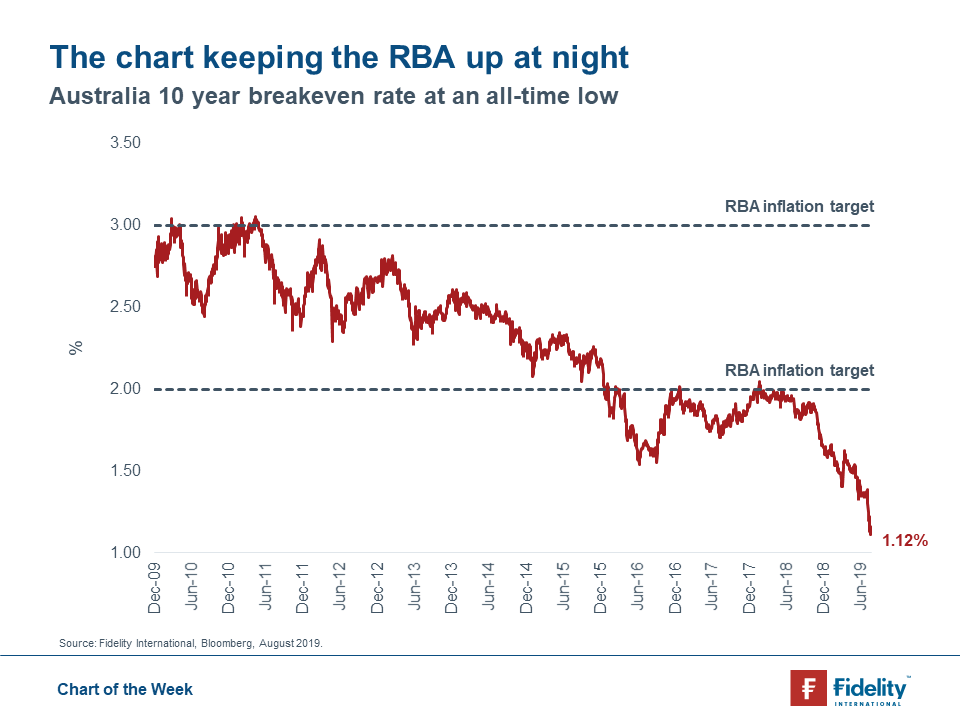

This is the chart that keeps the Reserve Bank of Australia up at night. Despite two interest rate cuts to a record low of 1.00%, market expectations of future inflation have collapsed in August.

The breakeven inflation rate is a market-based measure of expected inflation. It is the difference between the yield of a nominal Australian government bond and an Australian inflation-linked government bond of the same maturity (in this case, 10 years). Worryingly for the RBA, market expectations of inflation have collapsed to only 1.12%, the lowest on record going back to 2000. Consequently, the market expects that inflation will average 1.12% over the next 10 years, well below the RBA’s inflation target of 2-3%.

The bond market is telling the RBA that unless it continues to cut interest rates to stimulate economic growth and inflation, there is a substantial chance that it will miss meeting its key target of monetary policy. This chart suggests that the market is losing faith that the RBA will be able to meet its inflation target, and indicates that the cash rate will likely be cut again in the near future.