Since its inception in September 2020, the Fidelity Global Future Leaders Fund has invested through numerous market corrections and rallies including a pandemic, war, rate rises, and the cost of living crisis.

Given this has all unfolded over a few short years, what is co-portfolio manager, Maroun Younes proud of when he reflects on the Fund’s journey?

“The consistency of returns generated. Despite the rough periods we’ve faced since the Fund’s inception, we’ve still managed to recoup losses and deliver consistent outperformance for investors, irrespective of the macro market environment” he said. This is reflected of course in the Fund’s 11.88% return pa* for investors since inception, which has outperformed the MSCI World Mid Cap Index by 1.54% pa.

What has contributed to the Fund’s success?

We talk to Maroun to find out more.

What excites you about managing a Fund dedicated to the global small to mid-cap sector?

Recently, we’ve seen a lot of hype around ‘The Magnificent 7’, mega-cap technology stocks including Microsoft, Nvidia and Google, which have dominated equity markets. Our speciality lies in seeking the future leaders so we look for smaller companies that have been largely excluded from mainstream indexes. We’re looking for stocks that can graduate into large-cap names as has been the case with stocks we’ve previously held including Ferrari, Cheniere and Apollo Global Management.

We’re excited about this part of the market for a few key reasons.

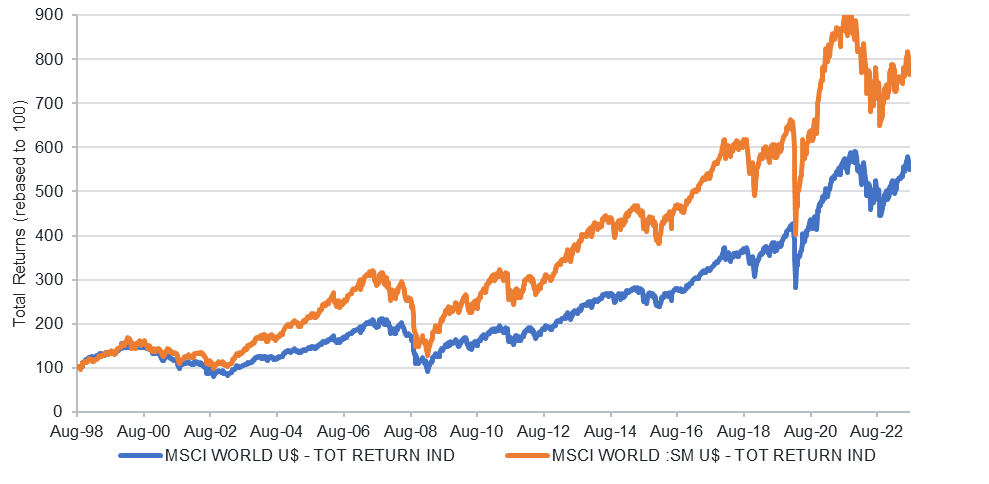

Firstly, the sector has outperformed the large-cap sector over the long-term.

Figure 1: Long-term total returns profile over 25 years

Source: Refinitiv DataStream, 31 August 2023. Past performance is not a reliable indicator of future performance. The performance of the Index is not a representation of the performance of the Fund.

Indices referenced: MSCI World & MSCI World SMID Cap Index (MSCI WORLD :SM), in USD terms

Secondly, it is a largely under-researched space in comparison to the large-cap space, which gives a bigger scope for alpha. For a global asset manager like Fidelity, our competitive advantage lies in over 400 investment professionals globally who specialise in bottom-up research and help us really get an understanding of the businesses we invest in.

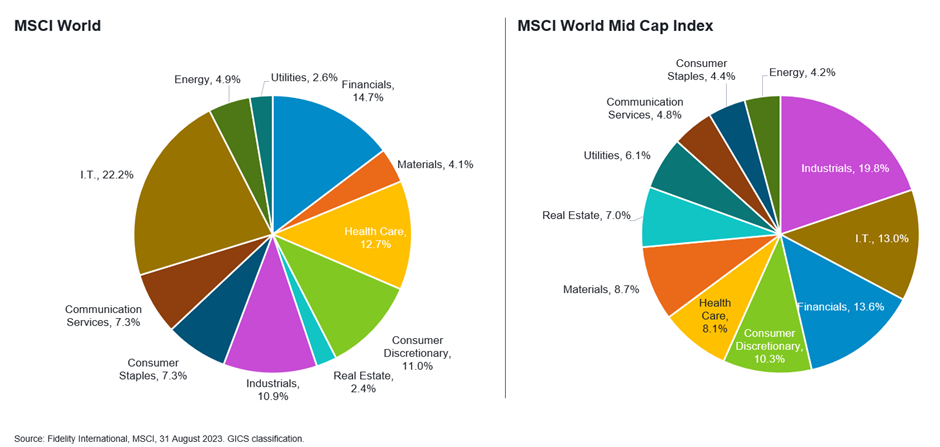

Thirdly, the large-cap sector is largely dominated by stocks that are hot at the moment, which are currently in sectors like technology and communication services. This means the returns of many global portfolios are largely dependent on the returns of these stocks. This is great when these stocks are performing well, but conversely can really suffer if these stocks all decline at the same time.

Figure 2: Differences in sector level diversification is noteworthy

Our focus on the small to midcap sector means we broaden our stock and sector exposure to other exciting and innovative opportunities, such as the US industrials space, a sector that currently makes up around 20% of our portfolio.

A company in this sector we like right now is Ametek, a US company listed on the NYSE with a market capitalisation of USD $35.19b. Ametek is a market-leading global provider of highly differentiated technology solutions servicing high specification needs, which gives them a strong competitive and scale advantage. The company has consistently grown its top line over decades, has generated an attractive return on invested capital, has low debt levels and regularly buys back its own stock.

How have you avoided the hype of ‘momentum’ stocks over the past few years?

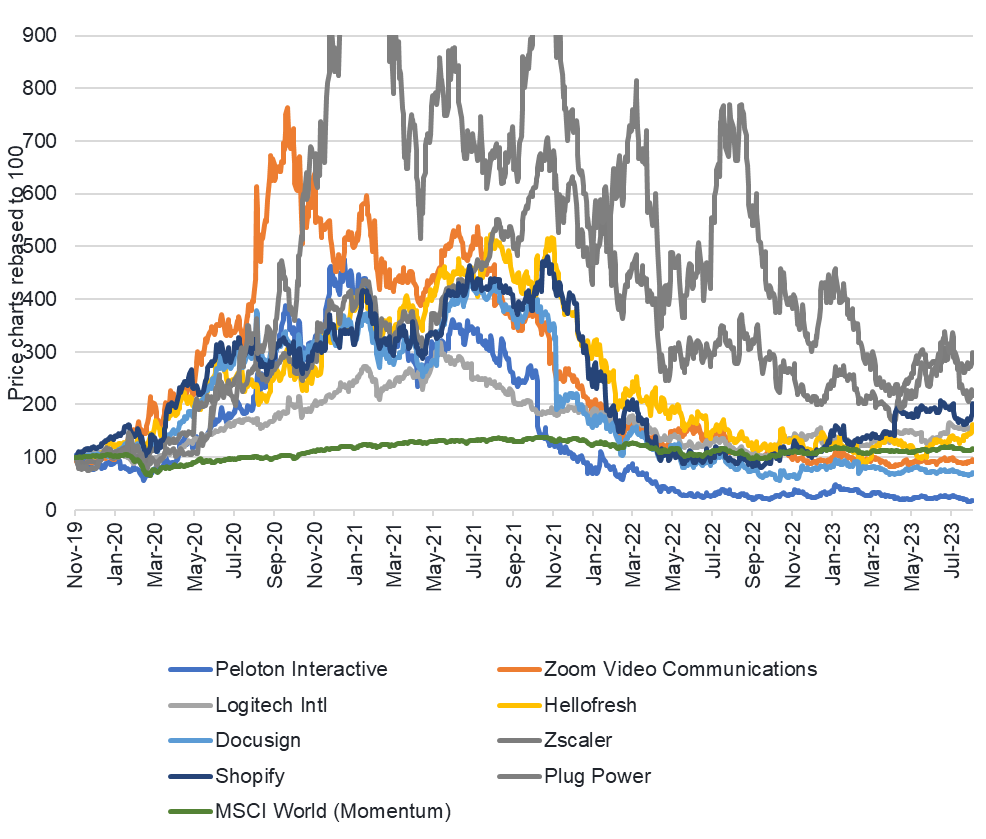

The long-term success of an active manager depends not only on what you’re invested in, but also what you’ve not, particularly in this end of the market. Momentum stocks tend to be driven by stories that make them very appealing over a period, they often generate alpha rapidly, but they are often loss-making over the long-term. We tend to call these stocks ‘Momentum Love’.

HelloFresh, Peloton, and Zoom, all drastically boomed during the Covid pandemic. Not owning these stocks may have hurt the portfolio in the short-term, but as we have seen, their share price has fallen dramatically from their peak levels. Over the long-term, not owning these stocks aligns with our focus to search for true global future leaders.

Figure 3: Investment discipline digs deeper to avoid tactical momentum

Almost half of the 40-70 holdings we hold are quality names. These companies are structural growth businesses with solid management teams, offering one or more of the attributes we’re looking for - persistent earning streams, favourable market structures, industry leaders and long-term compounders.

A quality company with these attributes we’ve held in the Fund for a long time is Arthur J Gallagher (AJG), one of the largest business insurance brokers in the world, based in the US. Insurance is a mission- critical expenditure for business customers and tends to be resilient even in times of economic weakness. As a broker, AJG operates a capital-light business model, but still owns the customer relationship.

As a global investor, what’s the biggest risk you’re worried about and how is the Fund positioned for this?

The biggest risk we’re facing is a global recession. To mitigate this, we ensure we invest in companies that we believe:

- Are high quality names with sticky and relatively defensive revenue streams, by virtue of them being mission-critical for their end customers

- Have robust balance sheets that allow them to withstand weaker economic periods, and potentially take advantage of vulnerable competitors through well-timed acquisitions

- Generate a robust free cash flow, which they can reinvest back into the business, or buy back their own shares if the share prices fall to attractive levels

Both Amatek and AJG, display these characteristics. They have modest organic growth (low to mid-single digit revenue growth) paired with some acquisitions. While the companies aren’t doing anything revolutionary, they’ve created mission-critical roles for their customers and made themselves somewhat indispensable. That’s part of the reason why we like them and part of the reason why they’ve delivered such great results over time.

*Return is net of fee as at 31 August 2023 since inception (28/09/20)