For most of modern history, society was designed for the young. Education systems absorbed children in great numbers, labour markets assumed decades of full-time work, and retirement was a brief afterthought at life’s end. That model reflected a population pyramid that is expanding - broad at the base and narrow at the top. But today, the pyramid has a narrower base with fertility rates falling.1

The fastest-growing demographic groups are the older populations. The challenge – and the opportunity – is how to reconfigure a society designed for the young to one that also caters for longevity. As people live longer, the traditional boundaries between work and retirement are dissolving. This shift is not a challenge to be feared. The longevity dividend - the economic and social value created by longer, healthier lives - can be realised through innovation across public policy, business, health, and financial services.

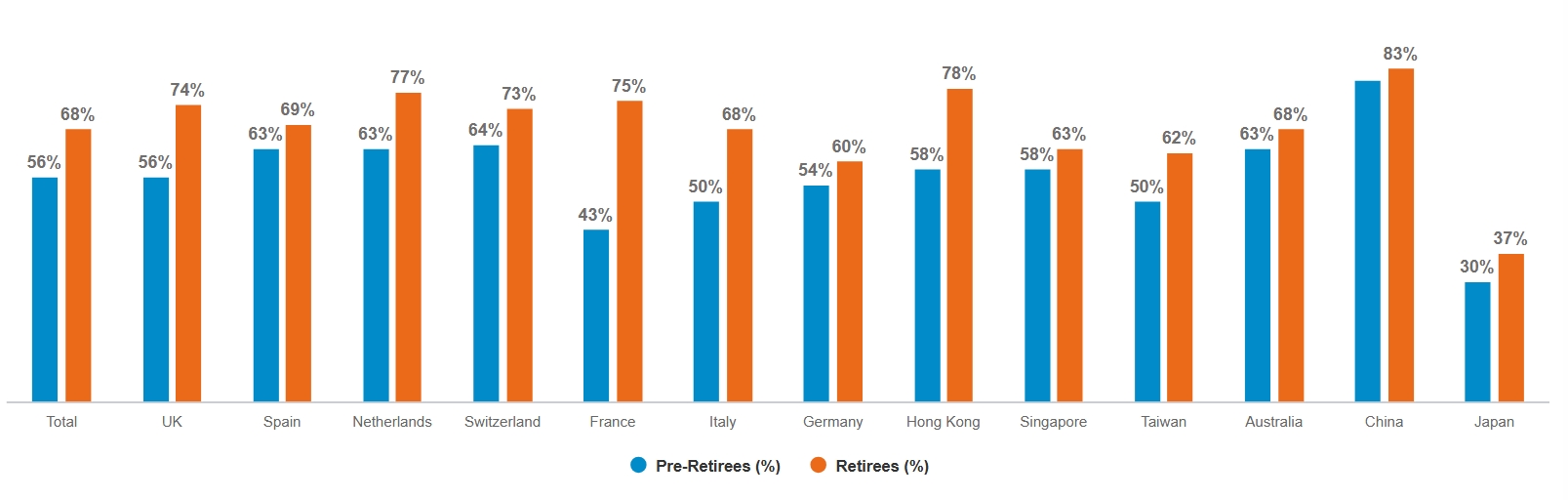

Encouragingly, our research shows that most people do not approach retirement with fear. And optimism increases with experience, with 56% of pre-retirees and 68% of retirees globally feeling positive about how life will be once they stop working (see chart below). This suggests that, with the right support, people can look forward to longer retirements with confidence.

Outlook on life in retirement (% responding very or somewhat positive)

Question: Thinking about retirement, which of the following statements reflects your outlook?

Source: Fidelity International, Opinium, October 2025.

The critical success factors

The most effective solutions for a longevity society will be those that combine structural changes including health, care, product and service innovation across a range of sectors including financial services and technology. Additionally, personalised guidance and support, along with trust-building initiatives, can foster confidence in both public systems and financial institutions.

Retirement planning is about recognising the interconnectivity of financial security with emotional wellbeing, social connectivity and physical health. This holistic approach will require collaboration from governments, communities, corporations including the financial sector, and the individuals themselves.

We believe there are a number of critical success factors to unlocking the full potential of the longevity dividend. Each is essential for helping people thrive in longer retirements and for enabling organisations and policymakers to respond effectively to demographic change.

- Address financial anxiety early. Helping people plan ahead can reduce uncertainty and stress. Early financial guidance and education enables individuals to make informed choices, build resilience, and feel confident that their resources will last. They also need clear, accessible information about where they stand financially, what options are available and be equipped to pivot if circumstances or plans change. Combined with simplified, actionable advice, individuals are better positioned to make informed decisions with confidence.

- Champion innovation in technology. Digital platforms, AI-powered guidance, and personalised tools are making it easier for individuals to access information, model scenarios, and make confident decisions about their future. Technology bridges gaps in financial literacy, supports wellbeing, and fosters connections - empowering people to take control of their longevity journey. For organisations, investing in technology in a way that effectively manages related risks means reaching more people, delivering tailored support, and driving efficiency.

- Prioritise health and care. Addressing concerns about wellbeing and autonomy is essential. By focusing on health and care provisions, and helping people plan for it, we remove major uncertainties and empower people to maintain independence and quality of life. This not only benefits individuals but also reduces pressure on public systems and families.

- Trust in public systems and institutions. Confidence in government support and financial institutions is vital. Transparent communication, reliable products, and accessible guidance help rebuild trust and encourage engagement. Predictability and stability in government pension rules are also essential, as people need assurance that the framework supporting their retirement will not shift unexpectedly, enabling individuals to plan with greater certainty and peace of mind. When people trust the systems and organisations that support them, they are more likely to seek help, follow advice, and participate in planning for their future.

- Support holistic wellbeing. Timely interventions across all four pillars—financial, physical, emotional, and social—make a difference. A holistic approach enables individuals to enjoy longer, healthier, and more connected lives. For society, this means a more resilient, engaged, and productive population.

Longer lives are not merely a statistic. It is an opportunity to create the conditions for people to live well and to enjoy more fulfilling retirements. Organisations and policymakers who embrace longevity wisely will not only support individuals in achieving security and purpose, but also establish a society that is wealthier, healthier and more cohesive than one before it.

1Populationpyramid.net, based on United Nations data, 2024.