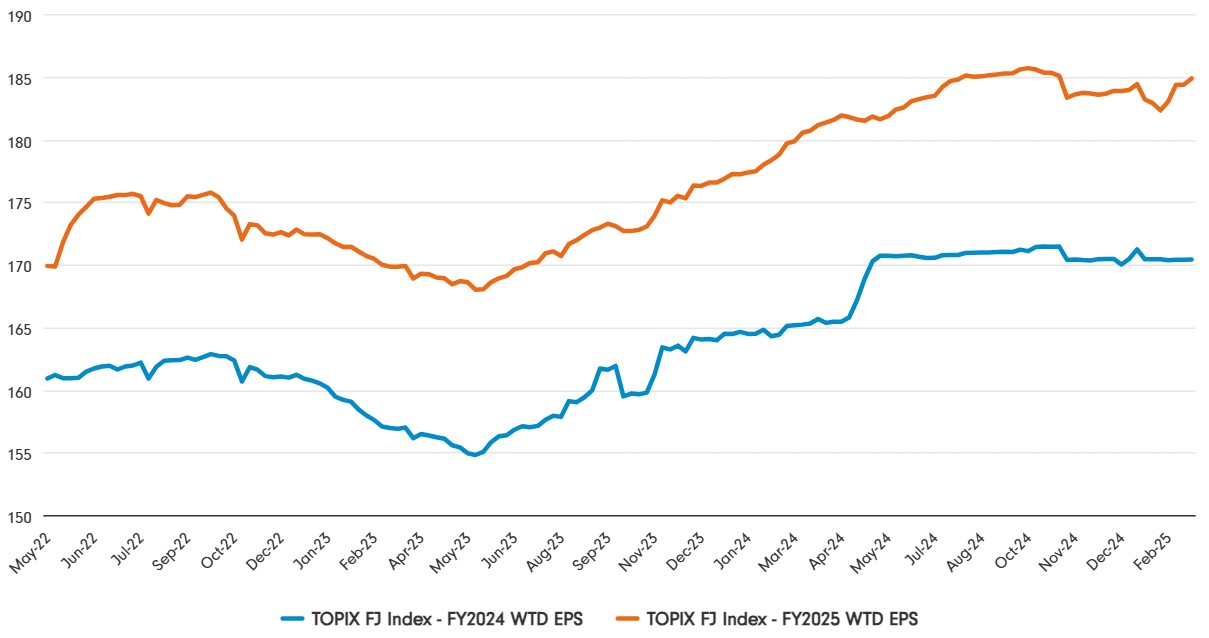

The fiscal 2024 Q3 earnings season concluded in February, with aggregate results exceeding market expectations. Non-manufacturing sectors generated the highest rates of revenue growth, while manufacturers delivered superior rates of profit growth due to forex translation gains (the yen weakened during the October-December quarter).

With progress toward full-year guidance high across a range of sectors, upward revisions to full-year guidance outnumbered negative revisions. The Ministry of Finance’s quarterly corporate survey subsequently underscored the strong profit momentum, especially among manufacturing industries, and resilience in domestic activity.

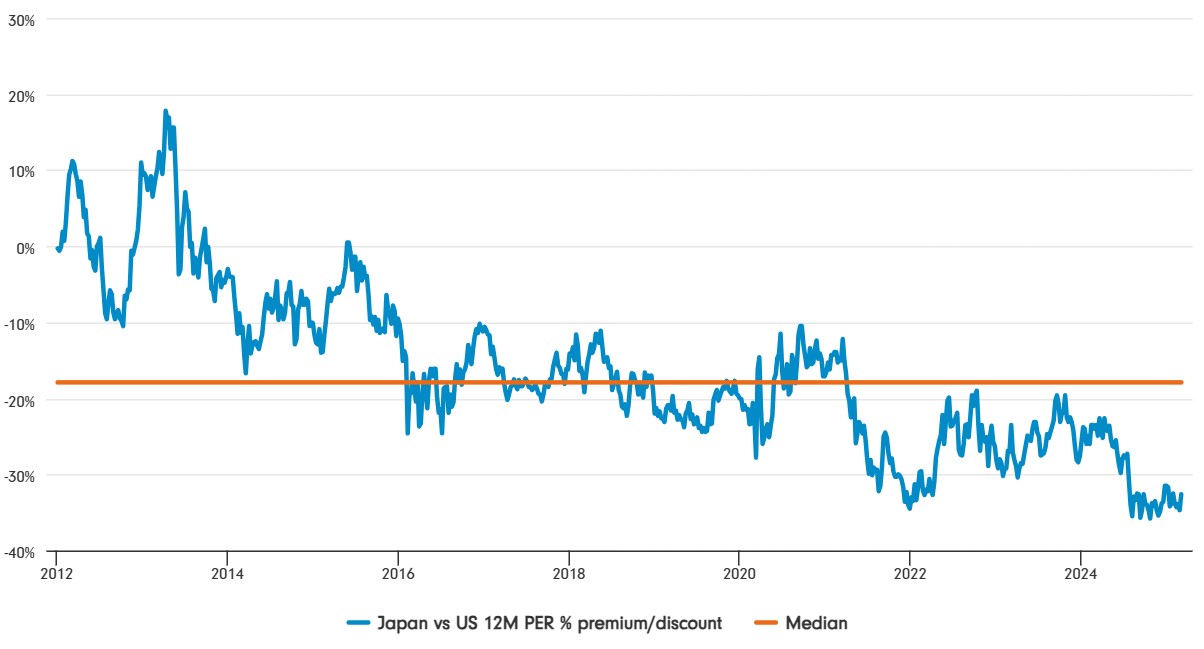

Furthermore, the valuation multiples of Japanese stocks compared to those in the US are at historic lows. TOPIX is trading on a 12-month forward PE ratio of 14.1x, a 33% discount to the S&P 500, which trades at 21.0x.

Source: (1) LSEG DataStream as of 7 March 2025; (2) Bloomberg as of 7 March 2025.

A compelling long-term opportunity

Overall, Japan continues to offer a wealth of under-researched companies, particularly in the mid/small-cap growth sector, which typically have better business models and returns on equity, and management is more incentivised in terms of shareholder returns.

Active managers like us, based in Japan, have the opportunity not only to invest in established global leaders, but also to unearth less well-known companies (including pre-IPO), where lower levels of analyst coverage can often create some great mispriced opportunities.

While global headlines may focus on trade policy uncertainties, investors who focus on companies with unique competitive strengths and clear growth potential - particularly those with strong domestic businesses - can navigate current market uncertainty and unlock the full potential of Japan’s equity markets.