Key points

- Emerging Asian economies have lagged behind in the shift to low carbon technologies. Asia Pacific produces about half of the world’s carbon dioxide, with China and India the first and third-largest emitters respectively.

- Governments and regulators in the Asia Pacific region are proactively defining green assets in financial markets and tailoring their own regulatory frameworks based on existing international structures.

- Standardisation of disclosure rules is key. Hong Kong and Singapore have partially adopted disclosure requirements in line with the Task Force on Climate-related Financial Disclosures (TCFD) recommendations.

- Power generation is the biggest contributor to green-house gas (GHG) emissions in Asian emerging market (EM) countries. However, there are encouraging trends at a corporate level that leading players in China and India are driving renewable energy capacity expansion, aided by effective government policy support. This is key for Asian emerging markets (EM) to achieve their net zero targets.

- At Fidelity, we monitor candidates with strong potential towards delivering emission-reduction targets and ultimately direct capital towards those that we believe can provide positive environmental effects.

Evolution of regulatory frameworks

Defining principles and standardising disclosure rules provide an investment path towards greener economies. Over the past two years, environmental, social and governance (ESG) awareness has been evolving across the region, with greater environmental considerations, in tandem with national policy initiatives and increasing scrutiny of issuers.

China, India and ASEAN countries have been enhancing issuers’ access to green financing via both private and public channels, by standardising their green bond principles. Singapore is one of the leading players in the region with the launch of its green bond framework and the second version of its green and transition taxonomy.

Standardisation of disclosure rules is key, with individual frameworks in various stages of development. Advanced countries like Hong Kong and Singapore have partially adopted disclosure requirements in line with the Task Force on Climate-related Financial Disclosures (TCFD) recommendations, with specific definitions provided by local regulators. However, there is no explicit mention around the disclosure of emission reduction targets and no required disclosure on scope 3 emissions.

Industry actions toward net-zero targets GHG emissions - renewable energy

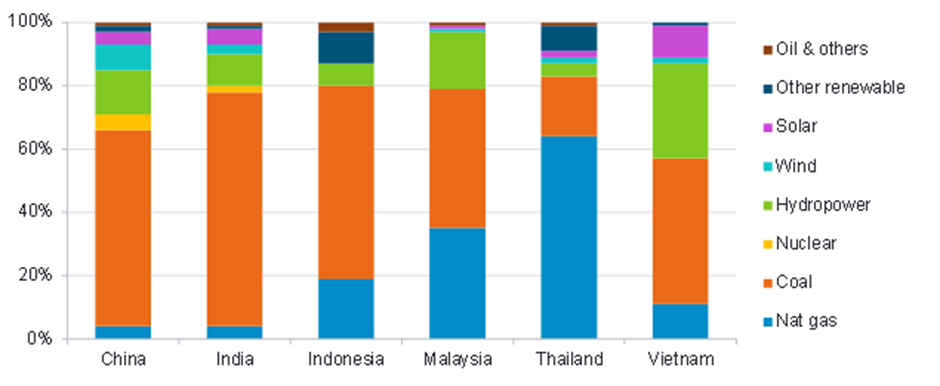

Power generation is the biggest contributor to green-house gas (GHG) emissions in Asian emerging market (EM) countries as fossil fuels account for over 70 per cent of energy mix. The transition to renewable energy is therefore key for these economies in hitting their net zero commitments. It is also capital intensive and therefore requires support from debt markets. Fortunately, governments recognise this and the sector is therefore well-supported by policies and many countries have been delivering significant progress towards their net zero GHG emissions targets.

Power generation mix for EM Asian countries in 2021

Source: BP Statistical Review 2022.

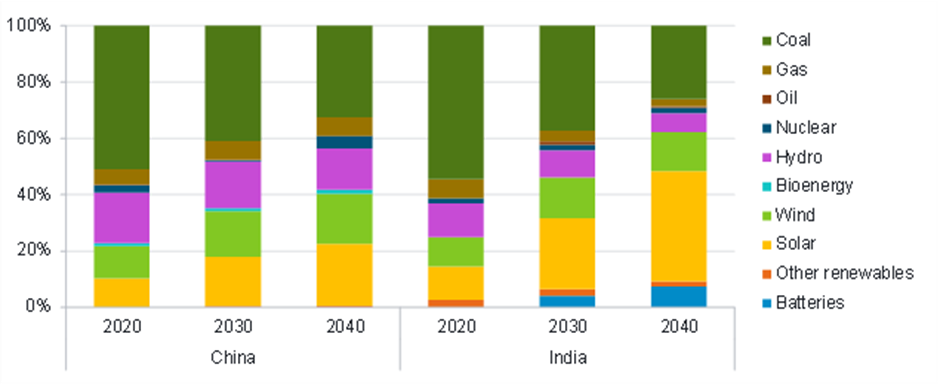

China and India are expected to drive renewable capacity expansion. Historically, China has the strongest track record of delivering capacity targets, hitting its 2020 installation goals by adding 463 gigawatts (GW) within six years1. The adoption of Feed-in Tariff (FiT) for wind and solar power has supported the sector’s early-stage expansion. Although the tariff has tapered off like in many developed economies as the market and technology mature, a more commercialised system (carbon emission trading system) has been introduced since 2021 to further standardise carbon emissions.

India has increased its renewable capacity by 68GW (72 per cent of total newly installed capacity) between 2016-2022, mainly in wind and solar power2. The country has also benefited from a series of supportive schemes, including purchasing obligation and dispatch priorities and is expected to continue to sponsor its 2030 renewable energy capacity targets. Among ASEAN countries, Vietnam has been implementing fixed tariffs and dispatch priority for over a decade, which has led to record high renewable energy capacity expansion over the past three years.

The high level of incentives has been critical for renewable energy capacity growth, which is likely to scale up in countries where wind and solar power are not yet cost-competitive. Meanwhile, major state-owned entities in the utility sector are expected to take the lead in developing new capacity, benefiting from their strong funding access and market position.

Installed capacity in China and India 2020, and projections up to 2040 in the Stated Policies Scenario (in % capacity)

Source: IEA, as of 2022.